Gold Correction Near its End on Converging Signals from Bonds and Currencies

Commodities / Gold & Silver May 15, 2008 - 02:09 PM GMTBy: Jim_Willie_CB

The springtime corrections are really about done. They have gone on for a couple of months. The extent of the pullbacks have been tested and retested. The long-term trends are just about ready to asset themselves again. Grand deceptions have resumed to attempt to fool the public and the investment community that the worst is over for banks, housing, and mortgage bonds. That is not even remotely true. The deeply wounded banks, the sharply corrected home prices, and the badly damaged mortgage bonds have much more pain ahead. Nothing has been fixed. Many mortgage resets have yet to take place. The New Resolution Trust Corp to facilitate secondary mortgages, to bury dead mortgage bonds, and to renegotiate home loans is not even agreed upon, let alone installed. Its operation will be sometime in 2009 at the earliest.

The springtime corrections are really about done. They have gone on for a couple of months. The extent of the pullbacks have been tested and retested. The long-term trends are just about ready to asset themselves again. Grand deceptions have resumed to attempt to fool the public and the investment community that the worst is over for banks, housing, and mortgage bonds. That is not even remotely true. The deeply wounded banks, the sharply corrected home prices, and the badly damaged mortgage bonds have much more pain ahead. Nothing has been fixed. Many mortgage resets have yet to take place. The New Resolution Trust Corp to facilitate secondary mortgages, to bury dead mortgage bonds, and to renegotiate home loans is not even agreed upon, let alone installed. Its operation will be sometime in 2009 at the earliest.

Until then, the system burns as foreclosures mount, inventory bloats, and home prices come down much more, guaranteeing another ugly storm of bank losses in mortgage bonds.

The ultimate determining factor right now is home prices , which are accelerating down. Wall Street seems unwilling even to mention home prices, preferring to talk about bank liquidity concerns having been addressed. Except that bank capital is still negative. Let's take a whirlwind tour of relevant charts, to see that the progress of the corrections is in its last stages. Sentiment is not good for gold, but it never is when the next upleg begins, the nature of the beast. Only the mentally tough, the well informed, and the unshakable types are loaded with gold & silver when the uplegs begin. The bull market in metals and bear market in US$-based paper is ready to resume.

GOLD

The gold price has corrected in a triple wave. Retests at the 850 level have been completed. Longer-term moving averages remain properly aligned. A big pullback from 1020 to 840 will next see the 180-point momentum swing to 1200, once again capturing global attention. The remedies all involve monetary inflation, which will be amplified as problems and crises persist.

SILVER

The silver price has corrected in a more volatile triple wave. Retests at the 16.30 level have been completed. Longer-term moving averages remain properly aligned. A big pullback from 21 to 16 will next see the 5-point momentum swing to 26, once again capturing global attention. The gains in silver will be double those of gold on the next uplegs.

US DOLLAR

The USDollar has bounced in an irregular double quantum jump. It is resisted by the 100-day moving average, which has held firm for over a full year. Longer-term moving averages remain properly aligned. No fundamental improvement has come to the four pillars of insolvency for the United States : federal budget deficit, trade & current account deficit, insolvent big banks, and rising tide of negative equity for homeowners. All pillars are seeing worsening conditions. The epicenter for US collapse financially is New York City , without dispute. The epicenter for US collapse economically is either the Midwest ( Ohio ) or California . My focus is squarely on California , sure to capture the news since the rate of decline will be so magnificent and tragic. It is also where the location of the greatest abuses of mortgage loans. Retests of the 71 level lie ahead. The only saving grace for the USDollar is the breakdown in the British pound sterling, and the potential of a Euro Central Bank official rate cut that would weaken the euro currency. The Competitive Currency Wars have no winners, only relative losers.

LONG-TERM USTREASURY (TNX)

The 10-year USTreasury Note competes with gold directly. The rise in its bond yield, known as the TNX, has come with the advent and heavy deployment of US Federal Reserve lending facilities to the big banks of many stripes. The USFed is actually draining bank funds from the bank system in order to rebalance its own donated portfolio of bonds. This is covered fully in the May Hat Trick Letter reports. Soon, the USFed will resort to outright monetization of bank insolvency, attempt to restore bank capital, and flood the system with printed money as it addresses its own portfolio lent in exchange for private mortgages heavily damaged. Longer-term moving averages remain properly aligned, although the 50-day MA threatens to cross over. On the other hand, the 200-day MA might offer stiff resistance. Falling long-term rates go hand in hand with heavy USFed monetary inflation of the pure variety. Falling long-term rates go hand in hand with gold rallies. Heavy resistance lies right here for the TNX to head back down, favorable for gold.

EURO

The euro exchange rate has corrected in an orderly fashion. Retests at the 154 level have been completed. Longer-term moving averages remain properly aligned, with the 50-day MA offering surprising support. A big pullback from 159 to 154 will next see the 5-point momentum swing to 164, once again capturing global attention. However, if the Euro Central Bank does change course with an official rate cut, then the euro will possible decline, and easily close the entire range down to the 148.50 level. That would aid the US $ DX index. That would also create a more powerful gold bull market in Europe , a bigger center of wealth than the crippled Untied States lately! The net effect might actually be positive for gold, as investors realize that a magnificent next stage of powerful broad inflation will be unleashed upon the entire Western world. Then there is the British pound sterling story.

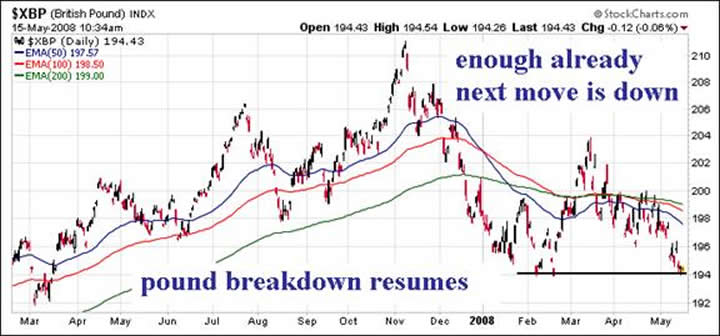

BRITISH POUND STERLING

The pound sterling is in the middle of a crash. The UK currency is looking very weak, having gapped back down to the critical 194 support level, as forecasted last November in the Hat Trick Letter. Housing prices in the UK have begun to fall for the first time in a decade, a trend very early here in its pathogenesis, sure to continue for another two years or more. Recession in the UK economy is assured, since they deployed the lunatic AngloSphere model of housing bubble foundation for economic vitality. That heretical catastrophic model was hatched across the Great Pond, the location of the primary meltdown in the Wall Street. The long-term picture is analyzed more fully in the May Hat Trick Letter report out this weekend. A painful disaster this way comes for England . The heavy duty monetization of their bank system, kept in highly questionable secrecy, will feed the gold bull, if not from plain vanilla monetary inflation, then from fear of the unknown.

JAPANESE YEN

The Japanese yen exchange rate has corrected in an orderly fashion. Retests at the 95 level have been completed. Longer-term moving averages remain properly aligned, with the 100-day MA offering strong support. A big pullback from 102 to 95 will next see the 7-point momentum swing to 109, once again capturing global attention. However, if the Bank of Japan does return to normalcy with an official rate hike, then the yen will rise with sudden power. It will force the liquidation of more Yen Carry Trades, and render deep damage to the Japanese exporters. Japan has two big trade partners nowadays, both the US and China . The irony here, not unknown to the FOREX arena, is that the yen might rise substantially as the Japanese economy undergoes a recession. Their stimulus to exit such a situation will feed the gold bull across Asia . One should know that the US $ DX index has a aberrant tiny yen component. My name for the DX index is the ‘Anti-Euro Index' since the euro is oddly weighted by over 50% within it, but the yen is under 20% in weight. Big moves in the yen will not move the DX index much.

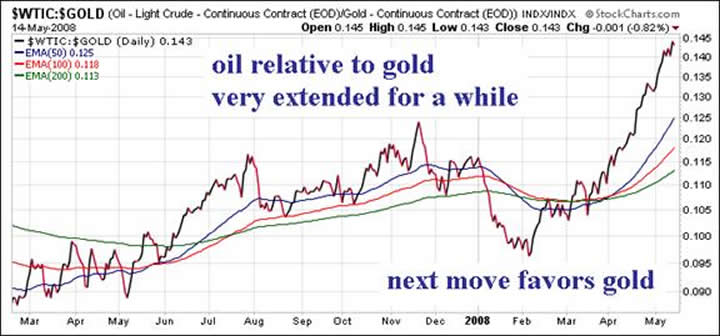

OIL/GOLD RATIO

The ratio of the crude oil price to the gold price has really shot up considerably. The USDollar weakness has opened the door for a big rise in crude oil, aided by speculators, probably with heavy US bank participation (to improve damaged balance sheets). Funds must have an eye on possible expansion to the Iran war front, even to Lebanon as a second front. Regardless, the oil price is due for correction, and with it, a relaxation of the ratio shown in favor of gold again.

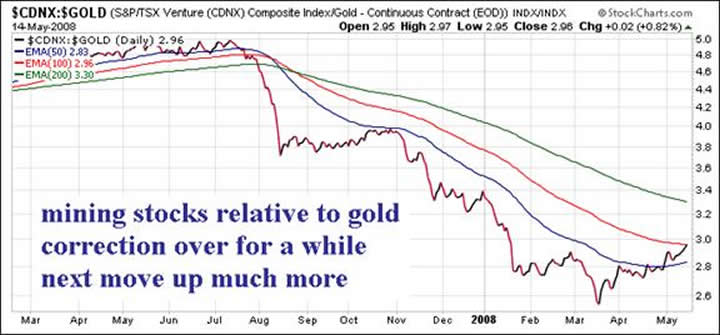

CDNX/GOLD RATIO

The ratio of the Canadian exchange stock index, laden with a heavy representation of mining stocks, versus the gold price, is another important indication of trend. The ratio hit bottom this March and has begun to recover. This is a very promising signal for not just gold, but leveraged investments like gold mining stocks in a general sense. Watch for a bullish crossover of the 50-day moving average above the 100-day MA. Later expect crossovers above the 200-day MA, during a full blown recovery.

BANKING STOCK INDEX

The BKX is a stock index worth watching as attempts are made to remedy the current US bank insolvency. Tremendous losses have been incurred on their balance sheets with asset backed bonds. Those losses are matched by tremendous losses in their stock equity, even their bond principal. Also, dividends have been cut. Notice that an attempt at recovery has taken place. The real story seems to be a newly formed bearish triangle though, one which indicates a huge decline if a breakdown occurs below 76. Given the next round of bank losses in commercial mortgages, prime adjustable mortgages, car loans, credit card lines of credit, it seems a cinch for another BKX breakdown , just like what occurred with the homebuilders.

HOMEBUILDER STOCK INDEX

Only a partial stock chart is shown here. In previous years, a previous huge decline occurred in a breakdown for the HGX index. The breakdown was duplicated in 2007. My forecast is for yet another HGX breakdown in 2008. How far down will it go? TO ZERO. The housing glut and declines dictate and assure that a remedy to the housing and mortgage systems comes only when almost all the homebuilders are out of business. If the system adds to the glut of supply, then the system is nowhere near completion of the remedy. Losses continue to be announced of very significant size for the entire group, on many fronts like deep discounts, land options, mortgage portfolios, and violations of bond covenants.

QUICK CONCLUSION

Sadly, the insolvent US$-based economic and financial system has a long way to go before any recovery can be claimed. The four primary pillars of the federal budget deficit, the trade and current account deficit, the bank insolvency, and the rising tide of negative equity homeowners, these scream of ongoing need for remedy. All forms of remedy involve monetary inflation. The current approach has been careful and directed. The next steps will be much more broad and systemic in the face of desperation to avert collapse. Beware of civil disobedience toward mortgages. Beware of civil disturbances. Beware of open scuffles at gasoline stations. Beware of possibly food riots in poor neighborhoods. Being the newest Thrid World nation, the Untied States will see food riots similar elsewhere in the world. The system inside the US is moving toward chaos. An inflationary recession does that. Job loss and rising prices make for a nasty cauldron for emotions. The only known plan will be to produce enough inflation to keep the system running. The implemented cure will plant seeds for further crisis one year from now, and guarantee a severe change via disruption. The only safe place to be will be commodity investments that oppose the Great Paper Chase in dissolution, in particular precious metals and energy. My favorite remains silver, for many reasons.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“You are able to consume and regurgitate complicated information into layman's terms. It shows that you understand your subject well. It is very easy to take complicated material and repackage it as complicated material. You, however, have the ability to take the complicated and make it understandable to the common man.” (RickS in Californiaa)

“Keep up the good work, and stay safe- the world needs your interpretative skills. “From your radio interviews, I know that your quick wit and conviction are genuine. Your confidence and eloquence comes across just as strongly. You make specific, seemingly outrageous predictions with specific timing, and you are very often right. Really, can one offer any higher praise to an analyst?” (TomH in California )

“The unfortunate demise of Dr. Kurt Richebacher leaves Jim Willie, Bob Chapman, and Jim Sinclair as the finest financial minds on the scene today.” (DougR in Nevada )

“There are four writers that I MUST READ. You are absolutely one of those favorites!! William Buckler, Ty Andros, Richard Russell, and YOU!!” (BettyS in Missouri )

“Your newsletter caught my attention when the Richebächer report ended. Yours has more depth and is broader in coverage for the difficult topics of relevance today. You pick up where he left off, and take it one level deeper, a tribute.” (JoeS in New York )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retaicl forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.