Stock Market Staring Into the Great Abyss

Stock-Markets / Stock Markets 2014 Aug 27, 2014 - 11:59 AM GMTBy: DeviantInvestor

Is a looming war coincident with a depressed gold price and a stock market peak an example of — staring into the great abyss?

Is a looming war coincident with a depressed gold price and a stock market peak an example of — staring into the great abyss?

From Peter Cooper:

“A five-year regime of artificially low interest rates is responsible for a bubble in stocks, bonds, real estate, emerging markets and many other asset classes…What would you rather own when staring into the great abyss?”

James Rickards regarding the crisis with LTCM in 1998 and the banking crisis in 2008:

“What the crisis of 1998 and the crisis of 2008 had in common and what the next crisis will have in common is that regulators and risk managers are using the wrong models to understand and measure risk. And if you have the wrong models you will get the wrong results every time. … So the system becomes very vulnerable to a rapid collapse. … That’s why I’m expecting another financial crisis rather sooner than later.”

James Rickards on the Fed and money printing:

“So the Fed is trying the same remedies: The money printing goes on and the banking system continues to inflate which is setting us up for an even bigger crisis.”

The world has looked over the edge of the great abyss many times before. Supposedly the financial world was close to collapse during the LTCM crisis and also during the Paulson TARP crisis. Regarding another great abyss from Zero Hedge:

“In front of 3 witnesses, Bank of England Governor Eddie George spoke to Nicholas J. Morrell (CEO of Lonmin Plc) after the Washington Agreement gold price explosion in Sept/Oct 1999. Mr. George said, ‘We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K.’”

And today leverage and the derivatives market is MANY times larger than it was in 1998-99.

And the geopolitical situation seems much more dangerous and unstable than in 1998-99.

And the groups in the middle-east are most definitely not “playing nice” with each other.

And many more nations are bypassing the use of the US dollar for international trading.

And the mood of the people, so it seems, in Europe, the U.S. and the U.K. is much darker and less confident than in the “dot-com” exuberance of 1999.

And 9-11 and all of the after-effects had not yet happened in 1998-99.

The next crisis/correction/crash might be far worse than the 2000 – 2002 debacles or the 2008 financial crisis.

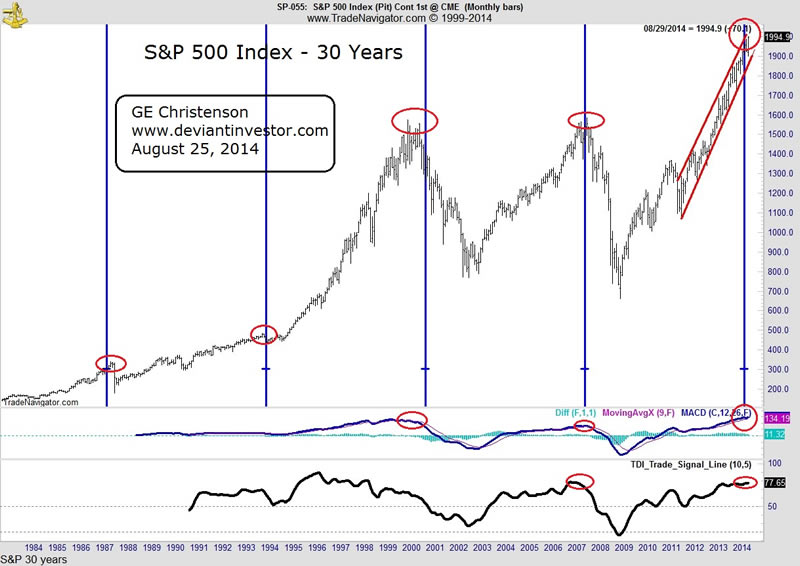

Further, US stocks look like they are in a bubble similar to 1999 and 2000. Consider the following monthly chart of the S&P 500 Index since 1984. Notice the blue line peaks in 1987, 1994, 2000, 2007, and 2014. A major stock market peak every 7 years deserves our attention, especially since it is peaking along with dollar and bond bubbles (generational low interest rates), massive global QE, geopolitical disasters, foreign policy failures, and the probability of new and devastating wars.

S&P 500 Index – 30 years

From General Martin E. Dempsey, U.S. chairman of the Joint Chiefs of Staff regarding ISIS and expanding the war in Iraq and nearby countries:

“This is an organization that has an apocalyptic end-of-days strategic vision that will eventually have to be defeated.”

The same article goes on to state that:

“Dempsey noted that destroying ISIS will require ‘the application of all the tools of [U.S.] national power – diplomatic, economic, information, military.”

And “truly defeating ISIS would require full scale war that would involve fighting in Iraq and Syria.”

The looming war coincident with an all-time stock market peak and other distortions is the edge of the abyss. A new war, a derivative crash, a spike in crude oil prices, another scandal, a dollar collapse, or perhaps a failure to deliver on gold contracts could trigger a stock market correction/crash, another massive debt increase, and an upward spike in the price of gold.

Gold has gone down for nearly three years, while the stock market has gone up for well over five years. The reversal may not occur tomorrow or next month, but it will occur.

This is, in my opinion, a time for caution in the stock and bond markets and for purchases of gold and silver. It is better to leave the Wall Street party early than to crowd the exit doors with about 500 million others who overstayed their welcome at the Wall Street “stocks always go up” extravaganza.

Furthermore the “high-frequency-traders” can levitate the S&P and suppress gold prices for only so long. Eventually the prices for bonds, stocks and gold will be reset in accordance with the realities of massive “money printing,” exponentially increasing debt, generational-low interest rates, huge deficits, escalating war in the middle-east, and Asian purchases of physical (not paper) gold.

Market peaks, market crashes, political crises, wars, deficits, debts, and cycles of confidence and despair seem to be inevitable in our current financial structure.

Are you prepared?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.