Financial Market Extremes: Expect Consequences

Stock-Markets / Financial Markets 2015 Apr 01, 2015 - 02:45 PM GMTBy: DeviantInvestor

WHAT EXTREMES?

WHAT EXTREMES?

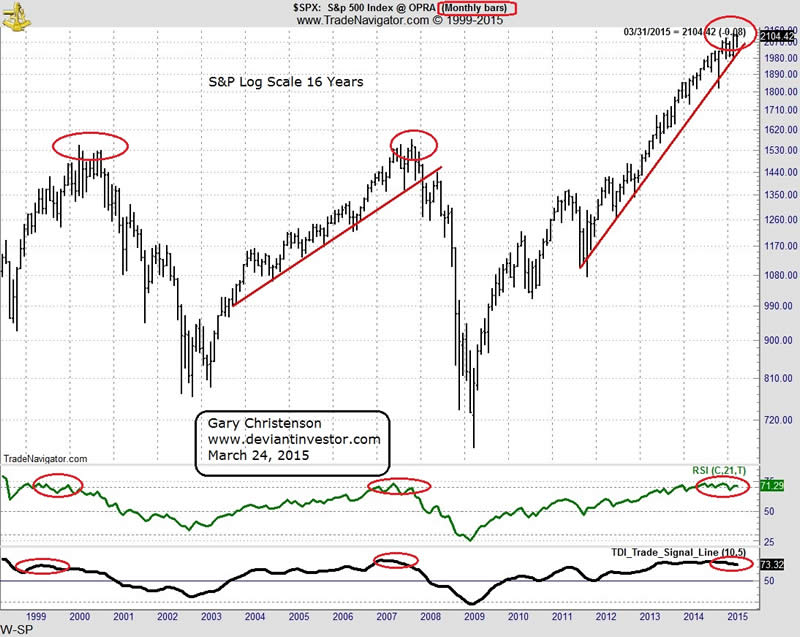

The S&P 500 Index has tripled in 6 years, is overbought, and at an all-time high. See graph showing 7 year cycle highs and overbought indicators.

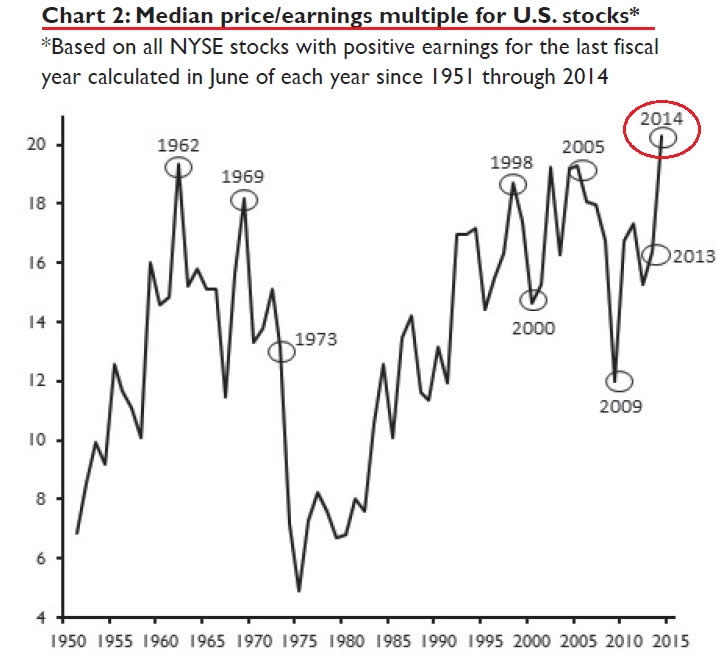

Earnings do not support the high valuations of US stocks. Note the extreme valuations as shown in the graph below, courtesy of Arabian Money.

Interest rates are currently at multi-generational or all-time lows and consequently bonds are extremely high in the “bubble-zone.” Many European banks and sovereign governments are “paying” negative interest. Unthinkable a few years ago!

The dollar index rallied over 25% between May 2014 and March 13, 2015 – an exceptional and parabolic rally, particularly considering the precarious financial condition of the US government and the Federal Reserve. See article here from Laurence Kotlikoff.

Derivatives, depending on who is counting, are approximately $1,000 Trillion globally. This extreme bubble is growing. All bubbles eventually pop.

Leverage in the financial system is more extreme than in 2008, before the “Lehman moment” crash in which the global financial system nearly froze.

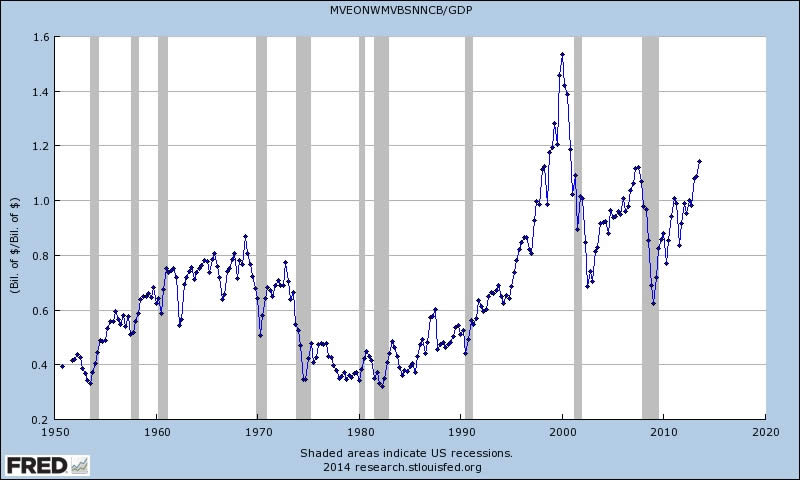

The “Warren Buffett Indicator” is flashing a warning – equity valuations are high compared to GDP. See graph below.

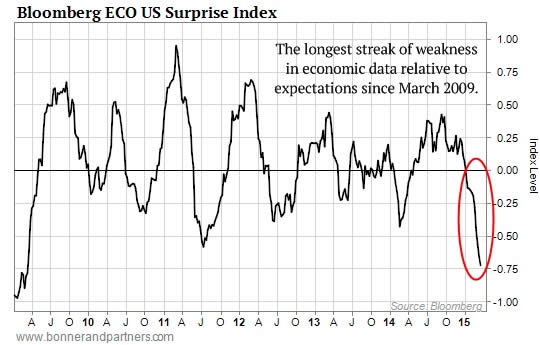

The Bloomberg Surprise Index is flashing a warning.

There are many more extremes that could be shown, but consider a few specifics.

Robert McHugh has listed a sequence of Fibonacci turn dates at the end of March and early April 2015. Risk of a stock market crash or important correction seems high in this time period.

Markets often turn around solar eclipses. We experienced a solar eclipse on March 20.

Greece will exit the Euro. The issue is not Greece, the Greek people, their economy, or austerity, but paybacks to various banks, mostly French and German. The piper and the bankers must be paid or banking cartel profits will be decreased. Banking cartel profits are used to “influence” politicians, so politicians listen to the needs of bankers. It is an old story…

We have many economic and political extremes in our current world. Perhaps this time will be different, but I doubt it. Plan on:

- Debt will increase until a “reset” occurs.

- Politicians will “extend and pretend” and make MANY promises.

- The S&P has enjoyed a large rally in the last 6 years. It will correct.

- Bonds are in a massive bubble, partially created by the low and negative interest rates forced upon the system by central banks. All bubbles eventually burst.

- Gold and silver and their stocks have been beaten down for nearly four years. They will rally to new highs.

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.