Is the U.S. Headed for a Recession?

Economics / Recession 2015 Apr 01, 2015 - 06:27 PM GMTBy: DailyWealth

Dr. David Eifrig writes: Are the government's economic statistics to be trusted at all?

Dr. David Eifrig writes: Are the government's economic statistics to be trusted at all?

Every economic statistic – from gross domestic product (GDP) to employment to inflation – comes from some agency performing calculations in a complex environment. But what do these numbers actually show us? Are these figures finagled by the government or other interested parties?

The answers are tricky...

You can't fully trust economic statistics because they describe quantities of things that can't be entirely known. Measuring the economy is difficult. Very difficult. And in a sense, there are no "real" numbers. But the official measures of inflation, GDP, or employment aren't hiding anything based on someone's conspiracy agenda.

This week, I'm going to cover each of these ideas – GDP, inflation, and employment... and see if the "official" stats are telling us the full story. We'll start with a close look at the official GDP figures...

People like to throw around GDP figures as a measure of a national economy's strength and the individual's standard of living. Most people don't monitor it closely, but they simply note when a headline or TV reporter broadcasts the quarterly update. This is often called the "headline number."

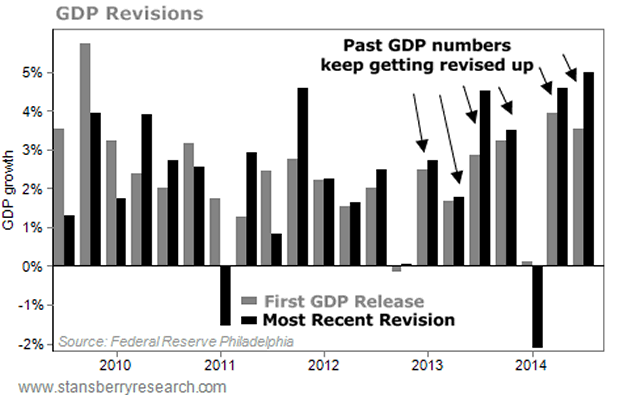

But GDP is complex. It's hard to compute. On January 30, the Bureau of Economic Analysis (BEA) reported the economy grew at a rate of 2.6% from September 30 to December 31. The agency also revised its number for the previous quarter. That's because the BEA gets this number out so fast, it doesn't have all the information yet. So it's constantly revising past numbers to get them closer to reality.

This time, the BEA reported that the third quarter of 2014 didn't grow at the blistering 3.59% pace it initially reported. It actually grew faster at 5%.

That's not unusual. Throughout this recovery, most BEA updates have revised numbers up from initial estimates. Take a look:

This means the economy is doing even better than most "headline" observers realize.

(And it suggests the numbers are honest. Why would you hide the good news in the old numbers no one pays attention to?)

We're following GDP closely. Besides being the biggest catch-all number for the health of the economy, we're watching for extended accelerated growth.

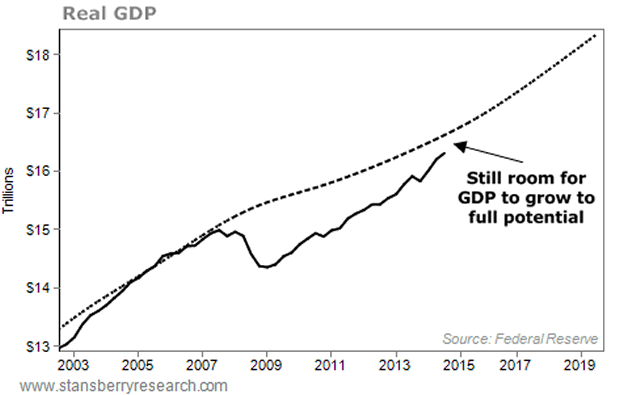

The reason is what's called "potential GDP." In the most basic interpretation, we have a lot of capital, factories, and businesses... and 318 million people in this country. There is a particular amount of economic output that these people will produce.

But in a recession, people don't buy as much, so people don't make as much money. The economy doesn't live up to its potential.

It has, however, been shown that after recessions, economies tend to eventually catch up to this potential GDP. It has also been shown that when you pair a recession up with a financial crisis, it takes even longer for GDP to catch up to the potential level... on average about nine years.

The thing is, we're still waiting to fully catch up...

There's no guarantee when, or if, we'll get back to potential GDP. But plenty of resources are creating pressure that should push growth upward, not downward.

It's clear the economy is doing well. But it's not as overheated as many bears would have you believe. The data show the economy is growing steadily... and we still have plenty of upside potential. Therefore, we don't expect a recession any time soon.

In tomorrow's essay, I'll cover inflation. Specifically, I'll take a look at the official consumer price index (CPI) figures, and see if they're telling us the whole story about rising costs.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

P.S. With the economy slowly recovering, now is a great time to take advantage of one of my favorite ways to earn tax-free income. I call it the "Master's Exemption"... and if you own a home or a condo, you qualify for this 100% LEGAL loophole. A friend of mine makes enough tax-free income from this for several nice vacations a year. You can learn about this loophole and many others in my new Big Book of Retirement Secrets. Learn how to order a FREE copy right here.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.