This Investing Move Could Help You Beat the Market by Over 20% in 2015

Companies / Investing 2015 Jan 03, 2015 - 01:05 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Welcome to 2015 – I’m thrilled you’re here!

Keith Fitz-Gerald writes: Welcome to 2015 – I’m thrilled you’re here!

I think this year is gonna be absolutely filled with opportunity for investors, perhaps more than ever before. But few of us are set up to take full advantage of it. That’s because most people’s portfolios are totally out of whack. (I’ll show you what I mean in a moment – and why it cramps your returns.)

But I’ve got great news for you.

There’s a stunningly simple tactic you can use to achieve significantly higher returns – 21.97% higher annually, on average, over the last 14 years, in fact. But that’s far from the only reason I want you to use this tactic today…

First, it is proven by study after study after study to be a foundational element on the path to higher profits.

Second, it is a way of injecting discipline into the investment process. That makes it an important risk-control mechanism.

And, third, what I’m about to share with you requires only about 20 minutes a year to do. Yes, a year. That means you can pick one day you won’t forget – like today, the first trading day of the year or perhaps your birthday – to make it happen.

… and immediately start building the kind of wealth you deserve.

Here’s how to start this year off right for your money.

The tactic I’m talking about is rebalancing.

Most investors haven’t heard of rebalancing. That’s very surprising, given all the lip service Wall Street pays to fancy-pants diversification, hyping stocks, and day trading as a sure route to wealth these days.

What I like about rebalancing is that it’s simple yet immensely profitable, because rebalancing forces you to buy low and sell high. There’s no ambiguity, no emotion, and no second-guessing yourself, the markets, the Fed, China, Russia, or any other influence in the headlines.

What I positively love about rebalancing is that it can lead to huge performance gains, even if the markets drift lower. Not too many strategies can do that.

How huge?

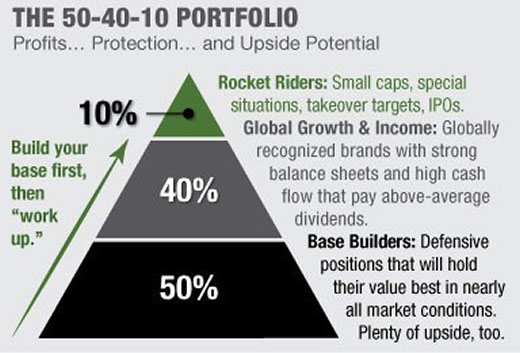

Try triple-digit huge – that’s why it’s a Total Wealth priority and absolutely critical to the success more than 750,000 subscribers and readers around the world have enjoyed over the years as a part of the Money Map Report’s proprietary 50-40-10 Strategy.

Rebalancing isn’t difficult. It doesn’t matter if you’re a newly minted graduate with $1,000 to your name or a sophisticated investor with 50 years of experience and $100 million. Anybody can do it.

I want you to have every advantage possible when it comes to building wealth, so I’m going to share my take on rebalancing – what it is and how it works. Then, I’m going to show what it can mean for your money.

Rebalancing: What It Means and How It Works

Technically speaking, rebalancing is the periodic adjustment of your investments to reflect market conditions that have changed. Boring… ugh!

The plain English definition is much more appealing: Rebalancing means you buy and sell specific investments that have gotten out of line with your plan in order to bring your risk down and boost your returns. (I love that part.)

Let’s look at an example…

John has $20,000 split between two investments – stocks and bonds – each representing 50% of his assets. He’s a balanced fellow and likes it that way. You probably know quite a few investors like John – who use index funds to invest just like he does, using some variation of the “set it and forget it” approach.

One year later, John finds that his stocks have appreciated by $5,000 while his bonds have fallen by $2,000. So his 50/50 split is now $15,000 in stocks and $8,000 in bonds, or 65/35. That doesn’t sound too bad on the surface because the value of his overall portfolio is now $23,000.

But John’s risks are mounting.

Because his stocks have appreciated so much, he’s got a far riskier portfolio than he thinks he does.

That’s where many investors find themselves now.

The S&P 500 is up 195.68% from their March 2009 lows through year end 2014. Anybody who’s got stocks and who hasn’t rebalanced is just asking for a repeat of 1999 – or 2007 if things roll over, or more appropriately, when they roll over.

Fortunately, the solution is very, very simple.

To get back to his preferred 50/50 split, John “rebalances” by selling $3,500 in stocks (and harvesting gains) and buying $3,500 in bonds (which have lost value and are therefore “on sale”).

I’ve used the 50/50 structure for simplicity’s sake. But as to what your plan is, that’s up to you. I always advocate for my 50-40-10 structure we’ve talked about so many times.

But What If…?

When I talk about rebalancing I usually get a lot of questions involving hypotheticals right about now. Maybe you have a few on your mind… What if Russia blows up? What if Oil prices stay low? What if the Fed raises rates too soon? What if… What if… What if…?

Many investors struggle with day-to-day volatility because they’re terrified by news headlines and all the hype they see around them. Wall Street wants it that way, because it forces the uneducated and the uncertain to trade more, which, of course, puts fees in their pockets.

Rebalancing once a year removes this from the mix. In fact, rebalancing is also largely immune from day-to-day gyrations. Consequently, it’s one of the precious few strategies individual investors can use to their advantage when going up against the Armani Army on Wall Street, because it allows you to play offense when everybody else is playing defense.

Now let’s take a look at why rebalancing is so powerful.

The Difference Is Worth 314.86% Over 14 Years

Over the years, I’ve learned that a picture is worth a thousand words (and potentially millions of dollars), which is why I want to share one with you now. It’s one thing to talk about the power of rebalancing, but quite another entirely to see it in action.

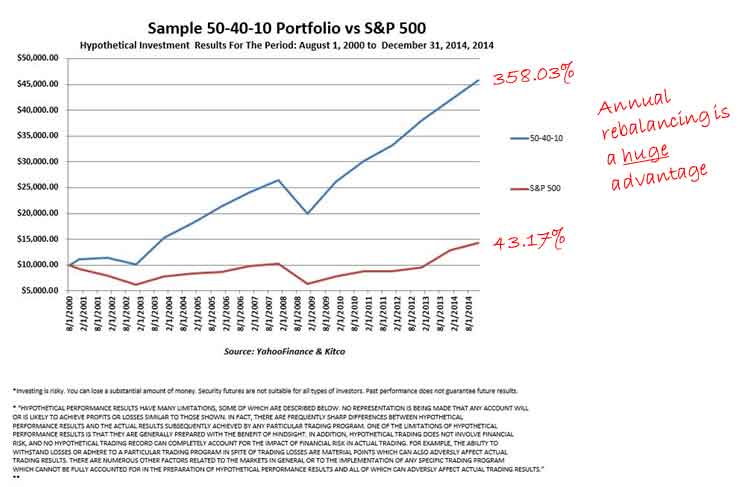

So I constructed a hypothetical $10,000 portfolio using the Money Map Method, with annual rebalancing, and another using a simple 50/50 split between stocks and bonds that was not rebalanced.

Just to put things in perspective, I also included the S&P 500 Index.

I ran the numbers from August 1, 2000, to December 31, 2014. I chose these dates deliberately, because our markets experienced several wars, recessions, the dot.bomb crisis, two meltdowns, three meltups, the financial crisis, and a whole slew of geo-political nonsense during this timeframe.

Take a look…

As you can see, rebalancing made a tremendous difference, producing a total return of 358.03% versus the S&P 500, which offered up only 43.17%. That’s a 314.86% advantage in total or approximately 21.97% every year.

So, when should you do it?

There are all kinds of opinions, with some studies suggesting that you rebalance based on volatility, taxable gains, market conditions, or when asset classes have moved by more than a set percentage. Most of these become very complicated very quickly.

I believe in keeping things simple.

That’s why I’m a big fan of “calendar rebalancing.” Again, I recommend picking a day you will remember, like your birthday or the start of a new year. If you’re math challenged, that’s no excuse – especially when you can use one of the free rebalancing calculators you can find on the Internet.

Just be sure to do it consistently to keep fees down.

It’s worth noting that Fidelity offers 65 commission-free iShares ETFs. So depending on your specific investments, it’s conceivable that you could even rebalance for free.

And, if possible, add money to your account on a regular basis, because doing so can really turbo-charge the rebalancing process and significantly boost your wealth.

Have a great weekend.

Until next time,

Keith Fitz-Gerald

Source : http://totalwealthresearch.com/2015/01/move-help-beat-market-21-97-2015/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.