One of the Longest Cyclical Bull Market In US Stocks May be Coming to an End

Stock-Markets / Stock Markets 2015 Apr 06, 2015 - 01:36 PM GMTBy: Jas_Jain

Some think that we are in a secular bull market that began in March 2009. I disagree because that would mean that the secular bear market only lasted for 9 years, Mar-00-Mar'09, when 17 years is more typical. Also, as of now the inflation adjusted S&P 500 has not made a new high reached in March 2000 (it is close, though). Warren Buffet seems to have been aware of this 17-year secular bull & bear cycles when he commented in 1999 that the next 17 years for the US stock market would not be the same as the last 17 years. Here is how I date the last two secular bull and bear markets in the current longwave cycle that began in the middle of 1949, including the probable outcome of the current secular bear market:

Some think that we are in a secular bull market that began in March 2009. I disagree because that would mean that the secular bear market only lasted for 9 years, Mar-00-Mar'09, when 17 years is more typical. Also, as of now the inflation adjusted S&P 500 has not made a new high reached in March 2000 (it is close, though). Warren Buffet seems to have been aware of this 17-year secular bull & bear cycles when he commented in 1999 that the next 17 years for the US stock market would not be the same as the last 17 years. Here is how I date the last two secular bull and bear markets in the current longwave cycle that began in the middle of 1949, including the probable outcome of the current secular bear market:

| Secular Bull: Jul'49-Jan'66 | 16 Years 7 Months | the longwave spring |

| Secular Bear: Feb'66-Aug'82 | 16 Years 7 Months | the longwave summer (high inflation) |

| Secular Bull: Sep'82-Mar'00 | 17 Years 7 Months | the longwave fall |

| Secular Bear: Apr'00-Oct'17? | 17 Years 7 Months? | the longwave winter (deflation) |

Prior to 1995 there were periods of mostly sideways moves during a secular bull or bear market, with cyclical market moves, e.g., Feb'66-Jan'73, but since then we only have relatively long cyclical bull markets followed by very sharp bear markets and that is expected to be the case when the current cyclical bull market ends.

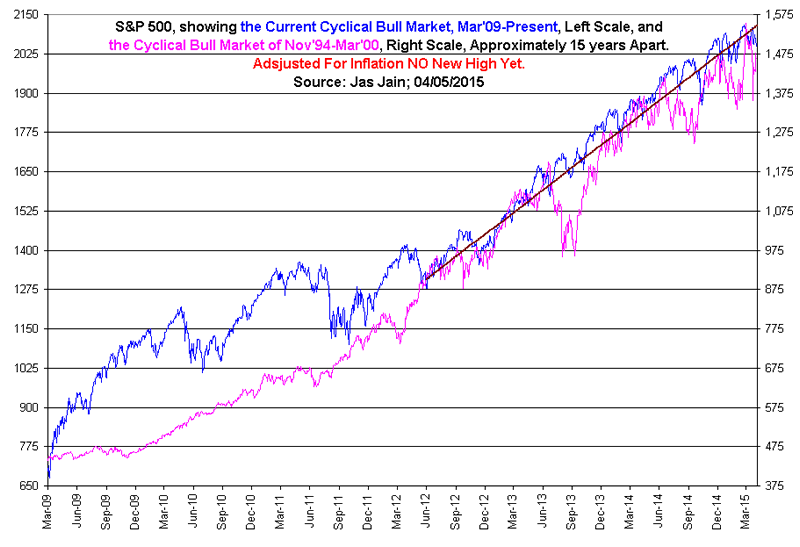

Fig. 1 above shows the current cyclical bull market, approximately 6 years in duration, and the cyclical bull market of Nov'94-Mar'00, 64 months in duration, both over-valued compared to the cyclical bull market of 2003-07. Interestingly, the last 33 months of the current market are following an identical trend line, shown in brown, with slightly over 20% per year gain, as the bull market of the late 1990s.

Most cyclical bear markets take place in the context of the economic cycle, i.e., a recession follows downturn in the stock market. This has been the norm since 1995 and there couldn't be any doubt that the end of the current bull market would foreshadow the next recession. If the current bull market is nearing the end then the recession couldn't be far behind.

Extremes of Over-Valuation

Using all the well-known measures of valuation of the US stock market, the current market is the most over-valued except for the bull market of the late 1990s, and probably the late 1920s. I posit that the current market is more over-valued than the market of 1990s. What is my valuation criterion? The economic growth, the mother's milk of the growth of the stock prices.

Looking at the economic data over a 7-year period smoothes out most of the cyclicality in the data due to the economic cycles. The annual GDP growth and the annual employment growth for the past 7 years is 1.21% and 0.31%, respectively. The same numbers 15 years ago were 3.7% and 2.6%! The economic and the employment growth is less than 1/3rd of the growth 15 years ago that was fueling the bull market of late 1990s. I rest my case.

By Jas Jain , Ph.D.

the Prophet of Doom and Gloom

Copyright © 2015 Jas Jain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.