Stock Buybacks and Sears’ Death Spiral

Companies / Retail Sector Feb 06, 2015 - 10:35 AM GMTBy: LewRockwell

Eric Englund writes On November 17, 2004, big news hit the retail world. Attention Kmart shareholders, your company announced that it was going to purchase Sears, Roebuck for $11 billion. In a November 18, 2004 New York Times article, it was stated: “The takeover is a triumph for Kmart’s largest shareholder, Edward S. Lampert, a billionaire investor who pushed the company to emerge from bankruptcy barely 18 months ago, shut many stores and sold dozens of others to Sears as he presided over a run-up in Kmart’s value on Wall Street.” It was further reported, in this article, that: “’This is going to be an enormous undertaking,’ said Mr. Lampert, who is Kmart’s chairman and will become chairman of the new company, to be called Sears Holdings. ‘We’re really not looking to have two separate cultures. We’re hoping to blend these into one great culture.’” To be sure, it is wonderful to have a great corporate culture; however, culture doesn’t matter if a company is broke. Under the chairmanship of Eddie Lampert, Sears has been driven to financial insolvency. I firmly believe Sears will declare bankruptcy and Eddie Lampert’s penchant for stock buybacks will have played a key role in breaking this company.

Eric Englund writes On November 17, 2004, big news hit the retail world. Attention Kmart shareholders, your company announced that it was going to purchase Sears, Roebuck for $11 billion. In a November 18, 2004 New York Times article, it was stated: “The takeover is a triumph for Kmart’s largest shareholder, Edward S. Lampert, a billionaire investor who pushed the company to emerge from bankruptcy barely 18 months ago, shut many stores and sold dozens of others to Sears as he presided over a run-up in Kmart’s value on Wall Street.” It was further reported, in this article, that: “’This is going to be an enormous undertaking,’ said Mr. Lampert, who is Kmart’s chairman and will become chairman of the new company, to be called Sears Holdings. ‘We’re really not looking to have two separate cultures. We’re hoping to blend these into one great culture.’” To be sure, it is wonderful to have a great corporate culture; however, culture doesn’t matter if a company is broke. Under the chairmanship of Eddie Lampert, Sears has been driven to financial insolvency. I firmly believe Sears will declare bankruptcy and Eddie Lampert’s penchant for stock buybacks will have played a key role in breaking this company.

Euphoria reigned when Kmart announced the takeover of Sears. Per the above-mentioned New York Times article: “Expressing faith in Mr. Lampert’s track record of squeezing profit from poorly managed companies, Wall Street cheered the news yesterday. The share price of Kmart rose nearly $8, to close at $109. Sears, Roebuck jumped $7.79, or more than 17 percent, to $52.99.” Oh, and the first year of operations, for this newly combined company, was a promising one. For fiscal-year 2005, Sears’ revenues were $48.9 billion with a net profit of $858 million. At fiscal year-end 2005, the balance sheet looked healthy too; with nearly $4.9 billion of working capital, $11.6 billion of equity, over $4.4 billion of cash, and a total-liabilities-to-equity ratio of 1.6 to 1. By the close of fiscal-year 2005, Sears Holdings Corporation’s share price was $114.74. Having faith, in Eddie Lampert, seemed to be well placed.

2005 did not turn out to be a fluke. Sears turned profits in 2006, 2007, 2008, 2009, and 2010. Over the six-year period, of 2005 to 2010, Sears’ cumulative net profit was $3.8 billion. Sears’ and Kmart’s employees were working hard and making Eddie Lampert look good. A feel-good story, correct?

Unfortunately, the answer is “no”. While front-line and backroom employees were doing their part, Eddie Lampert and Sears’ top executives were busy strip mining Sears’ balance sheet. Sears undertook stock buybacks, from 2005 to 2010, that totaled nearly $5.83 billion; meaning share repurchases exceeded profits, over this six-year period, by a little over $2 billion. Considering Kmart emerged from bankruptcy just 18 months before the acquisition of Sears, it seems counterintuitive for an executive team to willfully weaken Sears’ balance sheet instead of building as much financial strength as possible. Did Eddie Lampert, a Yale educated businessman, not learn any lessons from Kmart’s bankruptcy?

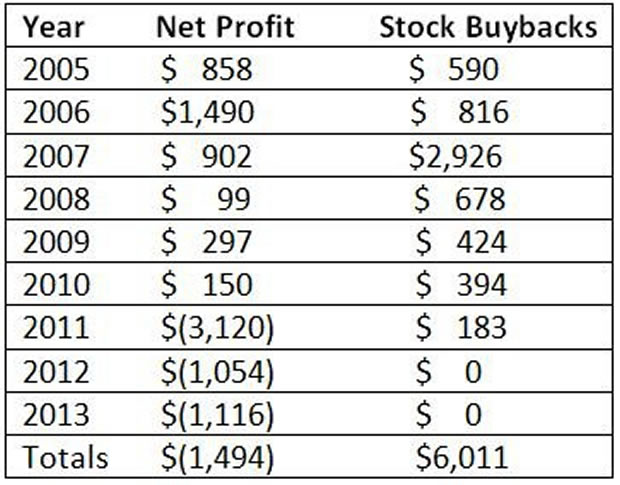

Well, the tough times came for Sears. This retailer lost $3.12 billion in 2011, $1.054 billion in 2012, and $1.116 billion in 2013. With big-box retailing being an ultra-competitive business, sound balance sheet management is critical. So why would a retailer’s management team knowingly weaken the company’s cash, working capital and equity positions; which is exactly what stock buybacks do. To me the answer is that short-term personal financial gain, for executives, trumped long-term strategic planning.

The following table should be embarrassing for Eddie Lampert, Sears’ board members, and its executives—dollar figures are in millions:

For the seven years Sears Holdings undertook share repurchases, the buybacks exceeded net profits in five of those years. This is what I mean by strip mining Sears’ balance sheet. Once management grasped the magnitude of the losses Sears was facing, the buybacks ceased; and should have never happened in the first place.

Through the third quarter of fiscal-year 2014, Sears Holdings’ net loss was $1.523 billion. And now, nearly ten years after Eddie Lampert’s triumphant acquisition of Sears, this retailer’s balance sheet is in tatters. As of the third-quarter ending November 1, 2014, cash stands at a paltry $326 million; working capital is negative $823 million while equity has nearly vanished and is merely $126 million. On top of this miniscule equity position stands a mountain of liabilities totaling $15.043 billion; leaving a mind-numbing total-liabilities-to-equity ratio of 119.4 to 1 (a ratio of 3 to 1 is considered to be a bit high and worrisome; so higher is not better).

When Sears’ ugly third-quarter results were announced on December 4, 2014, investors who visited Sears Holdings Corporation’s website were provided with some positive spin and perhaps a vision for soldiering forward:

“We remain intently focused on delivering an unparalleled integrated retail experience for our customers through Shop Your Way and above all, returning Sears Holdings to profitability,” said Edward S. Lampert, Sears Holdings’ Chairman and Chief Executive Officer. “During the quarter, we unveiled or expanded several Integrated Retail customer initiatives, which helped drive online and multi-channel sales. Our members are responding to our transformation, and we are encouraged by the year-over-year domestic Adjusted EBITDA trends, which mark a positive departure from the prior six quarters. At the same time, we continue to enhance the Company’s capital structure and liquidity to support our transformation into an integrated membership-focused company.”

I find the last sentence, of this paragraph, to be stunningly disingenuous. After all, now that Sears is broke, executive management is looking for ways to enhance Sears’ capital structure and liquidity. You’ll never hear a board member, or a high-level executive, admit that their company’s stock buybacks were a mistake. But if you do the simple math, and add back the $6.011 billion Sears Holdings threw away via share repurchases, you’d have a company that remains soundly capitalized and liquid enough to support a corporate transformation.

Of course, let’s not forget a premise behind stock buybacks is to enhance shareholder value. At fiscal year-end 2005, Sears’ stock was trading at $114.74. Sears’ stock, presently, is trading at $33.30; a decline of over 70%. Sears’ share repurchase program, accordingly, has resulted in the exact opposite of its intended outcome of enhancing shareholder value. Had the stock buybacks not occurred, Sears’ balance sheet would be markedly stronger and, hence, deserving of a much higher share price than it currently enjoys.

Considering 2014’s anemic Christmas season, I predict Sears Holdings’ net worth will fall into negative territory when it reports fiscal-year 2014’s results. When a company has little cash, negative working capital, and a negative net worth, it is painfully insolvent. I also predict that when Sears declares bankruptcy, the talking heads on CNBC and Bloomberg TV will not call Eddie Lampert onto the carpet and question Sears’ reckless stock buyback program running from 2005 to 2011. How did flushing away over $6 billion, for share repurchases, enhance shareholder value for Sears’ stockholders? This is not a question that will be posed by our lapdog media; yet the answer will be obvious when Sears’ shares hit $0.

Eric Englund

Eric Englund [send him mail], who has an MBA from Boise State University, lives in the state of Oregon. He is the publisher of The Hyperinflation Survival Guide by Dr. Gerald Swanson. He is also a member of The National Society, Sons of the American Revolution. You are invited to visit his website.

© 2015 Copyright Eric Englund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.