Stock Market Buy the Dip or Sell the Rally

Stock-Markets / Stock Markets 2014 Oct 25, 2014 - 12:22 PM GMTBy: Sy_Harding

I’ve been around a long time, through many economic and market cycles, and I don’t recall a time when the bull/bear debate had such strong arguments on both sides.

I’ve been around a long time, through many economic and market cycles, and I don’t recall a time when the bull/bear debate had such strong arguments on both sides.

The bullish case:

· The economic recovery from the Great Recession continues.

· The Fed promises to keep rates low until the economy strengthens more.

· Earnings continue to meet or beat Wall Street estimates.

· Corporations are buying back their stock, decreasing the supply.

· With interest rates so low, there’s no place for investors other than in stocks.

· Oil and energy costs are plunging, leaving consumers with more disposable income.

· The market has finally experienced the overdue 10% correction.

· Favorable seasonality has arrived.

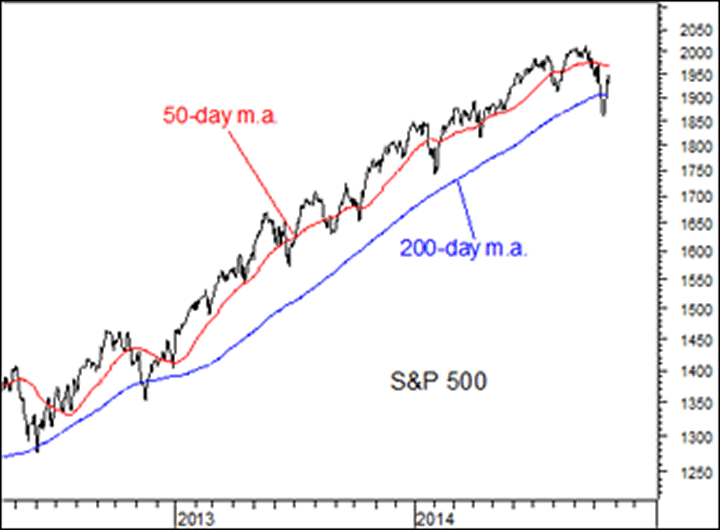

· The S&P 500 breaking below its long-term 200-day m.a. was a false alarm.

The bearish case:

· The recovery remains as anemic as it has been for the last five years. The Fed is ending QE stimulus on which the economy has been dependent. Every time the Fed let QE stimulus expire, the market and economy stumbled until they re-instated it.

· The economies of America’s largest global trading partners are in trouble. The 18-nation euro-zone is potentially even sliding back into recession. Global slowdowns will drag the U.S. economy down.

· That earnings are beating Wall Street’s estimates is only a measure of Wall Street’s ability to obtain guidance from companies. Actual earnings growth is slowing.

· That corporations are using their cash to buy back their stock, artificially manipulating the P/E ratio, rather than investing in growth, is not a positive for the economy. It’s an activity usually seen near the end of bull markets.

· The U.S. stock market is at high valuation levels even for times when the economy was already super strong and growing.

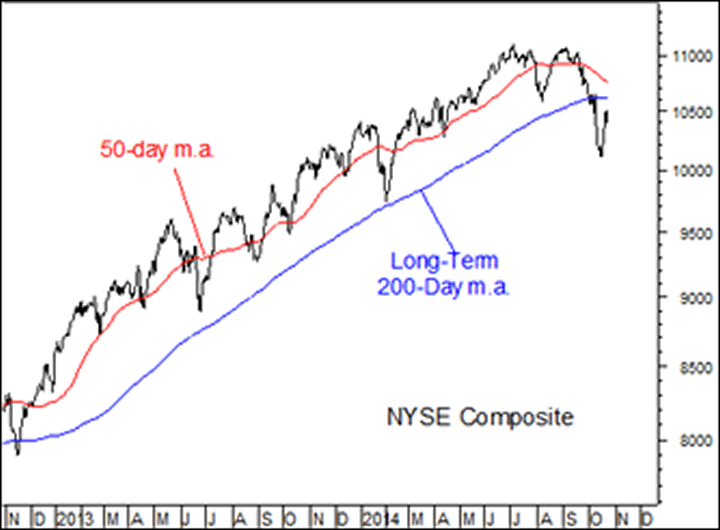

· On the 200-day m.a. being a false alarm, not so far on the broad NYSE Composite.

· After four straight down weeks, the market rallied back this week. So far, the rally looks as much like a normal brief bounce-back from an oversold condition beneath key moving averages, as the beginning of a new leg up.

· Investor sentiment has already spiked back up to levels of bullishness usually seen at market and rally tops. This week’s AAII poll showed the bullish percentage jumped to 49.7%, while the bearish percentage plunged to 22.5%. By the time a correction ends, fear has usually taken over, with bulls under 20% and bears over 50%, just the opposite of this week’s readings. For instance, in early September, just before the mid-September market peak, bulls were at 51.9%, bears at 19.2%.

· Meanwhile, in the midst of investor optimism this week, bellwether companies in important economic sectors released disappointing 3rd quarter financial reports and warnings, the likes of American Express, IBM, Samsung Electronics, Walmart, Family Dollar Stores, Coca-Cola, McDonald’s, eBay, Netflix, Amazon.

Strong arguments on both sides.

The financial media is excitedly pointing out that this is the best week for the S&P 500 since July 2013. Just two weeks ago, it was the worst week since May 2012.

My technical indicators have improved, but have not yet issued an all-clear signal, suggesting this still may be just a deserved bounce, after an unusual four straight down weeks that had the market short-term oversold, but may not be the end of the correction.

The answer one way or the other should not be many days away.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.