Silver and Gold Shelter From the Storm

Commodities / Gold and Silver 2015 Mar 11, 2015 - 05:22 AM GMTBy: DeviantInvestor

What storm? The stock and bond markets in the US are doing great, the media has sold the strong employment story, and all those nasty wars are far, far away.

What storm? The stock and bond markets in the US are doing great, the media has sold the strong employment story, and all those nasty wars are far, far away.

So the top few percent are doing well and are sheltered from the storm, but what about the rest of us? What storms are pounding us?

- Currencies are based on debt, and those dollars, yen, and euros are created every day to keep various financial bubbles inflated. Global debt is $200 Trillion and cannot be repaid except with deeply devalued currencies. Central banks are creating currencies, monetizing debt, reducing interest rates, and frantically promoting inflation to avoid deflation.

- Inflationary forces are powerful. Huge devaluation of our currencies is occurring. This extends the illusion of exponential growth and diminishes the debt hardship. Most of what we need, such as food, energy, and health care will cost more every year.

- Deflationary forces are also powerful. What happens when a few $Trillion of sovereign debt defaults and triggers many more $Trillion in derivative payouts – that might cause a chain of bankruptcies? Expect deflation in our bubble assets.

What will central bankers and politicians do? Extend and pretend, print currencies, create far more debt, and fabricate stories about how everything is good.

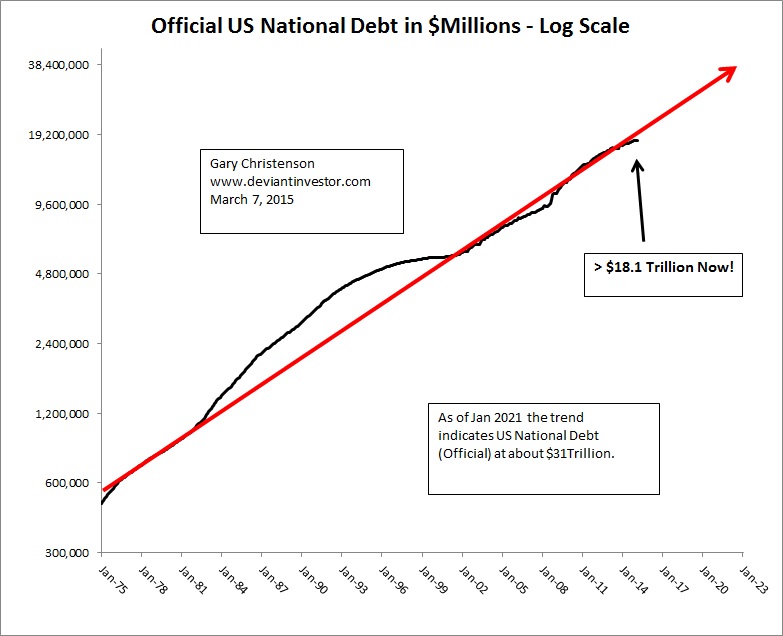

Look at the US national debt for the past 40 years. The exponential trend is clear – up 9% per year on average and about 10% per year since the 2008 recession/depression. It will rise until congress drastically cuts spending (just kidding) or some nasty reset occurs. Exponential increases do not last forever so our current exponential increases in debt, stock prices, welfare, military expenses, and economic stupidity will end someday.

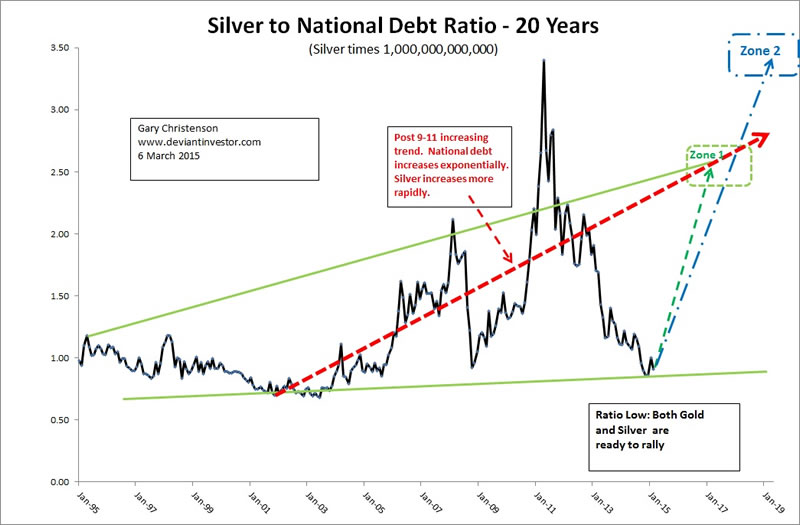

Gold and silver are real money, while dollars, euros, and yen are paper substitutes that circulate as currency in place of money. Look at the graph of the ratio of silver to the national debt for the past 20 years. Note the long term rise in the ratio and especially the increase since 9-11. Yes, there has been huge volatility in silver prices as shown by the ratio, but silver and gold – real money – are demonstrating their true value in the face of escalating debt.

Debt will increase and silver prices will rise more rapidly. Since silver and gold have been crushed during the past four years while stocks and bonds have rallied to new highs, expect those trends to reverse this year. When stocks and bonds decline central banks will accelerate their creation of currencies to reflate them and debt will increase even more rapidly, along with silver and gold prices.

Current (March 2015) Ratio 0.87

US National Debt $18.15 Trillion

Silver price $15.81

Suppose (more of the same – no hyperinflation):

Zone 1 (Approximately 2017) Ratio: 2.5

US National Debt $21 – $23 Trillion

Silver Price $55

Zone 2 (Approximately 2020) Ratio: 3.5

US National Debt $28 – $30 Trillion

Silver Price (no hyperinflation) $85 – $105

Other possibilities:

- Global war and hyperinflation: They will create unbelievable levels of debt and tremendously higher silver and gold prices. $150 silver and $5,000 gold will look inexpensive if the US dollar hyper-inflates.

- Nuclear war, financial and economic collapse, sovereign debt defaults, civil wars and new governments (unlikely, I hope): We better pray our leaders don’t push the world into such a global catastrophe. If they do who knows how high silver and gold will be priced and which currencies and governments will survive.

- Everyone plays nice and there is minimal need for wars, false-flags, and other distractions. Extend and pretend miraculously works through the end of the decade. In that unlikely and benign case, US national debt increases at only 9% per year to about $28 Trillion, the silver to national debt ratio is subdued at 2.0 – 2.5 and silver is priced at only $50 – $75 in this “best of all possible worlds.” (More of the same, no hyperinflation, only small wars, it’s all good, etc.)

Bottom Line:

- Debt will increase substantially from here, until a massive reset occurs.

- Gold and silver, in spite of financial cartel resistance, will assert their real value and be priced much higher, depending on the quantity of debt created, loss of confidence in government and central bankers, and the amount of chaos that occurs during the coming storm.

- Exponentially increasing systems do not last forever. Gold and silver do.

- Paper currencies eventually revert to their intrinsic value – effectively zero. (Famous last words: It can’t happen here!”)

- Don’t worry, be happy, and trust gold and silver more than paper and promises.

- I discuss the price of gold (no hyper-inflation) through the year 2021 using an empirical model based on the US national debt. You can read about the book here and here and here.

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.