Stock Market Investing - Don't Let Media "Noise" Drown Out True Value

Companies / Investing 2014 Sep 17, 2014 - 02:01 PM GMTBy: Money_Morning

Michael E. Lewitt writes: Signs of overvaluation and "irrational exuberance" abound in the market, and not surprisingly it is most often seen in the run-up of stocks with which we have daily familiarity.

Michael E. Lewitt writes: Signs of overvaluation and "irrational exuberance" abound in the market, and not surprisingly it is most often seen in the run-up of stocks with which we have daily familiarity.

We hear incessantly of Facebook Inc. (Nasdaq: FB) and Twitter Inc. (NYSE: TWTR) - when not checking them ourselves.

That lends some validity to the exuberance, as a ubiquitous presence in our lives can feel like a lock for growth potential, or permanence in the marketplace beyond challenge.

The tech sector as a whole has the ability to deliver tremendous returns - we've seen it often - which makes it all the more critical to use a few tools to screen out stocks of perceived value so we can invest in the true winners...

These Growth Rates Are Not Sustainable

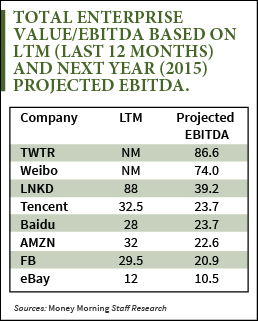

The following chart shows just how optimistically investors are discounting the future of a few social media and tech stocks that I've selected as a sample to examine.

The metric or ratio here is looking at total enterprise value to EBITDA (earnings before interest, taxes, depreciation, and amortization) more than five years into a central bank-induced bull market:

These are not multiples of earnings, which in the case of most of these companies would be considered fully-valued (with the exception of eBay); these are multiples of EBITDA (cash flow), since many of these companies have no earnings.

These are not multiples of earnings, which in the case of most of these companies would be considered fully-valued (with the exception of eBay); these are multiples of EBITDA (cash flow), since many of these companies have no earnings.

While these are unquestionably groundbreaking companies in cutting-edge industries, they are also operating in industries that have limited or no barriers to entry. And that is potentially a very big problem.

In an industry that thrives on creative destruction, optimism can often lead to despair as regulatory and technological changes wreak havoc on thin business models and market domination.

Some of these large companies like Facebook and Amazon.com, Inc. (Nasdaq: AMZN) will also confront the law of large numbers that inevitably limits their growth. Their growth rates inevitably slow. For example, this is something that investors in growing, well-known companies like Chipotle Mexican Grill, Inc. (NYSE: CMG) are also going to learn, to their disappointment.

This is one reason that Apple Inc. (Nasdaq: AAPL) trades at what seems to be a reasonable multiple; the company is just too large and is incapable of growing at the types of multiples seen at early-stage companies.

While the growth rates of some of the companies listed above has been extraordinary, they will inevitably slow. If they aren't able to demonstrate profitability sooner rather than later, investors will inevitably be disappointed. AMZN stock has been a notable exception to that rule, but soon will either have to make money or see its stock drop significantly. (Particularly as high-profile entrants such as Alibaba are poised to step into the lucrative e-commerce market.)

"Marquee" growth stocks will always trade at much higher multiples than the market. The reason is simple: they've captured the imaginations of investors and are at the center of a cultural, media, and economic revolution.

But by virtue of their epic valuations, they are highly vulnerable to sell-offs and changes in market psychology and investor whimsy. They are also vulnerable to the least sign of trouble or investor disappointment. When stocks are trading for a perfect ending, any blemish on that outcome can lead to dramatic sell-offs.

Easy Money Makes the Task Even More Daunting (and Important)

Most importantly these stocks, as well as the broader market, are beneficiaries of the flood of liquidity coming from central banks and supporting the prices of all financial assets. With more than $4.5 trillion of excess liquidity sitting in global banks (and much more coming), the world is awash in more money than ever before.

Financial asset prices are being inflated far beyond their fundamental values, including Manhattan apartment prices, Miami condos, or pieces of fine art. Social media stocks are no different.

When Federal Reserve Chair Janet Yellen warned a couple of months ago that, among others, social media stocks had entered a bubble, that was like the judge at the Indianapolis 500 handing out speeding tickets. And investors reacted accordingly, bidding up those stocks further. Until central banks stop injecting monetary heroin into the veins of the financial system, the most speculative stocks will keep trading at valuations last seen during the Internet Bubble.

And we all know how that ended.

In an era of trading cycles accelerated by information exchanged at the speed of light, it remains more important than ever to separate the wheat from the chaff when it comes to true stock values. By applying relatively simple metrics, reading daily financial news rather than Twitter feeds, it can still be found in an inflated market.

Source : http://moneymorning.com/2014/09/17/dont-let-media-noise-drown-out-true-value/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.