Hulbert on Interest Rate Hikes & Stock Market; a Response

Stock-Markets / Stock Markets 2015 Jan 30, 2015 - 02:24 PM GMTBy: Gary_Tanashian

Mark Hulbert has a piece this morning at MarketWatch in which he de-correlates the first Fed interest rate hike from any supposedly corresponding stock market movements. I agree with some but not all of what he writes. Let’s take it a chunk at a time.

Mark Hulbert has a piece this morning at MarketWatch in which he de-correlates the first Fed interest rate hike from any supposedly corresponding stock market movements. I agree with some but not all of what he writes. Let’s take it a chunk at a time.

Investors, it doesn’t matter when the Fed raises rates

Are you obsessed with whether the Federal Reserve will begin to raise official interest rates in July, September or sometime next year?

No. I’ve wanted them to do it for years now. So I’m obsessed with why the Fed refused to raise rates, despite a strong economy and inflation signals that were not nearly so tilted toward the dis-inflationary end of the spectrum as they are now. I am obsessed with wanting to know why the mainstream media and financial establishment even take their oh so heavily anticipated policy decisions each month seriously. I am obsessed with the all too obvious underlying message that this is all about a stock market ‘wealth effect’ that eventually trickles a little stream down Main Street, with Grandma and other prudent savers thrown in the gutter.

A review of historical data fails to find significant statistical support for believing that higher rates are in themselves bad for the stock market. And even if they were, the difference of a few months in the timing of increases makes little difference when determining if equities are expensive or cheap.

I concede that both of those beliefs are far from conventional wisdom on Wall Street. But the job of the contrarian is to challenge norms.

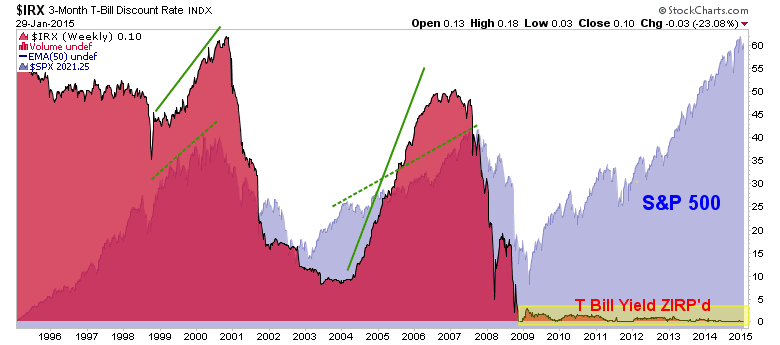

Agree. But I am not sure why Mark is using the 10-yr yield in his article. With the Fed at work on all parts of the curve, the whole thing is corrupted and not subject to extrapolation of historical data anyway. But insofar as it would be, why not use the Fed Funds rate or the 3 Month T Bill? This chart from NFTRH has clearly shown that rate hikes did not matter to the stock market for extended periods on the last 2 cycles… until of course, they suddenly mattered… big time.

Also, why go back to 1875 for data as his article does? In 1875 (or 1975… or 1985… or 1995… or 2005 for that matter) we did not have the levels of unconventional policy absolutely perverting bond market signals that we have today, under the shall we say innovative guidance of Ben Bernanke come Janet Yellen. Buy a boat load of long-term bonds here, sell a load of short-term bonds there; literally paint the macro financial backdrop to the exact desired specifications. Why didn’t policy makers of yore ever think of that?

Our theme continues to be one of distortions built in, and with reference to the chart above, given these man-made distortions, there is no longer a trend to be extrapolated (i.e. the article’s premise that historical data show Fed rate hikes do not matter to the stock market). In other words, the big blue mountain known as the S&P 500 above is looking mighty conspicuous when juxtaposed against the also conspicuous T Bill yield.

When presented with this historical record, some investors respond by arguing that we should be focusing on inflation instead. That’s because rate hikes are a response to higher inflation, and — so these investors argue — it’s inflation that is bad for corporate profitability.

Inflation is not readily apparent because everyone in the mainstream loves a rising stock market and that is where the inflation has rooted on this cycle. You could say that on this cycle the inflation resides in the marrow of the bones of the system. It is there, but it coexists with some perplexing signs of deflation, which would be the force that eventually exposes Fed policy as not just a joke, but a destructive force to a real financial and economic system.

Here I can’t help but conjure up Operation Twist, which literally painted this backdrop into being by “sanitizing” inflation signals (the above-referenced buying of long-term bonds and selling of short-term bonds). It’s the gift that keeps on giving, but just maybe another of Frankenstein’s monsters has gotten out of the lab and into the countryside. Maybe the elements of Op/Twist have mutated and can no longer be controlled. Okay, I am being ‘visual’ here, not data oriented. Bear with me.

But, once again, where is the historical support for investors’ arguments? Cliff Asness, a founding principal of AQR Capital Management, found no statistically significant evidence in U.S. data back to 1926 that higher inflation leads to lower profits.

The age of data extrapolations is over. Bernanke’s most ingenious and innovative policy tools ended it. This cycle breaks the mold. I would think twice about being a longer-term ‘Quant’ guy today.

That’s because, as an efficient discounting mechanism, the stock market looks far into the future. In fact, one academic study from a decade ago found that the market discounts events that won’t happen until as much as five or 10 years into the future.

Mark, this is a shall we say erroneous statement at best. What was the stock market discounting at the ends of the two green dotted lines on the chart above? In each case it was at all-time highs immediately before a powerful bear market and a deflationary liquidation, respectively.

Given that, it’s hard to consider it even remotely Earth-shattering whether the Fed decides to accelerate its rate hike by a month or two — or, instead, postpones it by a couple of months. As Asness put it to me: “I find it hard to believe that this [the Fed’s rate hike] is going to be shocking undiscounted information.”

Could not agree more. But again, the whole idea of discounting is dysfunctional. Again, Quant analysis cannot quantify things that have never been before.

The bottom line? Obsession with when the Fed raises rates keeps an impressive number of Wall Street analysts and financial journalists busy. But that doesn’t mean you need to pay attention.

Well yes, we do need to pay attention because a world full of media, casino patrons, hedge funds, black boxes, HFT’s, dark pools and thoroughly conditioned market participants is paying attention. But at its essence, you are right; Fed rate hikes don’t really matter… until they do.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.