Reality Always Wins… But Never on Schedule

Stock-Markets / Investing 2015 Mar 18, 2015 - 10:25 AM GMTBy: Casey_Research

By Louis James, Chief Metals & Mining Investment Strategist

By Louis James, Chief Metals & Mining Investment Strategist

“Expect the worst and you won’t be disappointed” is true enough, but it’s a miserable way to go through life.

For investors, expecting the worst is paralyzing, a reason to do nothing.

But when a market gets beaten up the way the natural-resource sector has been over the last few years, pessimism comes to dominate the chatter in boardrooms, blogs, and cocktail parties the way mold takes over a shower. It’s a blight.

“There are no buyers left in the market; it will take years to recover.”

“There’s no financing available, so everything will grind to a halt for years to come.”

“Don’t step on that black spot.”

Recent experience in the resource sector has been so bruising that the wounded have turned to pessimism as a psychological defense, to feel wise and experienced, or at least a little less foolish. An upbeat assessment wouldn’t just risk more money, it would risk more pain.

What Is

Opinions are plentiful, so rather than offering one more, let me summarize what I know for certain: price and value are related, but they often diverge.

The essential investment formula is “Buy low, sell high.” What makes that more than a truism is that price and value often move in different directions—but not forever. Price is a wandering dog that eventually comes home to value.

Hidden in the wreckage of today’s beaten-up resource market are stocks you can buy for much less than their real value. Entire companies are trading for less than their cash. Not all those stocks are going to recover, however, since in some cases management is such a liability that the cash is likely to be wasted. But it does tell us we are at or near the best time to implement the “buy low” part of the investment formula, picking up the stocks with real value.

Critical point: Don’t wring your hands over whether the bottom of the market is behind us or in front of us.

The only thing that matters is that you buy truly undervalued stocks in companies that have assets of real value—deep value, as is fashionable to say these days—and the management strength to develop that value.

That’s the reason Casey Research is holding a timely online event titled “GOING VERTICAL”. Eight stars of the mining industry and seasoned resource investors discuss the historic opportunity the current market offers, and the best ways to prepare your portfolio for a shot at the jackpot when the gold market rallies again. Register here to watch this free event now.

I know how difficult it is for investors to buy into an unpopular market when most of the pundits are dissing it. “What if it goes even lower?” is the big, paralyzing fear. Logical argument and economic reality—our civilization and most of the people living today simply cannot exist without natural-resource extraction—is not enough to neutralize the worries.

A Functioning Memory Is a Big Help

Fact: If you are in the right stocks, it’s possible not only to recover from a severe correction but to come out way ahead.

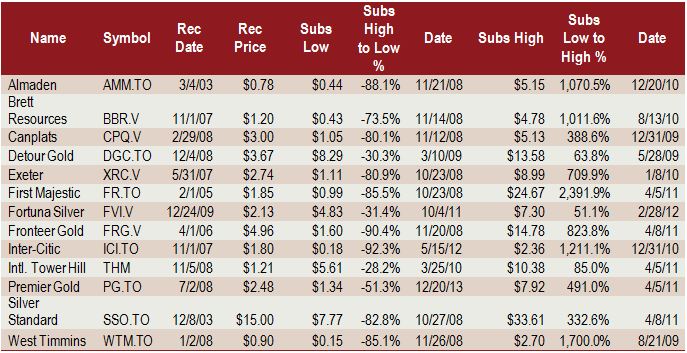

Below is a selection of actual stock picks from Casey International Speculator on which we made a lot of money despite severe retreats in the market and plunges in share prices. As a group, these stock rose after we recommended them, then fell an average of 69% before going on to become winners. The average gain from those lows to subsequent peaks was 795%. More downdraft than anyone wants, and more profit than most investors dream of.

Now, I’m not claiming this was our whole portfolio, nor that we sold any of these stocks at the top. What I am saying is that we made excellent returns on all of these stocks even though every one of them spit in our face after we bought it, selling off substantially—and then came back with gusto. One fell 90% and then soared 1,200%.

Key takeaway: Stocks in good companies will recover from even the most serious bear mauling.

What’s Coming

Whether it has already happened or is yet to come, three signs tell me the bottom in junior gold stocks is not far off.

- Investors don’t want to hear about junior gold stocks. Most readers who started this article didn’t even read this far.

- When gold broke through its previous low last November, most pundits announced it would drop to $1,000 or go even lower. It rebounded instead.

- While the sector continues to languish, stocks of the best junior companies have risen dramatically and largely have held on to those gains.

All good signs, yes. But I’d feel better if you didn’t bet on the timing. For a sure thing, bet on the value you can buy on the cheap now.

Click here to watch Franco-Nevada’s Pierre Lassonde… Casey Research Chairman Doug Casey… Pretium’s Bob Quartermain… Sprott US Holdings chairman Rick Rule… Aben Resources’ Ron Netolitzky… U.S. Global Investors CEO Frank Holmes… and Casey Research metals experts Jeff Clark and Louis James in GOING VERTICAL.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.