Russian Currency Crisis and Debt Defaults Could Create Contagion in West

Stock-Markets / Credit Crisis 2014 Dec 17, 2014 - 05:27 PM GMTBy: GoldCore

Russia’s currency market witnessed further huge volatility again today. The finance ministry said it would start selling foreign exchange which are primarily in dollars. This appeared to reduce selling pressure on the battered rouble.

Russia’s currency market witnessed further huge volatility again today. The finance ministry said it would start selling foreign exchange which are primarily in dollars. This appeared to reduce selling pressure on the battered rouble.

The fall of the rouble this year has been severe, with a 50 percent fall against the dollar and of course gold this year. The slide has been precipitous as in the past two days alone, it fell about 20 percent against the dollar and gold.

On Monday, the ruble fell 10% against the dollar and gold followed by another crash of 11% on Tuesday, despite a massive rate hike.

The heavy selling pressure this week, made the central bank sharply increase its key interest rate by an unexpected 6.5 percent or 650 basis points. The move did little to buttress the currency in the short term as speculators and traders continued to sell the rouble.

Momentum is clearly down and computer driven markets and increasing dominance of algorithmic or black box trading is exacerbating the rouble’s short term weakness. However, the sharp increase in interest rates and the fact that the fundamentals of the Russian economy remain reasonably sound and not much worse than many western economies, will support the rouble. It is likely to stabilise at these levels and recover in the coming months.

It is also important to note that political and economic relations between Russia and China are very good at the moment and China would likely provide financial assistance – if indeed that is needed.

The rouble rout is due in part to the collapse in oil and now very low oil prices. It may also be due to the effects of western sanctions. This is likely to rally the Russian people behind Putin and will not have the impact that western leaders hope it to have.

The effects of the crisis are already being felt in western Europe and in the global financial system.

Austria’s third largest bank, Raiffeisen Bank lost 10.3% of it’s share value on the news that the Russian central bank had raised rates a stunning 6.5% overnight on Monday.

It is worth remembering that it was the bankruptcy in 1931 of Austrian bank Creditanstalt’s, founded by the Rothchild family, that resulted in a new global financial crisis and ultimately the bank failures and deep recessions of the Great Depression.

In France, Societe General – a bank which is also exposed to the Russian economy to the tune of €25 billion – lost 6.3% of it’s share value. If the Russian crisis continues, and there is little to suggest it won’t – with the U.S. set to impose a new round of sanctions, the repercussions for the west and the global economy could be drastic.

In the modern, interconnected, globalised world of today, there is a real sense that and a risk that western leaders are “cutting off our nose to spite our face.”

The global banking system has a very limited capacity to absorb sizeable losses and the risk of contagion is as high now as in 2008. It may be the case that western banks and institutions have more to lose than Russia in the longer term.

Russia is still energy and resource abundant with close economic ties to the industrialising East, Asia and China. It also has substantial gold reserves – some 10% of their sizeable foreign exchange reserves of $370 billion.

It’s oil companies are reasonably well insulated from the crisis as the rouble value of their exports has soared.

It should also be noted that what looked like a public display of weakness, that was Monday night’s rate hike, is most uncharacteristic of Russia, especially under Putin. In the murky goings on of geopolitics, it is wise to question every action and motivation. Some have suggested that the move could lead to severe losses in the interest rate market and the multi trillion interest rate swap market and this could be part of the reason for the move.

Putin is well aware of Warren Buffett’s “financial weapons of mass destruction”.

In the event of another banking crisis due to financial instability, market crashes and or western banks exposure to Russia, larger deposits will be confiscated by banks as “bail-in is now the rule,” to quote Irish finance minister Michael Noonan.

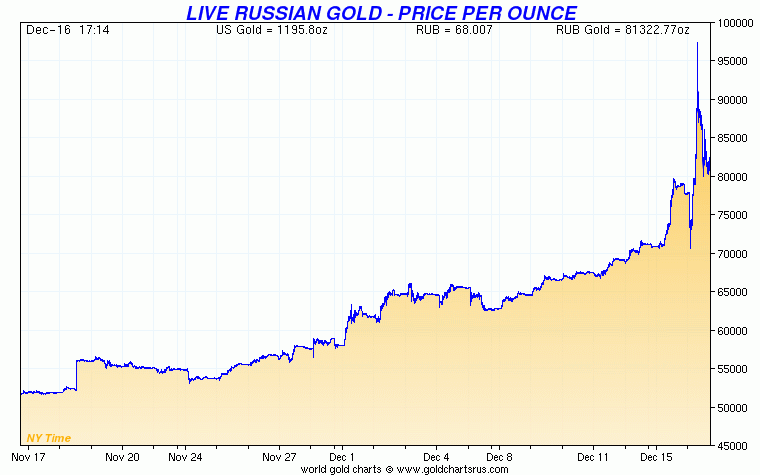

The experience of Russian holders of gold since this crisis began is worthy of note as evinced by the chart above. Gold has acted as a very effective insurance policy against financial instability and currency instability for those ordinary Russians prudent enough to have allocated some of their savings to gold as a diversification.

Must-read guide to and research on bail-ins can be read here:

Guide: Protecting your Savings In The Coming Bail-In Era

Research: From Bail-Outs to Bail-Ins: Risks and Ramifications – including World’s Safest Banks

MARKET UPDATE

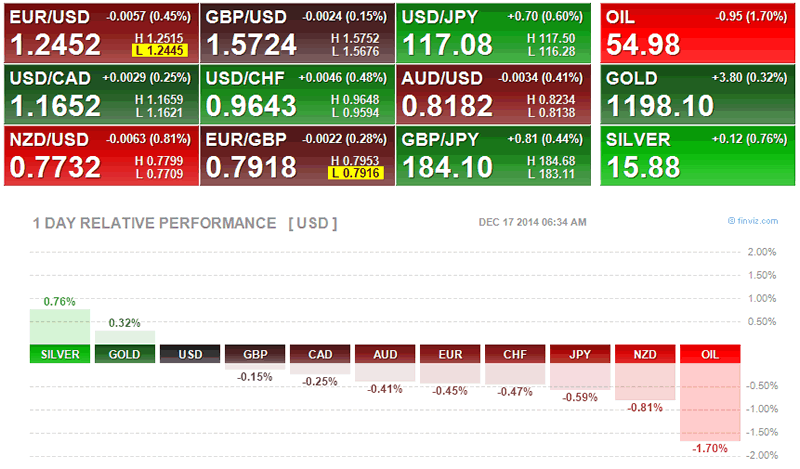

Today’s AM fix was USD 1,199.00, EUR 962.36 and GBP 763.16 per ounce.

Yesterday’s AM fix was USD 1,199.25, EUR 960.25 and GBP 763.95 per ounce.

Spot gold climbed $4.60 or 0.39% to $1,196.30 per ounce yesterday and silver fell $0.40 or 2.48% to $15.74 per ounce.

Gold in Singapore was flat again overnight with gold hovering just below $1,200 per ounce before slight gains in London saw gold touch the $1,200/oz level. Spot gold was up 0.3% at $1,199.66 an ounce by late morning in London. A volatile session yesterday, saw a high above $1,221 then a drop to a one-week low of $1,188.41, before finishing stronger.

The electronic gold market or futures gold market continues to have all the hallmarks of a managed market and gold seems tethered to the $1,200/oz level for now despite the very bullish geo-political backdrop and robust global demand.

There is a lot of market chatter about Russia selling gold – mostly by non gold experts and people who are not renowned for analysis of the gold market. The chatter is just that chatter as Russia is likely to keep accumulating gold rather than sell it.

Russia is unlikely to sell gold in any meaningful way as long as Putin remains at the helm. Indeed, while a wily Putin may allow an announcement regarding gold sales and official statistics may show a reduction in reserves, Putin may adopt the Chinese gold policy and not be so transparent regarding the Russian gold reserve accumulation and reserves in general.

Traders await the outcome of the U.S. Federal Open Market Committee’s last policy meeting of the year, where traders will look for a clue as to when they may raise interest rates.

The Fed’s statement is at 1900 GMT and analysts are looking for the phrase “considerable time” to be removed as a signal that the Fed may take action in 2015 to hike rates. As ever it is important to watch what the Fed does rather than what they signal they might do.

SPDR Gold Holdings, the world’s largest gold ETF, saw a second consecutive daily outflow on Tuesday, of 1.8 tonnes, after they posted their largest weekly rise last week since July.

In other precious metals, silver climbed 1% to $15.92 an ounce and platinum up 0.7% at $1,197.52 an ounce. Palladium was up 0.8% at $785.31 an ounce.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.