Good News for Euro Single Currency

Currencies / Euro Feb 17, 2015 - 01:06 PM GMTBy: Nadia_Simmons

Earlier today, the ZEW Centre for Economic Research showed that its index of German economic sentiment rose by 4.6 points to 53.0 this month from January’s reading of 48.4, which is the highest reading since February 2014. Thanks to these positive numbers, EUR/USD bounced off this week’s lows and climbed above 1.1400. Will we see the exchange rate above 1.1500 later this week?

Earlier today, the ZEW Centre for Economic Research showed that its index of German economic sentiment rose by 4.6 points to 53.0 this month from January’s reading of 48.4, which is the highest reading since February 2014. Thanks to these positive numbers, EUR/USD bounced off this week’s lows and climbed above 1.1400. Will we see the exchange rate above 1.1500 later this week?

In our opinion, the following forex trading positions are justified - summary:

EUR/USD: long (stop loss order at 1.1056)

GBP/USD: none

USD/JPY: none

USD/CAD: short (stop loss order at 1.2876)

USD/CHF: none

AUD/USD: none

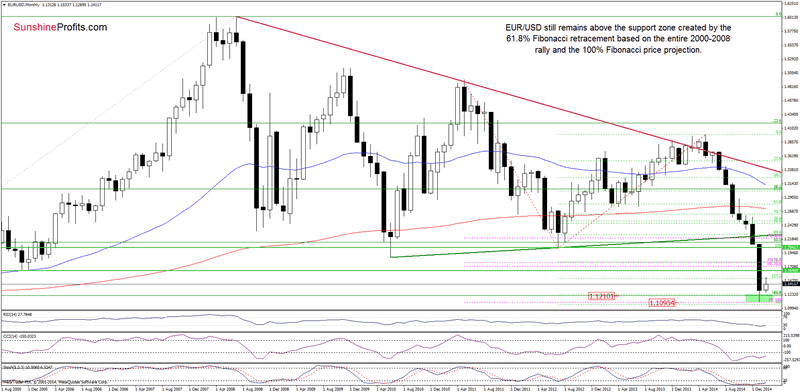

EUR/USD

EUR/USD still remains above the support zone created by the 61.8% Fibonacci retracement (based on the entire 2000-2008 rally) and the 100% Fibonacci price projection, which means that an invalidation of the breakdown below these levels and its positive impact on the exchange rate are still in effect.

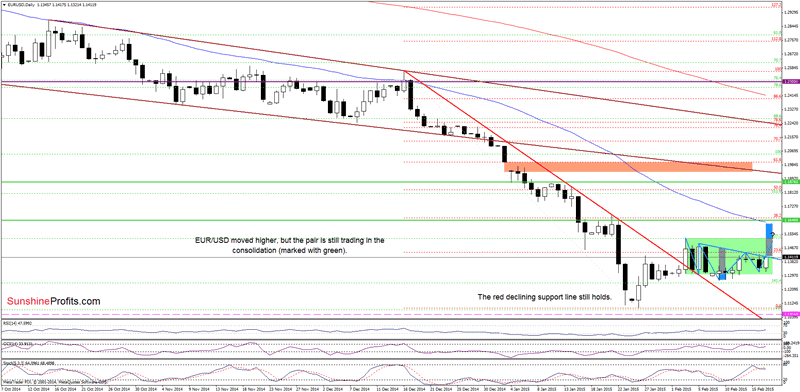

Having said that, let’s focus on the daily chart.

From this perspective, we see that EUR/USD moved lower and reached the lower border of the consolidation (marked with green) yesterday. Despite this small deterioration, the pair rebounded and climbed above 1.1400 once again. With this upswing, the exchange rate reached the blue declining resistance line, which is a neck line of the potential reverse head and shoulders formation. Therefore, in our opinion, if the pair moves higher and breaks above this line, it would be a bullish signal, which will trigger further improvement and an increase to around 1.1617, where the size of an upward move will correspond to the height of the formation and where the previously-broken 50-day moving average is. Nevertheless, before we see a realization of the above-mentioned scenario currency bulls will have to push the pair above 1.1533, where the upper border of the consolidation is.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Long positions with a stop loss order at 1.1056 are justified from the risk/reward perspective at the moment.

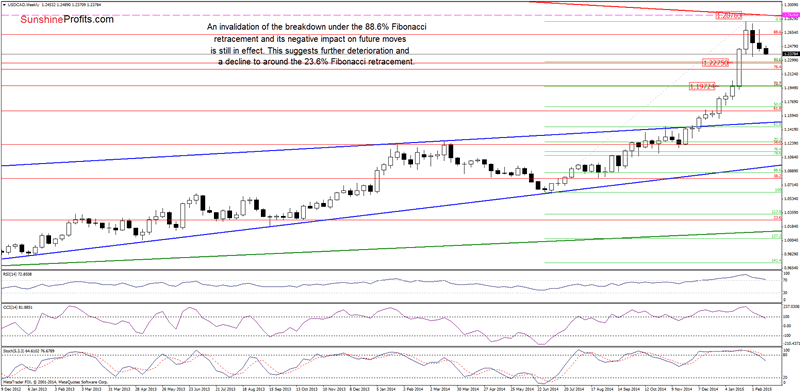

USD/CAD

The situation in the medium-term has deteriorated slightly as USD/CAD extended decline below the 88.6% Fibonacci retracement and the long-term red declining resistance line. This is a bearish sign which suggests a drop to the 23.6% (around 1.2275) or even 38.2% (at 1.1973) Fibonacci retracement based on the entire Jun-Jan rally in the coming week.

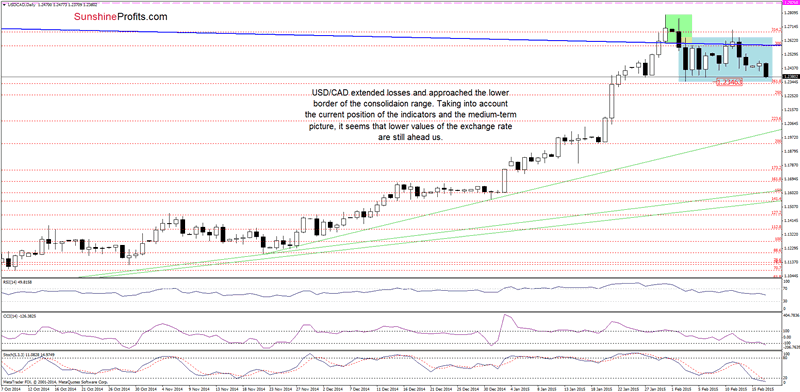

What can we infer from the daily chart? Let’s check.

Quoting our previous Forex Trading Alert:

(…) although USD/CAD rebounded slightly, the pair is still trading under the long-term blue support/resistance line, which suggests further deterioration and a drop to at least the lower border of the consolidation (marked with blue) around 1.2350-1.2376.

Looking at the daily char, we see that the situation developed in line with the above-mentioned scenario and currency bears pushed the pair to our downside target. What’s next? Although the exchange rate could rebound from here as the support level based on the Feb 3 still holds, the current position of the indicators and the medium-term picture suggests that lower values of USD/CAD are still ahead us. If this is the case, the above-mentioned downside targets would be in play.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop loss order at 1.2876 are justified from the risk/reward perspective at the moment.

AUD/USD

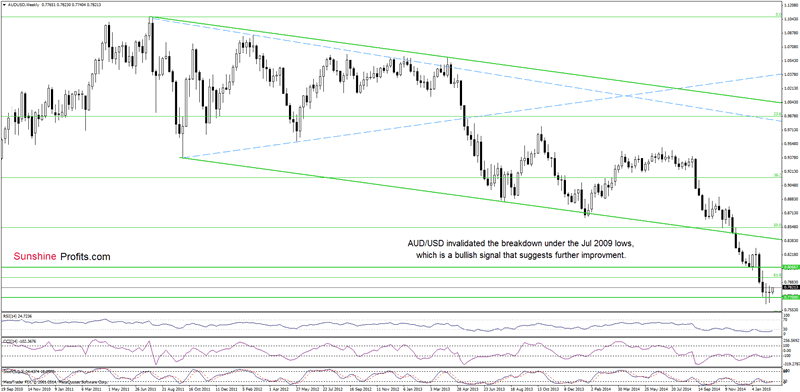

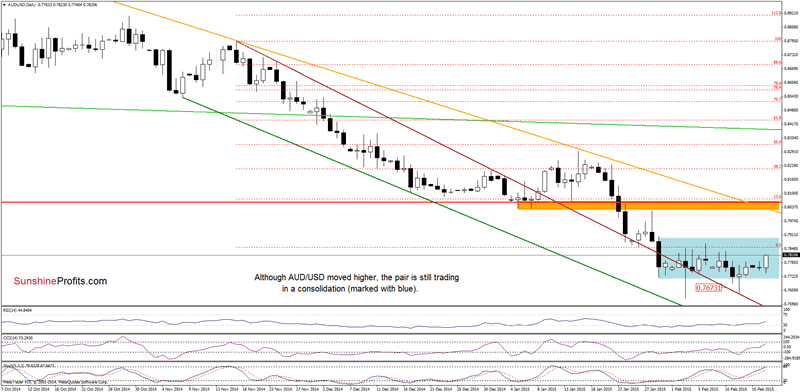

As you see on the weekly chart, an invalidation of the breakdown below the Jul 2009 lows and its potential positive impact on future moves is still in effect.

Having said that, let’s take a closer look at the daily chart.

On the above chart, we see that the situation in the very short-term has improved since our last Forex Trading Alert was posted and AUD/USD extended gains, climbing above 0.7800. Taking this fact into account, and combining it with the medium-term picture and buy signals generated by the indicators, we think that the exchange rate will move higher in the coming days. If this is the case, the initial upside target would be the upper line of the formation around 0.7905.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski

Founder, Editor-in-chief

Sunshine Profits: Gold Investment & Silver Investment

Sunshine Profits: Forex Trading

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.