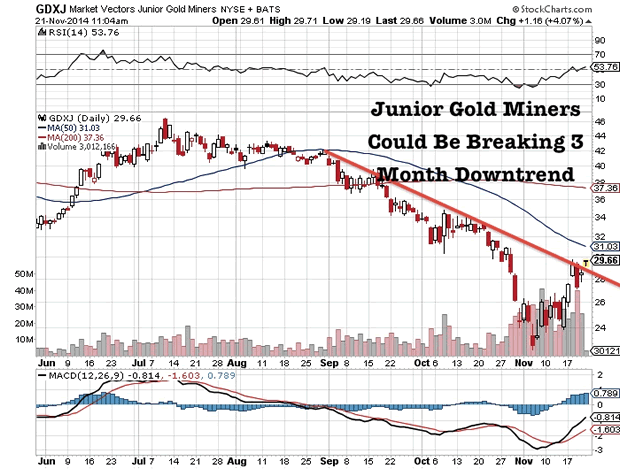

Junior Gold Miners (GDXJ) Breaking Three Month Downtrend?

Commodities / Gold and Silver Stocks 2014 Nov 21, 2014 - 05:10 PM GMTBy: Jeb_Handwerger

For several weeks I have been expecting a major secular bottom in precious metals and the junior miner. I told you to watch for the accumulation after a shakeout. See the full article from several weeks ago by clicking on the following link.

For several weeks I have been expecting a major secular bottom in precious metals and the junior miner. I told you to watch for the accumulation after a shakeout. See the full article from several weeks ago by clicking on the following link.

The junior gold miners (GDXJ) appear to be on the verge of breaking a three month downtrend. There have been some strong days of accumulation in November. A break above the 50 day moving average at $31 would confirm the painful correction is over.

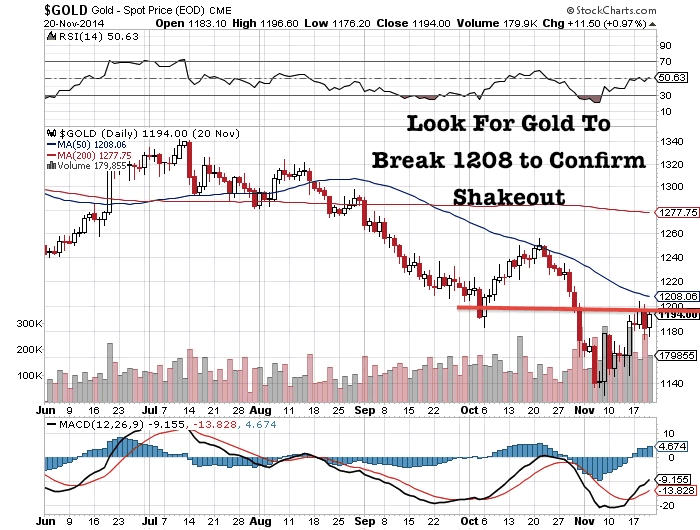

Gold broke below $1180 which triggered a lot of stop losses and margin calls. The weak hands were shaken out and it appears there was large accumulation as volume was high. Now gold appears to be reversing higher breaking above the critical $1200 mark. Look for gold to break above the 50 day at $1208 to confirm a potential shakeout.

For about the two past months, we have witnessed panic selling in precious

metals and junior miners the capitulation. However, on November 7th and

14th we saw major accumulation in gold futures on high volume. This may

signal the beginning of a major short covering combined with value buying

or the accumulation after the capitulation.

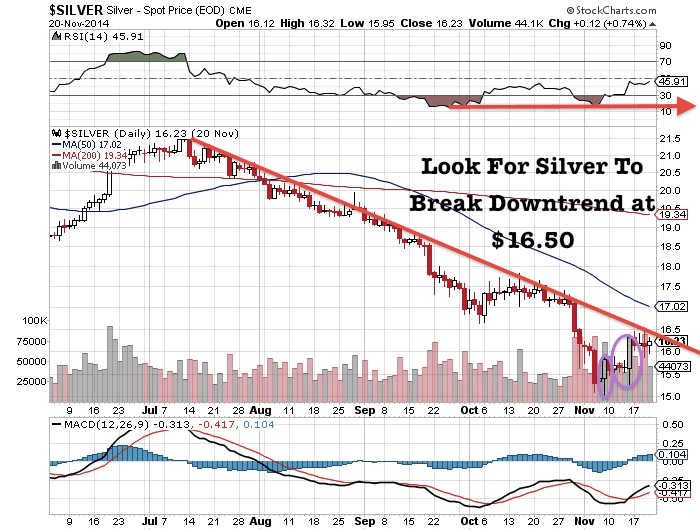

Silver has seen a nice bounce off $15 with some accumulation. Look to see if silver can break recent five month downtrend at $16.50 and hit over 50 on the RSI.

Some of our junior miners including what I believe are the top three discoveries in Nevada were affected by the panic selloff which I said may be a bargain buying opportunity. Despite making new high grade discoveries these stocks were trading for at least 50% off. Smart money continues to accumulate while the weak hands panic.

How does one find the mining stocks that outperform? One of the best ways is follow the majors with top technical teams. Look to see what they are investing in and try to buy it at a discount to what they payed for it. If you see a NYSE producer taking equity positions in a small cap junior than that may be a takeout target in the next upswing. Stay tuned to my free newsletter where I highlight the juniors attracting major capital. Remember M&A is increasing and this may be one of the best times to start investing in this sector at historic lows.

In my premium service last week after the US Election, I told my readers to keep a close eye on the critical and strategic metal space especially the heavy rare earths used in our latest top secret missile technologies. The rare earth sector is trading for pennies on the dollar and only a select few in that sector will make it through the finish line. The companies who are advancing the processing and metallurgy should outperform.

The key to rare earths is being able to separate the elements from the ore and refine it into a pure concentrate and then into a powder The Chinese use solvent extraction which is not good for the environment. Nanotechnology research has other potential cleaner technologies that could replace solvent exchange. Many investors gave up on the rare earths as they realized that the chemistry and metallurgy is complex. However, don't be discouraged. The rare earth industry was invented in the US and there are some great metals processing engineers and nobel prize winning technologies right here in the US which could revolutionize this sector.

Advancing US rare earth independence is a matter of national survival. Alaska Republican Senator Lisa Murkowski, who has been a major supporter for US rare earth independence is taking over the Chair of the Senate Energy and Natural Resources Committee.This could be a huge political boost to bring heavy rare earth independence to the forefront of the agenda. Remember she already introduced rare earth legislation which was not being advanced.

Senator Murkowski said, "We have got to change the dynamic here, in this country, with how we view the importance of minerals to our nation...We can't move forward until Washington (D.C.) gets out of our way...We don't want to be sitting in a situation where the Chinese are making all of the decisions as to what we are going to be manufacturing - how, when and where - because they have access to all the critical minerals...We have got them here; we just need the ability to develop them."

In addition to rare earths pay attention to Platinum and Palladium deposits (PGM) in North America. PGM's have a huge supply demand imbalance as most of the supply comes from unstable jurisdictions. The big majors just bought a junior PGM developer in Minnesota. Expect more deals to be announced as there are so few advanced high quality PGM projects in North America.

By Jeb Handwerger

Disclosure: Author owns no stocks mentioned.

© 2014 Copyright Jeb Handwerger - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.