Why Money Is Worse Than Debt

Interest-Rates / Fiat Currency Sep 17, 2014 - 01:07 PM GMTBy: GoldSilverWorlds

Francis Schutte writes: Everybody has to spend energy, has to work for his living. This is true for Government as well as for the billionaires and for the ordinary employee. Nothing – except for sunshine and air – comes for free. Note that today, sometimes people even pay for sunshine (vacation) and air (airports in Venezuela).

Francis Schutte writes: Everybody has to spend energy, has to work for his living. This is true for Government as well as for the billionaires and for the ordinary employee. Nothing – except for sunshine and air – comes for free. Note that today, sometimes people even pay for sunshine (vacation) and air (airports in Venezuela).

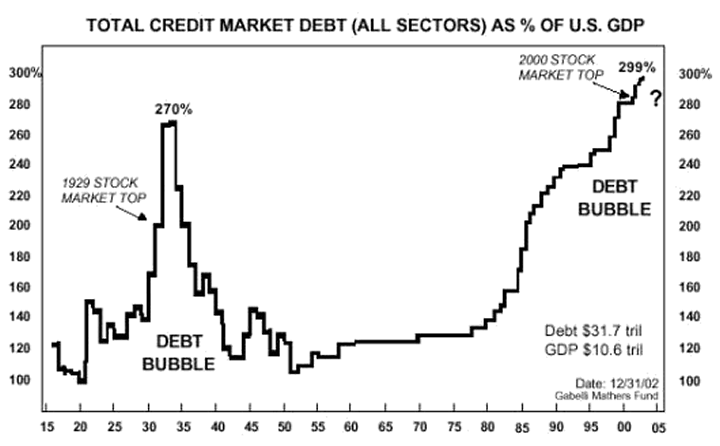

Not hard to understand that today’s fairy tale of “Free Fiat Money” will have a bad ending…or is it? Few people seem to realize the dramatic situation we are in, and that the denial is fed by the propaganda sold by politicians through the mainstream media. The 4th generation (see Galbraith’s Age of Uncertainty) doesn’t seem to be mentally able to grasp the seriousness of the situation the world is in.

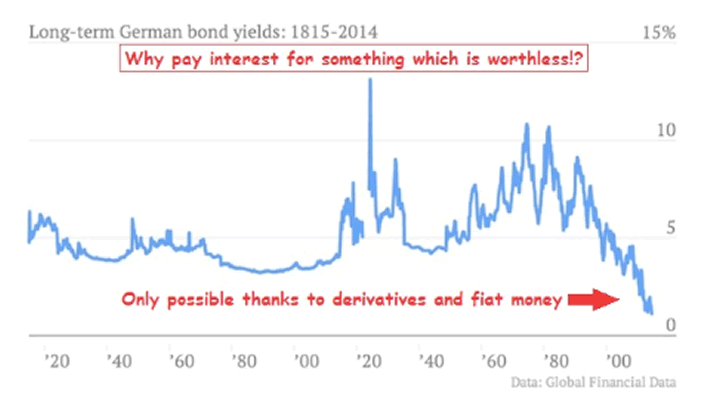

Governments and central banks (which are like economic Siamese twins), not only print fiat money but, on top, make the cost to print more money, issue new debt and serve past debt ridiculously low….In reality, real interest rates (nominal interest rate less real inflation rate), or the cost to issue more fiat money, has even become negative. Propaganda must be extremely solid to keep such a mirage alive and absolute no accident may happen.

Note 1 : up to today we still do not know what really made the Big Crash of 1929 happen. Some blame the bad state of the economy, others the overextended on margin (debt) thriving stock markets. The fact is we had a debt bubble like we have today.

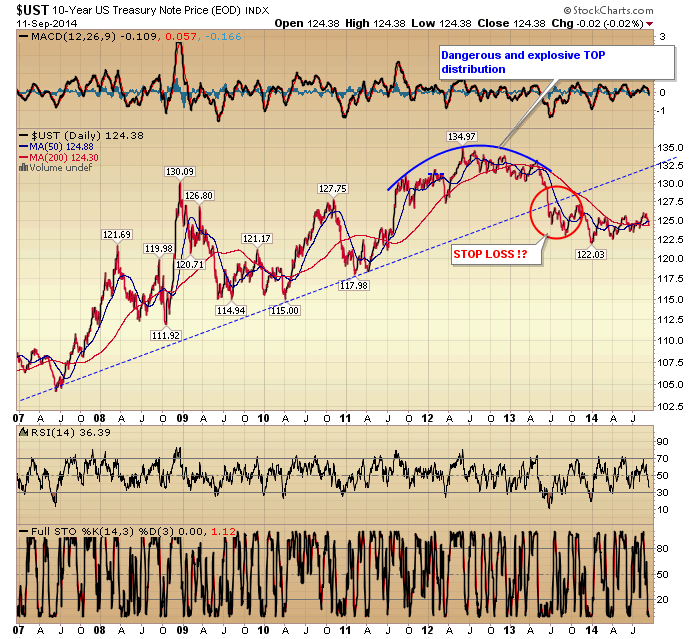

Note 2: Bond markets show huge top formations and we already have indications that the price has fallen down out of the top.

Modern money is worse than debt. Nowadays, it has a negative value – whoever exchanges it for goods and services, gets automatically mugged! Whoever buys Treasuries and Bonds gets mugged. Whoever keeps money in saving accounts and as bank deposits gets mugged. Whoever buys a life insurance gets mugged. Whoever buys real estate gets mugged. Whoever keeps banknotes under his mattress gets mugged…Apparently there is no way to escape the global holdup by governments and bankers.

Governments are using the so created fiat debt money to pay for goods and services. The are getting richer for each Dollar/Euro/Yen/Sterling note they bring into circulation (although the reality is that they get less broke, for it is mathematically impossible to cover all the historic and future debt). Those who understand what is happening, know that, as sellers ,they have become subjects of theft in broad daylight. Governments are paying for goods and services with “negative fiat money,” or, to put it blunt, the buyer is exchanging his goods and is getting more debt than assets in return.

By doing so, authorities deny the very existence of the Constitution.

Article 1 Section 10 paragraph 1 of the Constitution (the supreme law of the United States):

Money is silver or gold. No state shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility.

Today’s situation is actually a lot worse than the one pictured by “the emperor has no clothes.” Therefore, the one million dollar timing question is to find out WHEN some accident will make it all blow up. The second million dollar question is to find out which action, what happening will actually make it happen….

The market can stay irrational longer than you can stay solvent

Forecast economic evolutions and financial markets is a rather easy exercise compared to timing when these will unfold. TIMING when something will happen is extremely difficult. Technically speaking, bottom and top formations can be short but sometimes last for years.

Easy to forecast the target based on the size of the formation. Hard to forecast when the price will break out of the bottom (gold & silver) or down of a top (bonds, money). Experience teaches us that price can break out once we have completed ¾ to 4/5th of a pattern. And ¾ to 5/5th we have for bonds and gold/silver. The respective formations started in 2010/11 and are still maturing and it can take another 12 to 18 months before we see some action.

Today’s mania market, today’s Tulip bulb, today’s South Sea company is the belief fiat money has any value at all.

Because the many warnings issued by financial analysts fail to become reality in the short/medium term, people which want immediate satisfaction rather believe the propaganda sold by the authorities through the mainstream media and are becoming dangerously complacent. Also, authorities are seen as almighty and the herd becomes convinced they will come up with a decent solution….that is until we actually have a catharsis and/or a war.

Note: there are more and more indications pointing to the fact that WW III will be fought in the Middle-East but also in Europe!

The future for the West will be very bleak if our central planners continue to play games by manipulating major markets and selling lies through the mainstream media. Some day the can will hit the wall and it will be ‘Game Over.’ Unless, off course, you are prepared.

Price goes up or comes down when time is up and nobody believes it will.

Mean time, many who are invested in gold & silver are unhappy and some start to doubt whether they made the right decision, disbelief is growing and some investors/traders start to liquidate or have liquidated their positions…The sector is being purified and is preparing for the next dramatic bull run which will happen at some time in the near future.

The special ratio PF charts in the subscriber’s sections clearly show the latest configuration for Gold expressed in the major currencies – as well for the miners. The only thing we can’t predict at this time is WHEN it will happen.

Goldonomic.com offers a special one-year coaching program in which you get personalized advice on protecting your wealth. Get to know more about the ultimate wealth protection strategies and the one-year personalized coaching program.

Source - http://goldsilverworlds.com/money-currency/why-money-is-worse-than-debt/

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.