Gold Surges on Inflation Hedge and Safe haven Buying

Commodities / Gold & Silver May 19, 2008 - 10:19 AM GMTBy: Mark_OByrne

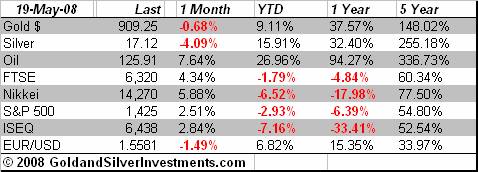

Gold was up $20 to $898.40 on Friday and silver was up 28 cents to $16.90. Gold started the week with the rally continuing in Asia and has risen in early trading in Europe to over $910 per ounce.

Gold was up $20 to $898.40 on Friday and silver was up 28 cents to $16.90. Gold started the week with the rally continuing in Asia and has risen in early trading in Europe to over $910 per ounce.

Oil has weakened slightly but the dollar has also weakened slightly and this likely contributed to gold's rally this morning.

Inflation hedging and safe haven buying is reemerging on both the surging oil price, inflationary pressures and with much of the economic data being very negative last week, especially the appalling consumer sentiment numbers which showed consumer confidence falling to their lowest levels since 1980, 28 years ago.

Today's Data and Influences

This week is a quite week on the U.S. indicators front, with little to add to the picture of a struggling economy. The midweek release of the FOMC minutes will gain more attention than usual, in view of the Fed's recent policy decisions.

Economic indicators deteriorated last week, as signals from retail sales, manufacturing activity, and consumer confidence were generally negative. In addition, oil prices bounced back up to record levels.

Core producer prices are expected to have accelerated slightly in response to pipeline pressures from intermediate and crude goods, while existing home sales likely declined again. Other numbers to watch include existing home sales and PPI reports for April, with the latter expected to point to upside inflation risks.

Dollar to Keep Falling

The dollar's recent bounce is likely to have been another short term bounce in its ongoing bear market. Despite all the positive “talking up” of the dollar in recent days, its recovery has been meager at best. In the last 30 days it did rise some 3% versus the euro however it was 4.8% weaker than the Swiss franc and 2.2% weaker than the Japanese yen during the same period. It was also down against the Australian dollar and many of the Asian currencies during the month, showing that the much touted recovery was primarily against the euro and is tentative at best.

While the dollar may continue to strengthen against the euro in the short term it remains in a bear market. In the same way that many analysts were wrong when they said that 1.30 would be the high in the euro/dollar rate so they will be wrong with the call that 1.60 is the highest the euro will rise against the dollar. Indeed, it is not beyond the realms of possibility that the dollar will fall to 2:1 to the euro as it did with sterling in recent years – unless there is a significant steep recession in the Eurozone.

The same people who have called the end of the dollar bear market will be proved wrong again. The dollar remains a currency facing substantial headwinds in the form of the huge annual trade, current and now increasing budget deficits and burgeoning stagflation. Until these deficits are materially corrected and the threat that is stagflation dissipates gold will remain in a bull market.

Trichet Warns on Credit Crisis and Inflation

Fears of a sustained downturn in world economies was back on the agenda today after Jean Claude Trichet, the president of the European Central Bank, gave warning that the worst if the credit crunch has not passed and was still heading for a "very significant market correction". Speaking on BBC Radio 4, Trichet said containing inflation was the best way to protect prosperity and employment. "Price stability and credibility in price stability in the medium term is the best way to have a high level of sustainable (economic) growth and sustainable job creation," he said. Trichet said inflationary pressures were being added to by an accumulation of oil price rises and food price rises, adding: "

Silver

Silver is trading at $17.15/17.20 per ounce at 1200 GMT.

PGMs

Platinum is trading at $2148/2158 per ounce (1200 GMT).

Palladium is trading at $448/453 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.