Stock and Financial Markets Update

Stock-Markets / Stock Markets 2014 Aug 04, 2014 - 03:31 PM GMTBy: Jonathan_Davis

The purpose of this post is to show what is happening.

The purpose of this post is to show what is happening.

So, the US $ is to collapse, so say the inflationistas, the gold bugs, the Anderson shelter types etc.

Yet the $ index, against a generally accepted basket of currencies, has failed to collapse for over 2 years and, indeed, is rising again, from multi year support.

This is the reason why the GB£ has recently been falling – not because of anything internal to the UK.

1.70/72 was 20 year resistance, apart from the extreme period of 2003-2007. As I told clients, from 1.70/72 £ could rise further 20% or fall 20% to 1.35. Falling so far. On verra.

The £ has fallen recently due to $ strength and has broken below rising support, since February. It seems fair to suggest the break will hold. Next support down at 1.63.

$ strength suggests risk off and we are seeing strength in PMs – which is no surprise at all.

Also, US Treasuries, which again the inflationistas said would collapse, are having a storming year…

We have been huge bulls.

Now, at relative level to S&P of last Autumn and a little push higher and the relative price will take us back to last Summer/Spring. Inflation? Yeah right. #turningjapanese as I have been wont to say for over a year now whenever anyone would ask me.

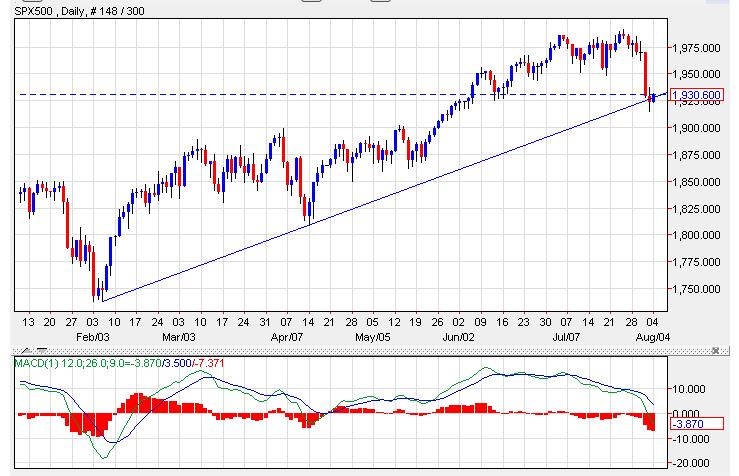

Western equity markets are looking fragile right now.

The FTSE is down on 15 MONTHS AGO!

The S&P has fallen a few % and sits right on multi month support before the US opens in a couple of hours. MACD pointing down so I’ll suggest the downturn is not over. That, in turn, suggests it could be part of a bigger move down this Summer.

Look at the DAX:

I make that 8% down… and broken 2 year support.

Whereas Emerging Markets – as we have written of often, positively, positively (!) soars:

Like USTs, relative price is back to Autumn last year and looking strong, relative to S&P.

By the way, US Small Caps looking awful.

So, stick with the plan. Could be a sizeable shakeout, this Summer, of Western share prices. Treasuries to do well in that environment as will US$ and PMs.

By Jonathan Davis

http://jonathandaviswm.wordpress.com/

25+ year veteran of the world of financial services, the last 10 doing the same thing under his own name. We work with families all over the UK and in Switzerland and, indeed, on 2 other continents. If interested in our Wealth Management work, cast a glance at the firm’s website.

From time to time media folk call me and ask me to rant live or in the press. JD in the media.

I don’t buy hype. I don’t believe it’s the end of the world but I do believe, within a generation, the West will have no welfare state. The maths don’t lie. We’re toast. It’s obvious if you think about it.

© 2014 Copyright Jonathan Davis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.