The Easy Money Path to Deflation

Economics / Deflation May 25, 2008 - 04:05 PM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. Due to family illness, this week's letter will be shorter than usual but all the more powerful. This week we re-visit the scenario used for the Occasional Letter series as another milestone is passed.

Welcome to the Weekly Report. Due to family illness, this week's letter will be shorter than usual but all the more powerful. This week we re-visit the scenario used for the Occasional Letter series as another milestone is passed.

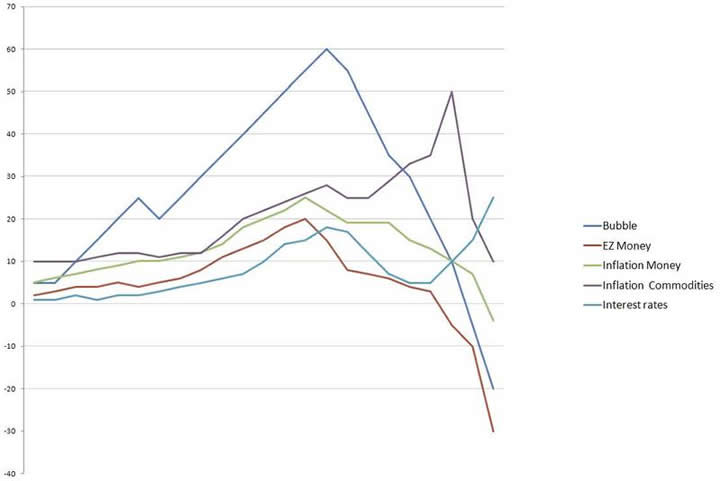

The Scenario: bubble, easy money, inflation in fiat money supply, inflation in commodities and hard assets, inflation, fear of inflation, rising rates, YC inverting, flattening, rising and inverting again, tightening, withdrawal of liquidity, corrections, crashes, talk of stagflation, FEAR, withdrawal of speculative funds, further corrections and crashes, demand collapse.....Deflation.

I wrote the above scenario many years ago. My only regret was that I didn't write it more clearly. It was not written as a linear listing of events, it was meant to show an interactive series of events that run parallel to each other. These events overlap, some are a reaction to others but they all move in the same direction. Let me attempt to show you how I "see" this. I am going to quantify the various factors that make the scenario and measure them on a time line. This will give us a visual representation of the various strands. The relationships on the chart are important, not the numerical value.

Don't worry about whether you think EZ money should be a higher value, that's not what I want you to see. Instead think of the trends and how they relate to each other. The diagram displays the historical as well as the future trend. Right now I see a post bubble, low interest rate environment, where EZ money is disappearing as credit contracts. Funds have poured into commodities as unstable stock markets and topped out bond markets make traditional investment havens unattractive. Meanwhile money, real paper and coinage, continues to slow and contract as the real economy suffers.

Which brings us to the milestone. Current interest rates are not reflective of current circumstances. Think of the attractiveness of assets and their returns. Commodities are currently appreciating in capital, prices are rising but they do not pay a dividend or a yield. We have been here before and not that long ago, last time it was tenuous promises of dot.com companies, this time its hard and soft commodities. The "attractiveness" measure of assets is about to change.

The IMF issued a downbeat report on the UK economy earlier this week. Whilst it is country specific, its relevance to other similar economies cannot be ignored, especially the US . (The latest IMF report on the US - http://www.imf.org/external/pubs/ft/scr/2007/cr07264.pdf is incredibly inaccurate even though it is less than a year old)

Here are the paragraphs that interested me:

Three elements can help respond to these broader challenges.

First, continued moderation in nominal earnings growth is essential. If secured even in the face of relative price changes, monetary adjustment and associated sterling depreciation may reduce risks to output, the external balance, and employment without compromising the nominal anchor. But if not, monetary flexibility to address these concerns will be diminished.

The risks to nominal wages appear balanced. So far, nominal remuneration has held steady, encouraged by the flexibility of labor market institutions and public sector pay restraint. But key wage settlements remain outstanding, and tolerance for continued low real earnings growth is uncertain.

In this context, we see no scope for further near-term monetary easing absent assurances of continued wage moderation, fiscal policy that is tighter than planned, or signs that house price and credit developments are significantly curbing domestic demand, relative to our central case projection for continued growth. Indeed, given the risks to the nominal anchor, monetary policy should stand ready to tighten at the earliest clear signs of emergent nominal wage inflation.

Second, as the commodity and consequent relative price shocks have a permanent element, the appropriate focus of the policy response is fiscal. In this context, budget consolidation should rebalance demand-away from domestic in favor of external-to the benefit of the current account balance, activity, and employment.

Third, efforts to stabilize financial markets remain essential. This will not only reduce lagged effects on credit flows from past strains, but will reduce remaining tail risks and support more efficient pricing of risk in future.

There is no respite for the UK consumer. If inflation pressures remain.....

To read the rest of the Weekly Report, visit An Occasional Letter From The Collection Agency and sign up to the 14 day free trial.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.