The Silver Price Sentiment Cycle

Commodities / Gold and Silver 2014 Sep 15, 2014 - 03:25 PM GMTBy: DeviantInvestor

The following chart shows:

The following chart shows:

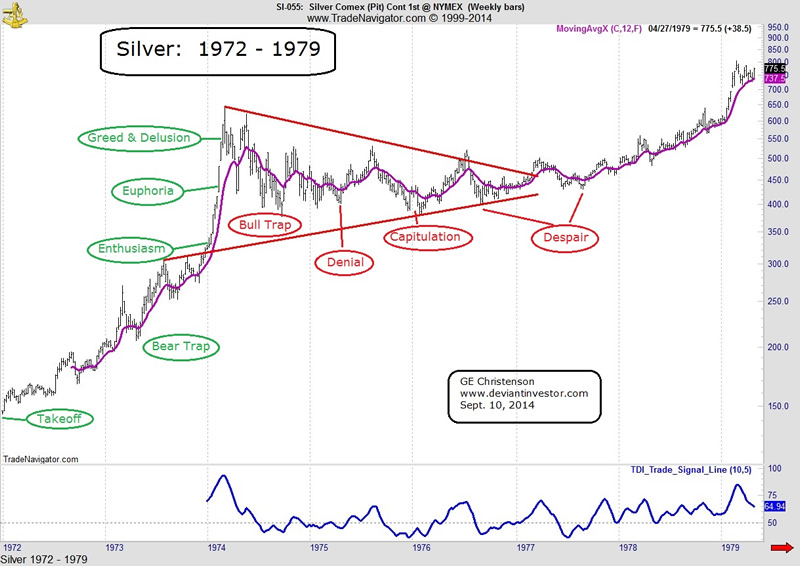

Silver Prices: 1972 – 1979

- Silver moved upward from about $1.40 in 1971, rallied to about $6.40 in March 1974, and fell to about $4.30 in August 1977.

- The March 1974 peak took about 3 years and ended about 4.55 times its starting point.

- The August 1977 low took another 3.5 years and fell about 33% from the peak price.

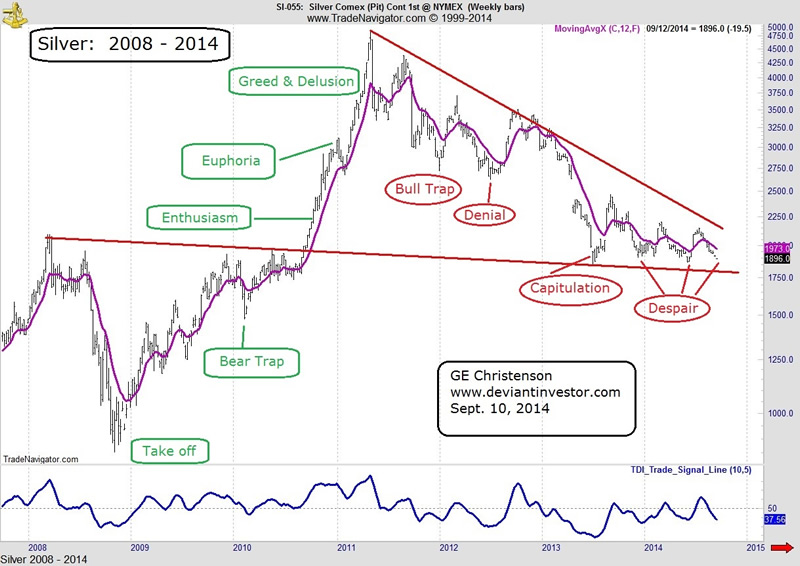

Now look at the following chart of silver prices from 2008 – 2014.

Silver Prices: 2008 – 2014

- Silver moved upward from about $8.53 in October 2008, rallied to over $48 in April 2011, and fell slightly below $19 in September 2014.

- The April 2011 peak took about 2.5 years and ended at about 5.7 times its starting point.

- The correction into the September 2014 low has taken about 3.4 years and declined about 61% from its peak.

Do you see the similarities? I have placed sentiment labels on both graphs.

Sentiment 1971 – 1977 2008 – 2014

Takeoff 1.40 $8.53

Bear Trap 2.50 14.70

Enthusiasm 3.50 23.00

Euphoria 4.50 29.00

Greed & Delusion 6.00 44.00

Bull Trap 3.80 27.50

Denial 3.90 26.50

Capitulation 3.80 19.00

Despair 4.15 18.70

What is Different This Time?

Probably not much! The patterns are similar, but the potential rally from present prices in 2014 looks like it could be even larger than the 1977 – 1980 rally. Why? See below. In the early 1970s silver went from “ho-hum” to “enthusiasm” to “wow, who would believe it could go to $6.40?” After the 2008 crash silver went from “going back to 5 bucks” to “enthusiasm” to “wow, who would believe it could go above $45?”

As a reminder, after silver rallied to the then astounding price of $6.40 in early 1974, it crashed back to $3.80 and then traded sideways for 2 years. Less than 3 years later it had briefly traded at $50.00, due to a combination of inflation, debt and deficits, political issues, conflict with the USSR, fear, a market corner, and dollar weakness.

After rallying to another “unthinkable” price of nearly $50 in 2011, silver crashed to about $18.50. However, in another 3 -5 years, perhaps in 2017 – 2019, I expect silver will have rallied to $50, $100 or maybe $300 or more, due to a combination of multiple wars, unpayable debts, inflation, deficits, bailouts, bail-ins, massive “money printing,” inflationary expectations, QE, potential hyperinflation, considerable fear, currency wars, counter-party risk, political issues, derivatives, conflict with Russia, economic and dollar weakness, and the weakening or outright loss of the dollar’s global reserve currency status.

We know that financial television (and others) expect (hope) the S&P to rally and silver to collapse, but we must remember who pays the bills for financial television, buys the advertising, and supports the various fictions in our current economic and political environment.

Along with many others, I expect that silver will rally for the next 3 – 7 years.

Favorable for Silver Prices Unfavorable for Silver Prices

More debt and more war Fiscal sanity and peace

Congressional corruption Congressional honesty

Weaker dollar Strong dollar

$10 gasoline $3 gasoline

Considerable price inflation 2% inflation

Asian gold and silver purchases Weak demand from Asia

Ukraine and Middle-East wars Peace in our time

Low congressional approval ratings High congressional approval ratings

Amateur hour in foreign policy Strong foreign policy

Money flow out of bonds into silver Money flow out of silver into bonds

Money flow out of S&P Money flow out of silver

More restrictions on mining Fewer restrictions on mining

Lack of exploration for new silver Discovery of new silver deposits

Increasing energy prices Decreasing energy prices

More fiscal insanity A balanced budget

More “money printing” Back to a modified gold standard

I expect that silver will rally well over $100 in the next few years because most or all of the “favorable” and few or none of the “unfavorable” items listed above will occur.

Does this month look more like another bottom in silver and another top in the S&P, or does it look like a new paradigm with responsible leadership in the political and financial worlds, lasting employment, prosperity for all, declining debt, and a balanced government budget?

Are you buying silver instead of bonds? Are you buying silver instead of S&P indexed funds? Are you buying gold instead of earning 0.10% interest in your saving account? Are you preparing for a financial future based on real assets instead of paper promises secured by the integrity of politicians and bankers?

GE Christenson aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.