Bitcoin Price Fall to $350?

Currencies / Bitcoin Oct 18, 2014 - 11:10 AM GMTBy: Mike_McAra

Briefly: no speculative positions.

Briefly: no speculative positions.

Marc Andreessen, founder of Netscape and, currently, founder and partner at Andreessen Horowitz, a venture capital firm invested in Bitcoin startups, expressed his views on Bitcoin and Apple Pay, we read on CoinDesk:

Apple Pay is the next big thing that's "freaking out" financial services companies right now, but, in the long term, bitcoin will prove to be the real innovation, Marc Andreessen has said.

(...)

"What we say from our [Andreessen Horowitz's] standpoint is that, in the long run, bitcoin is by far the most innovative and radical thing," he said, adding:

"It's the thing that will actually have a big impact over 20 years, but Apple Pay is the thing that's going to have a big impact in the next three years. And the combination of those two is going to cause enormous change."

(...)

"[Apply Pay] is innovative, but in a way [it's] very consistent with the status quo. If anything, its big selling point is it doesn't require massive structural change."

He went on to describe the dilemma that exists in today's payments industry, maintaining that there is a network effects problem in that no one will use a new payments system until both the merchant and consumer sides of the industry embrace it fully.

This is convergent to our opinion on how the Bitcoin/Apple Pay situation will play out. Apple Pay is innovative as far as the ease of use is concerned. Users might be lured to it by the same means they are lured to other Apple products - friendly interface, aesthetics, "cool factor." In this sense, it is possible that Apple Pay will make its mark within the months to come. This is also where Bitcoin developers might learn from Apple - they need to develop a packaging for Bitcoin's revolutionary ledger that will be easy to use even for somebody who can't tell the difference between one bit and one bitcoin.

Looking at the inherent potential, Bitcoin seems to go far ahead of anything Apple can offer. The ledger mechanism is something not seen previously and, given that improvements are made in the security and user-friendliness departments, it might start the revolution in payments. This is not to say that Apple pay can't be successful. The contention here is that over the long run, Bitcoin's ledger system will have far more impact than Apple Pay's features.

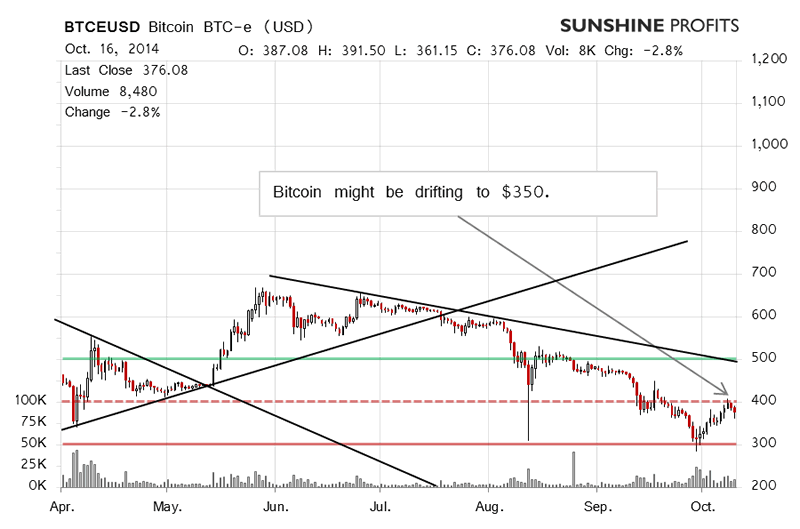

For now, let's take a look at the charts.

Yesterday, we wrote:

The volume is still relatively significant and today's close might turn out to be even more important than yesterday's. If Bitcoin stays below $400 or depreciates further, we might be in for a move down.

In our opinion, Bitcoin still might have room for appreciation but the developments of the last two days have made the outlook more bearish.

Bitcoin stayed below $400 yesterday and, in fact, today we've seen a move down (this is written before 10:00 a.m. ET). There has been an important change compared with the previous couple of days, though. Namely, the volume is visibly lower. At the moment of writing, not even 25% of yesterday's volume has been reached. Based on that alone, today's move doesn't have very important bearish implications.

It has been a rather weak move down on relatively low volume which doesn't add a significant bearish tinge to the market conditions. But does this development have any other possible outcomes?

It is possible that today, with not much bitcoins traded, marks the end of the pause in a more significant rebound - the one that started in the first week of October. But this is not what we're betting on just now. If Bitcoin stays below $400, even without a significant move down, we might still see more depreciation. A move to $350 or slightly lower is a possibility but not one which would make us suggest shorts at this time.

On the long-term BTC-e chart, we see a possible beginning of a move lower, which could end around $350. Yesterday, we expressed the following views:

There's been a moderate reversal and the volume is similar to what we saw yesterday. Overall, today doesn't look too inspiring as far as long positions are concerned.

If we see more action below $400, even not necessarily a strong move down, just stagnation below this level, Bitcoin might be opened up for a more significant slide. If this is not the case, we will stick with the appreciation scenario since the currency might still recover some ground following the last two plunges (think Sept.-Oct.), possibly to $500.

If there's a strong move above $400, we might reenter longs. At present, a buy limit order looks like the best way to go with an entry price at $427, a stop-loss at $357 and an initial target at $500.

This is still up to date and today very much looks like a possible first day of stagnation. It's too early to assess whether this is really the case but it seems to us that we might see more weakness in the days to come, perhaps preceded by not much action.

If Bitcoin comes back and goes above $400 the situation will be decidedly bullish and it might even start a sizeable rally. A move below $350, however, could be an indication of more pain to come.

At this time it seems best to stay out and see if the currency rebounds off $350. We still favor an appreciation scenario with Bitcoin coming back with a vengeance but the situation is not favorable for long positions just now.

Summing up, we don't support any speculative positions in the market.

Trading position (short-term, our opinion): no current positions; a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.