A Scary Story for Emerging Markets

Stock-Markets / Emerging Markets Oct 27, 2014 - 07:13 PM GMTBy: John_Mauldin

The consequences of the coming bull market in the US dollar, which I’ve been predicting for a number of years, go far beyond suppression of commodity prices (which in general is a good thing for consumers – but could at some point threaten the US shale-oil boom). The all-too-predictable effects of a rising dollar on emerging markets that have been propped up by hot inflows and the dollar carry trade will spread far beyond the emerging markets themselves. This is another key aspect of the not-so-coincidental consequences that we will be exploring in our series on what I feel is a sea change in the global economic environment.

The consequences of the coming bull market in the US dollar, which I’ve been predicting for a number of years, go far beyond suppression of commodity prices (which in general is a good thing for consumers – but could at some point threaten the US shale-oil boom). The all-too-predictable effects of a rising dollar on emerging markets that have been propped up by hot inflows and the dollar carry trade will spread far beyond the emerging markets themselves. This is another key aspect of the not-so-coincidental consequences that we will be exploring in our series on what I feel is a sea change in the global economic environment.

I’ve been wrapped up constantly in conferences and symposia the last four days and knew I would want to concentrate on the people and topics I would be exposed to, so I asked my able associate Worth Wray to write this week’s letter on a topic he is very passionate about: the potential train wreck in emerging markets. I’ll have a few comments at the end, but let’s jump right into Worth’s essay.

A Scary Story for Emerging Markets

By Worth Wray

“The experience of the [1990s] attests that international investors have considerable resources at their command in the search for high returns. While they are willing to commit capital to any national market in large volume, they are also capable of withdrawing that capital quickly.”

– Carmen & Vincent Reinhart

“Capital flows can turn on a dime, and when they do, they can bring the entire financial infrastructure [of a recipient country] crashing down.”

– Barry Eichengreen

“The spreading financial crisis and devaluation in July 1997 confirmed that even economies with high rates of growth and consistent and open economic policies could be jolted by the sudden withdrawal of foreign investment. Capital inflows could … be too much of a good thing.”

– Miles Kahler

In the autumn of 2009, Kyle Bass told me a scary story that I did not understand until the first “taper tantrum” in May 2013.

He said that – in additon to a likely string of sovereign defaults in Europe and an outright currency collapse in Japan – the global debt drama would end with an epic US dollar rally, a dramatic reversal in capital flows, and an absolute bloodbath for emerging markets.

Extending that outlook, my friends Mark Hart and Raoul Pal warned that China – seen then by many as the world’s rising power and the most resilient economy in the wake of the global crisis – would face an outright economic collapse, an epic currency crisis, or both.

All that seemed almost counterintuitive five years ago when the United States appeared to be the biggest basket case among the major economies and emerging markets seemed far more resilient than their “submerging” advanced-economy peers. But Kyle Bass, Mark Hart, and Raoul Pal are not your typical “macro tourists” who pile into common-knowledge trades and react with the herd. They are exceptionally talented macroeconomic thinkers with an eye for developing trends and the second- and third-order consequences of major policy shifts. On top of their wildly successful bets against the US subprime debacle and the European sovereign debt crisis, it’s now clear that they saw an even bigger macro trend that the whole world (and most of the macro community) missed until very recently: policy divergence.

Their shared macro vision looks not only likely, not only probable, but IMMINENT today as the widening gap in economic activity among the United States, Europe, and Japan is beginning to force a dangerous divergence in monetary policy.

In a CNBC interview earlier this week from his Barefoot Economic Summit (“Fed Tapers to Zero Next Week”), Kyle Bass explained that this divergence is set to accelerate in the next couple of weeks, as the Fed will likely taper its QE3 purchases to zero. Two days later, Kyle notes, the odds are high that the Bank of Japan will make a Halloween Day announcement that it is expanding its own asset purchases. Such moves only increase the pressure on Mario Draghi and the ECB to pursue “overt QE” of their own.

Such a tectonic shift, if it continues, is capable of fueling a 1990s-style US dollar rally with very scary results for emerging markets and dangerous implications for our highly levered, highly integrated global financial system.

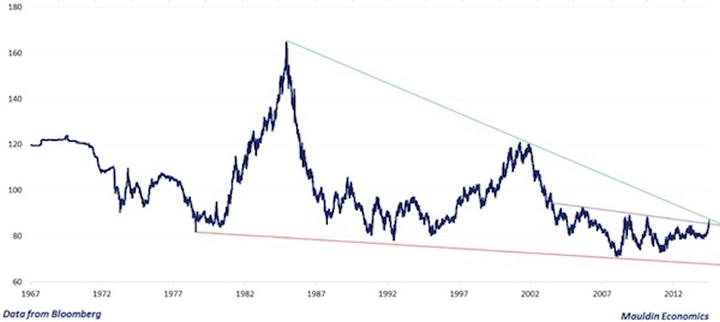

As Raoul Pal points out in his latest issue of The Global Macro Investor, “The [US] dollar has now broken out of the massive inverse head-and-shoulders low created over the last ten years, and is about to test the trendline of the world’s biggest wedge pattern.”

One “Flight to Safety” Away from an Earth-Shaking Rally?

(US Dollar Index, 1967 – 2014)

For readers who are unfamiliar with techical analysis, breaking out from a wedge pattern often signals a complete reversal in the trend encompassed within the wedge. As you can see in the chart above, the US Dollar Index has been stuck in a falling wedge pattern for nearly 30 years, with all of its fluctuations contained between a sharply falling upward resistance line and a much flatter lower resistance line.

Any break-out beyond the upward resistance shown above is an incredibly bullish sign for the US dollar and an incredibly bearish sign for carry trades around the world that have been funded in US dollars. It’s a clear sign that we may be on the verge of the next wave of the global financial crisis, where financial repression finally backfires and forces all the QE-induced easy money sloshing around the world to come rushing back into safe havens.

Let me explain…

As John Mauldin described in his recent letter “Sea Change,” the state of the global economy has radically evolved in the wake of the Great Recession.

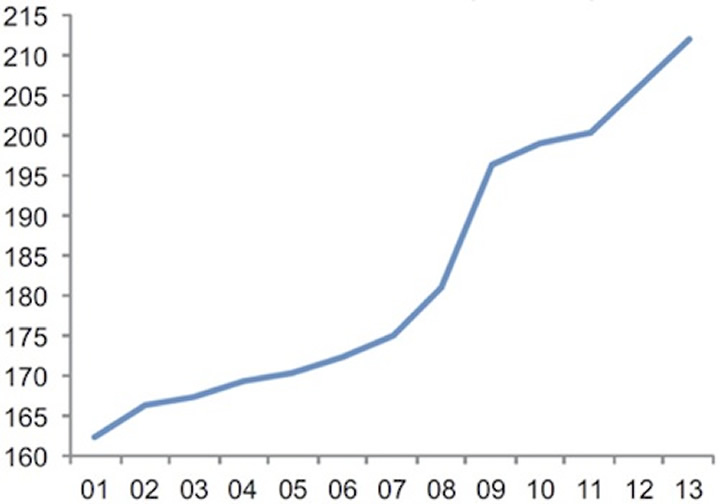

Against the backdrop of extremely accommodative central bank policy in the United States, the United Kingdom, and Japan and the ECB’s “whatever it takes” commitment to keep short-term interest rates low across the Eurozone, global debt-to-GDP has continued its upward explosion in the years since 2008… even as slowing growth and persistent disinflation (both logical side-effects of rising debt) detract from the ability of major economies to service those debts in the future.

Global Debt-to-GDP Is Exploding Once Again

(% of global GDP, excluding financials)

*Data based on OECD, IMF, and national accounts data.

Source: Buttiglione, Lane, Reichlin, & Reinhart. “Deleveraging, What Deleveraging?” 16th Geneva Report on the Global Economy, September 29, 2014.

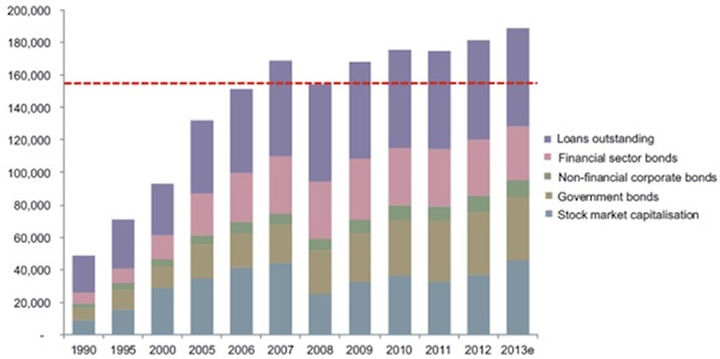

As John Mauldin and Jonathan Tepper explained in their last book, Code Red, monetary policies have fueled overinvestment and capital misallocation in developed-world financial assets…

Developed World Financial Assets Still Growing

(Composition of financial assets, developed markets, US$ billion)

Data from the McKinsey Global Institute

Source: Buttiglione, Lane, Reichlin, & Reinhart. “Deleveraging, What Deleveraging?” 16th Geneva Report on the Global Economy, September 29, 2014.

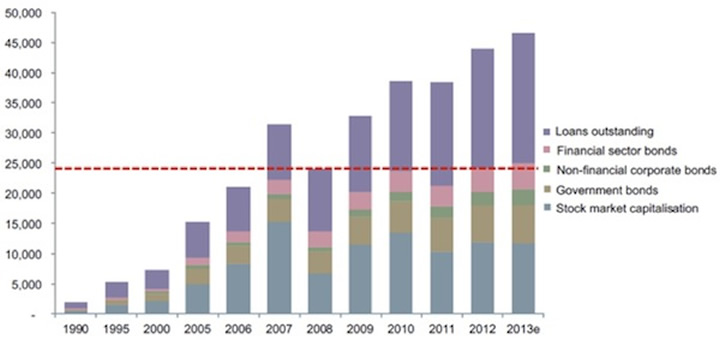

… but the real explosion in debt and financial assets has played out across the emerging markets, where the unwarranted flow of easy money has fueled a borrowing bonanza on top of a massive USD-funded carry trade.

Emerging-Market Financial Assets Have Nearly DOUBLED Since 2008

(Composition of financial assets, emerging markets, US$ billion)

Data from the McKinsey Global Institute

Source: Buttiglione, Lane, Reichlin, & Reinhart. “Deleveraging, What Deleveraging?” 16th Geneva Report on the Global Economy, September 29, 2014.

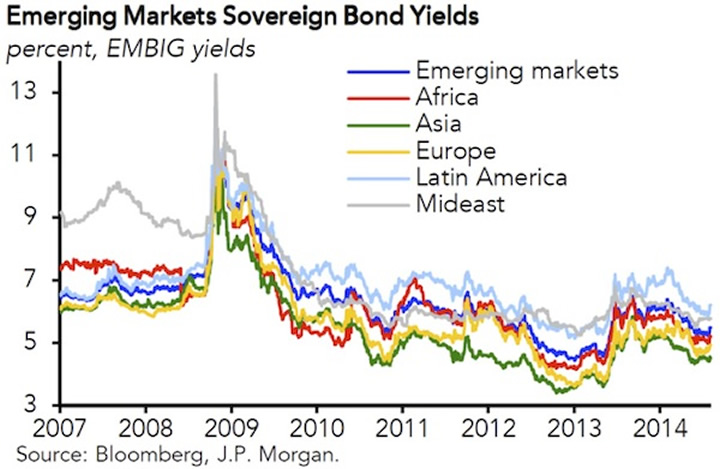

These QE-induced capital flows have kept EM sovereign borrowing costs low…

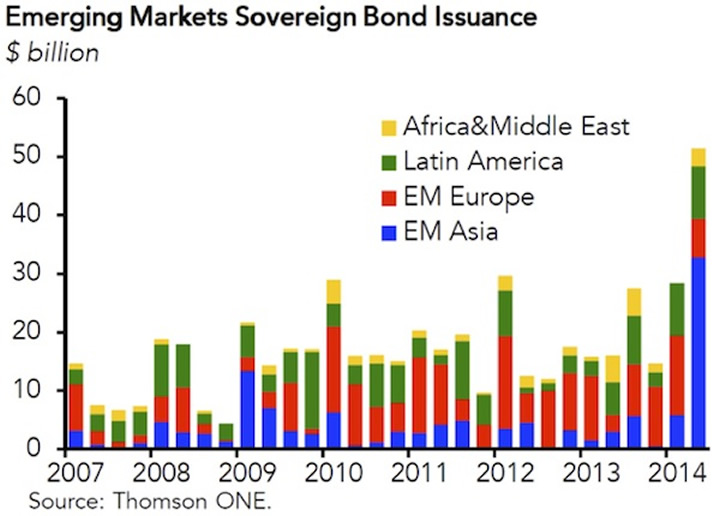

… and enabled years of elevated emerging-market sovereign debt issuance…

… even as many those markets displayed profound signs of structural weakness.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.