Gold Price Forecast to Double to Over $2,400 Per Ounce

Commodities / Gold and Silver 2015 Mar 18, 2015 - 03:05 PM GMTBy: GoldCore

- Gold price set to soar to new records in ‘Asian century’

- Gold price set to soar to new records in ‘Asian century’

- Gold price to double by 2030: ANZ

- Gold to exceed $2,400 per ounce

- Gold demand in Asia set to double

- “Greater demand from investors and central banks will see gold prices rise materially over the long-term”

- “Most of the time you don’t want to pay for it. But if you need it, you’re glad you have it”

The price of gold is forecast to double in the next 15 years, and growing wealth across Asia, particularly in China and India, will lead to demand for gold bullion and send its value soaring, a new study from ANZ predicts.

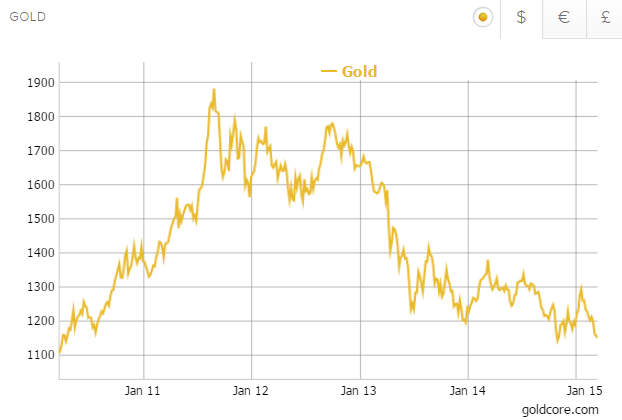

Gold in US Dollars – 5 Years (GoldCore)

ANZ’s just released report `East to El Dorado: Asia and the Future of Gold’ says the price of gold could exceed $2,400 per ounce by 2030, more than double its current value of around $1,150.

Since 2003, we have said that gold was likely to surpass its real record high or inflation adjusted high of $2,400 per ounce due to store of value, investment and central bank monetary demand.

“Asia’s rise will have profound implications for the gold market,” ANZ chief economist Warren Hogan said. As incomes rise across Asia, so will the appetite for gold rings and necklaces, the report predicts. “A growing middle class will buy more jewellery,” Hogan said.

There will also be an increasing appetite for gold coins and bars as stores of value.

Gold holds cultural significance in China, India and across much of Asia, where gold is considered an ideal gift for weddings in the hope it can bring luck and happiness.

Difficulty in obtaining gold in China and India in the past also adds to the allure, according to the report. The Chinese government has a history of nationalising gold stores and prohibiting gold ownership, while in India gold imports were largely banned until 1990.

Developments in money management practices in Asia, and rising demand for diverse financial products, will also help fuel demand for physical gold, the report says.

“A larger body of professional money managers will drive investment demand,” Mr Hogan said.

“And regional central banks will purchase more gold to provide confidence in newly floated currencies … These factors will support a long term and significant increase in the gold price.”

ANZ’s report predicts annual gold demand from 10 key Asian countries – including China, India, Japan, Indonesia and South Korea – will double from 2,500 tonnes to 5,000 tonnes.

ANZ said it believes the gold price will rise above $2,000/oz by 2025.

“While the near-term could see prices trade only marginally higher over the next few years, we believe the combined effect of greater demand from investors and central banks will see gold prices rise materially over the long-term,” it said.

“Beyond its role as the world’s largest producer and consumer of physical gold, we believe China will eventually dominate the price discovery process too, as Asia’s financial centres gradually open up. There is no reason why Shanghai should not become a major centre for gold trading provided the appropriate institutional and legal reforms take place.”

A climbing US dollar has dampened investor demand for gold so far in 2015, but investors still see gold as a safe haven during periods of share market and economic decline the report says.

“One things that’s never changed for the gold market in the last 30 or 40 years is its safe haven appeal,” he said.

“Most of the time you don’t want to pay for it. But if you need it, you’re glad you have it.”

Must Read Guide: 7 Gold Must Haves

MARKET UPDATE

Today’s AM fix was USD 1,149.00, EUR 1,080.50 and GBP 782.91 per ounce.

Yesterday’s AM fix was USD 1,154.75, EUR 1,087.54 and GBP 781.50 per ounce.

Gold fell 0.55% percent or $6.40 and closed at $1,148.50 an ounce yesterday, while silver slipped 0.58% or $0.09 at $15.56 an ounce.

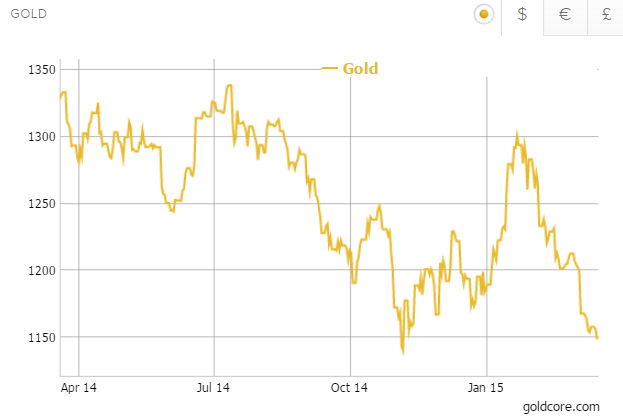

Gold in US Dollars – 1 Year (GoldCore)

In Singapore, bullion for immediate delivery ticked down 0.2 percent at $1,146.20 an ounce near the end of day. Comex U.S. gold futures for April delivery inched down 0.2 percent to $1,145.40 an ounce.

Gold is holding above yesterday’s 3-1/2 month low at $1,142.86/oz. Its 14-day relative strength index (RSI) remains in oversold territory at 25.5. Gold’s RSI has been below 30 for the best part of a fortnight.

Yesterday, SPDR Gold Trust ETF saw further liquidations and holdings fell 0.4 percent to 747.98 tonnes.

The Dubai Gold and Commodities Exchange (DGCX) is in an advanced stage of talks with a local bank on its plans to launch a spot gold contract, a senior executive at the exchange said. DGCX had said early last year that it planned to introduce a spot gold contract as part of its growth as a top trading centre for the precious metal. The launch had originally been scheduled for last June, but has been delayed. “We are in advanced stages of talks with a local entity,” Ian Wright, chief business officer at DGCX, told Reuters. He did not disclose the name of the local bank, but said the contract should be launched in the “near future”.

Thousands of anti-austerity protesters clashed with riot police near the new headquarters of the European Central Bank (ECB) in Frankfurt on today, hours before the ceremonial opening of the 1.3 billion euro ($1.4 billion) building.

Several cars were set on fire and streets were blocked by burning stacks of tires and rubbish bins. At least one police officer was injured, police said. Police used water cannon to try to make a path through the mass of protesters to the entrance of the building, which is blocked off from the street by police barricades.

ECB President Mario Draghi was due to make a speech there this morning

Gold fell to its lowest in nearly four months, as markets await the outcome of the U.S. Federal Reserve meeting today.

As always language from the FOMC’s policy statement will be used to infer any hints on when interest rates might be raised. Analysts are focusing on the word, “patient” to determine whether the rate hike will come in June or September or be delayed again.

If the word “patient” is absent from the statement, some analysts predict further price falls for the precious metals.

In London, spot gold in the late morning is trading at $1,150.47 or up 0.07 percent. Silver is trading at $15.56 or up 0.12 percent and platinum is trading at $1,094.46 or up 0.05 percent, at a five and a half year low.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.