Kurdistan Oil, Chaos, Power and Arrogance

Politics / Middle East Aug 12, 2014 - 07:39 AM GMTBy: Raul_I_Meijer

Boy, what a day so far; hard to keep up. tell me, is it just me, or has the US really started another round of regime change in Iraq?

Boy, what a day so far; hard to keep up. tell me, is it just me, or has the US really started another round of regime change in Iraq?

Washington wants a new government in the capital, Baghdad, a national unity one, ostensibly to respond to the Islamist State threat.

PM Maliki doesn’t want to go, but also can’t lead such a government (nobody likes him). Iraqi President Fuad Masum then tells him off, so does a court. Maliki sends loyal troops into Baghdad, threatens to take the President to court, and the latter names deputy parliament speaker Haider Al-Abadi as new PM.

Meanwhile, the US pulls their support from Maliki, and the Islamist State conquers another city not far from the capital, and not anywhere near where the Americans are bombing them.

And most of that was before America had even woken up.

BTW, the President is Kurd, Maliki is Shi’ite, and the parliament chairman is Sunni. Lovely. National unity? You would need a nation first.

The US yesterday started directly arming the Kurds under siege where they are indeed bombing, and the Kurds took back some ground from the IS.

Wait a minute! The US is arming the Kurds? For real? Did they forget the longstanding fight between the Kurdish PKK and the Turks over Kurdistan? The Turks who yesterday elected Erdogan as their president?

That’s the same Erdogan who is hated by all his neighbors, Israel, Syria, Iraq, Iran, and who’s said some ugly things about America too, but who they need to keep the IS from moving north.

Erdogan might be at least a little bit nervous that these US arms may someday be used against him to make Kurdistan a sovereign nation after all.

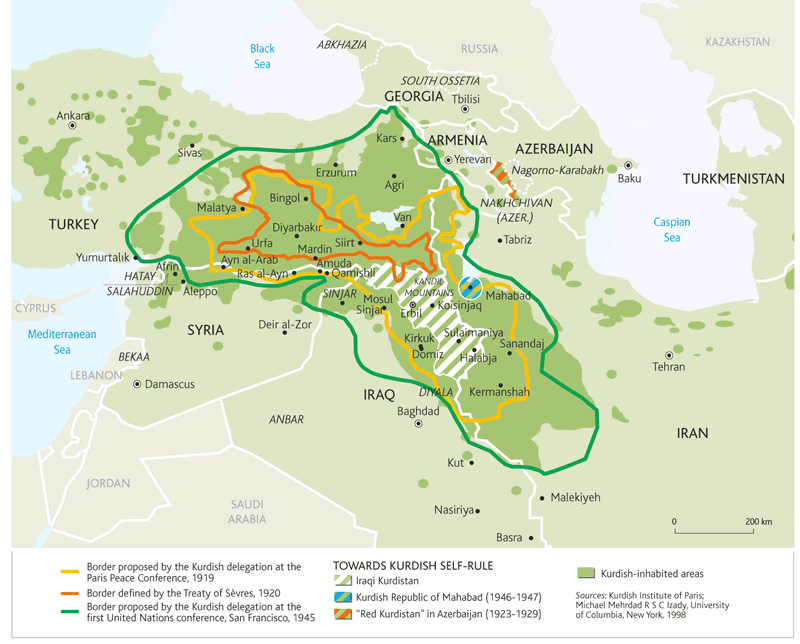

Kurdistan, which for many decades has been a nation on paper only, stretches across Iraq and Turkey (where 18% are Kurds). And Iran, Syria, Armenia and Azerbaijan.

In the middle of the – clickable – map, you see Mosul (the dam the IS took), Erbil (the town the US is shelling) and Kirkuk, near which one of the world’s main mega oilfields is located.

And isn’t it interesting to know that the Kurds forcibly took control of that oilfield on July 11, 2014, from the Iraqi government? It all adds to the intrigue. Who shall we support today? If today is Monday …

Wikipedia on Kurdistan and its oil and gas reserves, in particular the Kirkuk field:

• Kurdistan Regional Government (KRG)-controlled parts of Iraqi Kurdistan are estimated to contain around 45 billion barrels of oil, making it the sixth largest reserve in the world. Extraction of these reserves began in 2007. Gas and associated gas reserves are in excess of 2,800 km3. Notable companies active in Kurdistan include Exxon, Total, Chevron, Talisman Energy, Genel Energy, Hunt Oil, Gulf Keystone Petroleum, and Marathon Oil. In July 2012, Turkey and the Kurdistan Regional Government signed an agreement by which Turkey will supply the KRG with refined petroleum products in exchange for crude oil.

• Kirkuk Field is an oilfield near Kirkuk, Iraq. It was discovered by the Turkish Petroleum Company at Baba Gurgur in 1927. The oilfield was brought into production by the Iraq Petroleum Company in 1934. It has ever since remained the most important part of northern Iraqi oil production with over 10 billion barrels of proven remaining oil reserves in 1998. After about seven decades of operation, Kirkuk still produces up to 1 million barrels per day, almost half of all Iraqi oil exports. Oil from the Kirkuk oilfield is now exported through the Kirkuk-Ceyhan Oil Pipeline, which runs to the Turkish port of Ceyhan on the Mediterranean Sea.

• On 11 July 2014 Kurdistan Regional Government forces seized control of the Kirkuk mega oilfield, together with the Bai Hassan field, prompting a condemnation from Baghdad and a threat of “dire consequences,” if the oilfields were not returned to Iraq’s control.

That’s right, Iraq lost – control over – about half of its oil exports one month ago. To an army that belongs to that part of the population the President belongs to!

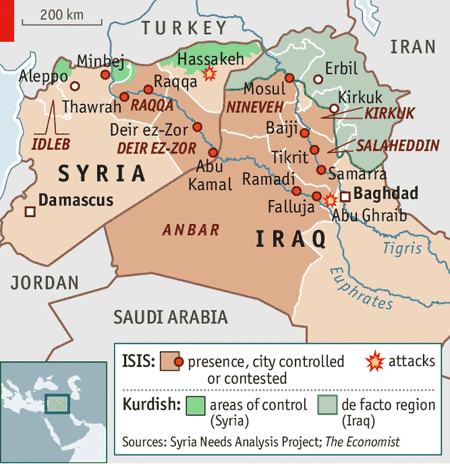

And that takes us right back to why the US is meddling in Iraq. And Ukraine too, of course. Kirkuk is in Kurdish hands now, and it must be a nightmare for all of those oil companies active in Kurdistan to even ponder the IS conquering those parts of Kurdish Iraq that they are active in. A nightmare, but by no means impossible. They’re just about literally on the doorstep:

Oil and gas were always important, they’ve been the reason for the majority of all US and European wars and invasions of the past 150 years, But control over fossil fuels has gotten a lot more important recently, ever since everyone (well, everyone …) has acknowledged that conventional peak oil indeed happened in 2005, and that shale oil and gas won’t last long (less people understand this last bit, admittedly, but TPTB do).

The fight over oil has now literally become the fight for power, as I’ve said more than once recently. That is what we see develop here. The 2003 invasion of Iraq gave Big Oil access to a lot of oil and gas, but it also left behind an unparalleled chaos. And now they’re forced back in. I see Washington plan a lot of mayhem and chaos, but I doubt they wanted this at this particular point in time. This is not a powder keg, this is Pandora’s box.

But there’s no way back. The US doesn’t want Putin in control of Russian resources, even though, as I said yesterday, they’re going to need him dearly if they want to prevent Iraq from blowing up in their faces, and they don’t want the Islamist State in control of 45 billion+ barrels of oil in Kurdistan and the greater Iraq area.

By the by, when I read reports of children being buried alive etc., I think of patterns. These accusations are always used against new enemies. I don’t know how out there the IS is, but it does make me wonder.

In my view, America doesn’t sufficiently understand the region, and therefore chooses the Wrong Friends, Wrong Enemies, Wrong Fights. And I think that is due to pure American hubris and arrogance.

Washington thinks it has the by far best, most expensive, most advanced army, and that that alone will make it ultimately victorious no matter what happens. So why then pay too much attention to what happens? What that idea disregards is that the US hasn’t actually won a war or an invasion since 1945, though it had the numero uno army the whole time.

Creating chaos may be a tried and tested approach, but not if you yourself get confused and no longer oversee what is going on. Then you’re merely yet another part of the chaos.

The only way left to go then is ever heavier weapons, trying to spread ever more death and fear among the ‘enemy’. But Washington doesn’t even always now who the enemy is. And if you don’t know that, you can’t win.

Still, we’re in it for keeps. Here are two things from a few days ago that tell you why; they come on top of countless other examples The Automatic Earth has served you lately. BusinessWeek:

China’s 2020 Shale Gas Production Target Cut In Half

Tapping China’s vast shale-gas reserves has proved more difficult than government planners in Beijing once hoped. In 2012, China’s National Energy Administration projected that, by 2020, from 60 billion to 80 billion cubic meters (bcm) of domestic shale gas would be pumped annually. Earlier this week the country’s energy chief, Wu Xinxiong, slashed the goal in half, to 30 billion bcm by 2020.

In the US, the Marcellus play was cut by 90-odd%. In Poland, no.1 EU shale prospect, close to nothing was ever found. China’s just getting started cutting expectations and targets.

And from the Wall Street Journal:

Statoil Fails to Make Commercial Discoveries in Arctic Drilling Campaign

Norwegian energy company Statoil said Thursday it was disappointed by the results of an Arctic drilling campaign in the Barents Sea after making no commercial discoveries of oil or gas. Statoil said it had ended its three-well drilling campaign in the Hoop area, and the Apollo, Atlantis and Mercury wells all contained noncommercial volumes of oil and gas.

Shell left the Arctic. Statoil now does. That leaves Exxon, in its recently announced sanction-busting deal with Russia.

Still, even that doesn’t leave much hope, as becomes clear – once again – in the following by Ambrose Evans Pritchard, who’s late to the game in reporting on the same EIA review we covered two weeks ago in Say Bye To The Bubble with help from Wolf Richter, information we expanded on last week in Debt and Energy, Shale and the Arctic.

But hey, it’s Ambrose, and he does numbers well.

Oil And Gas Company Debt Soars To Danger Levels To Cover Cash Shortfall

• The EIA said revenues from oil and gas sales have reached a plateau since 2011, stagnating at $568bn over the last year as oil hovers near $100 a barrel. Yet costs have continued to rise relentlessly.

• … the shortfall between cash earnings from operations and expenditure – mostly CAPEX and dividends – has widened from $18bn in 2010 to $110bn during the past three years. [..] .. to keep dividends steady and to buy back their own shares, spending an average of $39bn on repurchases since 2011.

• The agency, a branch of the US Energy Department, said the increase in debt is “not necessarily a negative indicator”

• … “continued declines in cash flow, particularly in the face of rising debt levels, could challenge future exploration and development”.[..] upstream costs of exploring and drilling have been surging, causing companies to raise long-term debt by 9pc in 2012, and 11pc last year. Upstream costs rose by 12pc a year from 2000 to 2012 due to rising rig rates, deeper water depths, and the costs of seismic technology.

• Global output of conventional oil peaked in 2005 despite huge investment.

• … the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120 ..

• Analysts are split over the giant Petrobras project off the coast of Brazil, described by Citigroup as the “single-most important source of new low-cost world oil supply.” The ultra-deepwater fields lie below layers of salt, making seismic imaging very hard. They will operate at extreme pressure at up to three thousand meters, 50pc deeper than BP’s disaster in the Gulf of Mexico.

• Petrobras is committed to spending $102bn on development by 2018. It already has $112bn of debt. The company said its break-even cost on pre-salt drilling so far is $41 to $57 a barrel. Critics say some of the fields may in reality prove to be nearer $130. Petrobras’s share price has fallen by two-thirds since 2010.

• … global investment in fossil fuel supply rose from $400bn to $900bn during the boom from 2000 and 2008, doubling in real terms. It has since levelled off, reaching $950bn last year. [..] Not a single large oil project has come on stream at a break-even cost below $80 a barrel for almost three years.

“It is just too expensive and too difficult.”. Or as we say where I come from: There Is No There There.

Oil companies already lose $110 billion a year (aka ‘the shortfall between cash earnings from operations and expenditure’). They’re now committing that exact same amount to new projects, money they’ll also have to borrow. What if interest rates go up to 5%? Will they still drill? Or are we going to take someone else’s oil by force?

As I said, hardly new for Automatic Earth readers, but this is so important in understanding what is happening geo-politically these days that it bears repeating. There is no way back. Oil has become ultimate power. And will lead to the ultimate fight. Having bigger and better guns and tanks won’t win that fight.

But Washington, by the look of things, doesn’t seem to understand that. Arrogance and hubris tend to be costly. In ultimate fighting, they can be deadly. America’s not exactly making a lot of friends these days, and the ones they do make are the wrong friends. Even the New York Times now reports on the fine folk gunning down the people of east Ukraine. Will Putin let them do as they please? And if not, what will “we” do?

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.