Gold and Silver Postcards From the Great Emptiness

Commodities / Gold and Silver 2015 Jan 11, 2015 - 03:40 PM GMTBy: Jesse

“We who are born into this age of freedom and independence and the self must undergo this loneliness. It is the price we pay for these times of ours.” - Natsume Sôseki

“We who are born into this age of freedom and independence and the self must undergo this loneliness. It is the price we pay for these times of ours.” - Natsume Sôseki

"The issue isn't just jobs. Even slaves had jobs. The issue is wages. - Jim Hightower

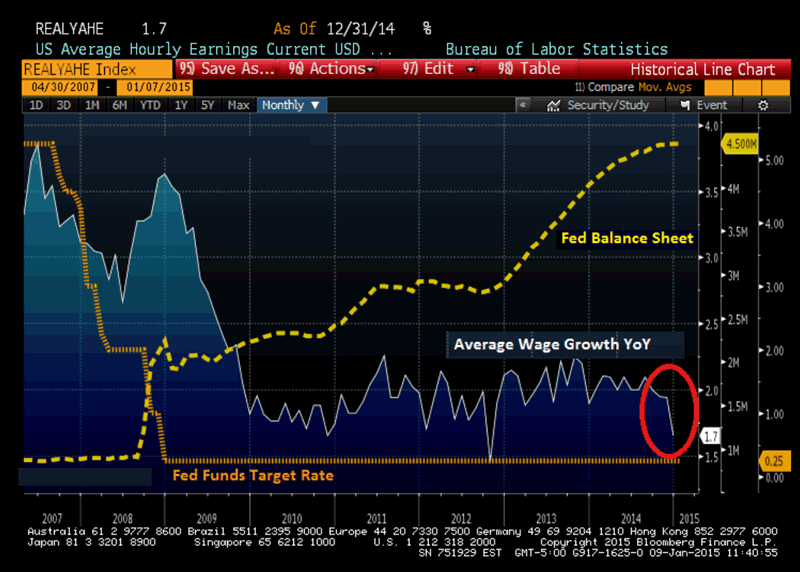

The headline 'Jobs Number' came in better than expected at an adjusted +252,000.

And the Unemployment Rate fell more than expected to 5.6%.

Yay us! We win again!

Why weren't stocks rallying with these glorious numbers?

Perhaps the market noticed that average wages fell much more than expected, and the Labor Participation Rate continues to decline.

Well beat us with a selfie stick. What does that mean?

Perhaps it means, like the accounting numbers of IPOs being puked out by Wall Street, that the results are 'tailored' misrepresentations of reality. In other words that a Holden Caulfield might have used, The Recovery™ is a phony.

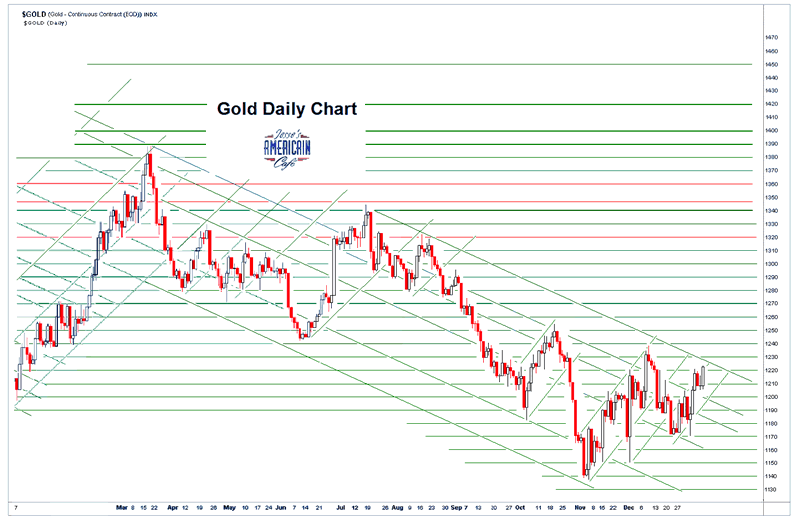

Gold has marched up tightly into overhead resistance as can be seen from the chart below. As is often the custom with a Non-Farm Payrolls number that exceed expectations, gold did not drop, but went a bit higher.

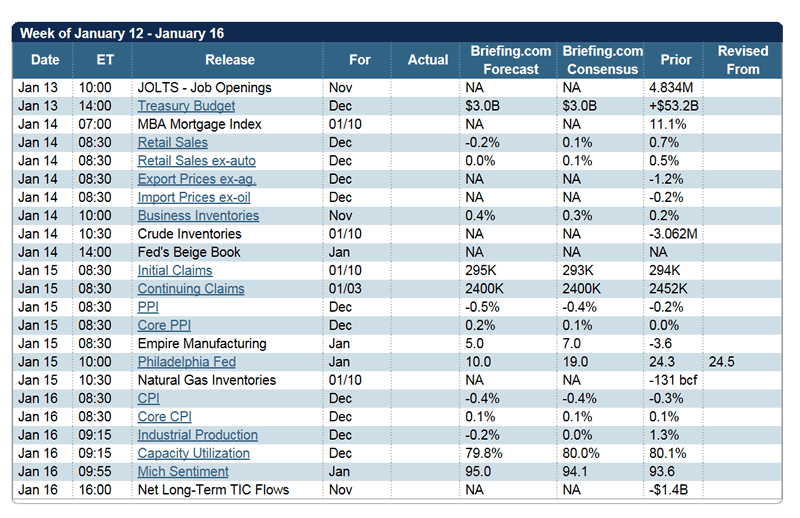

It is the next week that will now be much more important. The wiseguys will often trot out a two-step, rather than the simpler smash and grab, when we have too many amateurs anticipating a move in some particular way.

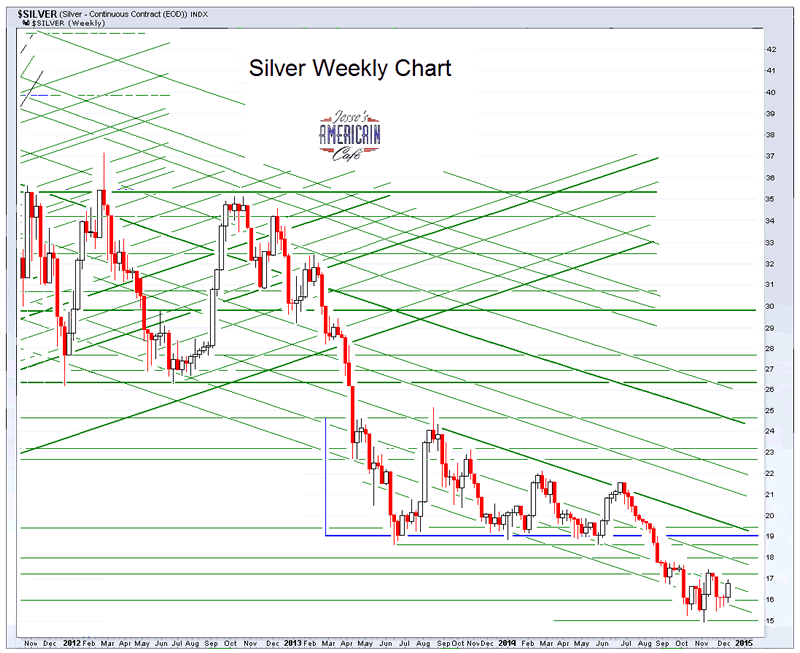

But let's not guess. Let's see what happens next week. Follow through is everything, and breaking the continuing downtrend of lower highs and lower lows is the only way in which one might say that the trend is broken and the bottom is in on this long bear market in precious metals.

There was nothing important happening at the Comex warehouses or in the delivery report, which is not unusual since we are in an inactive month. This is opposed to an active month, in which there is a great appearance of activity, but little or nothing actually happens either.

The news came out today that Mitt Romney wants to take another run for President in 2016 because he doesn't think Jeb Bush or Chris Christie can win. Darn, I was hoping for another battle of the dynasties in 2016. Or competing crime families, but that might just be a given these days.

Samuel Beckett couldn't write this Théâtre de l'Absurde.

Have a pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.