Gold Price “Going Higher” and “A Big Buy Here”

Commodities / Gold and Silver 2015 Apr 10, 2015 - 06:42 PM GMTBy: GoldCore

- Negative Interest Rates and Rising Interest Rates Positive For Gold

- Negative Interest Rates and Rising Interest Rates Positive For Gold

- HSBC suggests negative rates may drive customers out of digital and into holding paper cash

- ZIRP and NIRP very positive for gold

- Rising U.S. rates not negative for gold due to emergence of China, India, Middle East and EMs

- When rates do rise will be positive for gold

- Costly in terms of wealth preservation and returns not to have an allocation to gold

- Gold “going higher” and “a big buy here”

- Gold up 3.1% in euros and 2.2% in pounds this week

One of the persistent arguments against owning gold by many financial advisers and brokers is that it “does nothing” and it incurs storage costs. Unlike cash, which earns interest, gold is a non yielding asset. The second is that gold will perform badly when interest rates rise. Both arguments are demonstrably misguided.

In today’s world of ZIRP and NIRP – zero percent interest rate policies and negative interest rate policies – and actual negative interest rates in a growing number of countries internationally – the old rationale that favours holding cash over gold is increasingly defunct.

Base rates in the industrialised nations have been near zero since the financial crisis of 2008. Frequently throughout this period the rate of inflation has been higher than this implying a loss in spending power over time for each unit or currency.

This factor, coupled with the many risks which were left unresolved or have been exacerbated in the wake of the last financial crisis – which we consistently cover here – provides a strong incentive to hold gold in favour of cash.

These risks include

– massive unpayable debt leading to currency debasement and a likely international monetary crisis

– increasing geopolitical tensions between NATO nations and Russia and in the Middle East

– risks of cyber terrorism and cyber warfare to the massive, unwieldy digital banking and financial system

– risk of confiscation of bank deposits in event of bank failures – the developing bail-in regime

In the past few months the central banks of Sweden, Denmark and Switzerland have entered into the uncharted waters of negative interest rates.

Interest rates look set to go lower in the short term, prior to going higher in the long term.

An interesting research note from HSBC this week suggests that QE would have little impact on these smaller, open economies to spur inflation and – in the case of Switzerland and Denmark – direct intervention into FX markets have led to further difficulties.

It was in this context that Sweden’s Riksbank pushed the repo rate into negative territory. HSBC suggest that the Riksbank experiment will “act as a barometer for central banks around the world trying to tackle low inflation or deflation.”

If and when QE in the major currency blocks fails to achieve its stated objectives it is not unlikely that central banks who – as HSBC points out – must be seen to be doing something, will follow suit even if no demonstrable effects are seen in Sweden et al.

How domestic banks react to negative rates remains to be seen. To date, they have taken no action because the Riksbank has given no indication of how long the policy will be in place.

HSBC points out that if the banks continue to have to absorb the costs, it will impair their ability to lend causing further deflationary pressure. On the other hand, if they pass the costs onto their customers they may decide to pull their cash out of the banks causing a liquidity crisis and bank runs.

Central banks around the world continue to hold and accumulate more gold. Central banks are the largest buyers of gold today which is not surprising given the debt levels in the U.S., UK, Japan and indeed much of the EU today.

This shows that monetary authorities, the entities who actually print and digitally create paper and electronic cash today still regard gold as having a very important function.

It is also important to note that contrary to received wisdom by many market participants today, gold should perform well in a rising interest rate environment.

Gold should increase even if U.S. interest rates rise as rising interest rates will be bearish for the risk assets – equities and bonds. Gold has a proven long term negative correlation with equities and bonds.

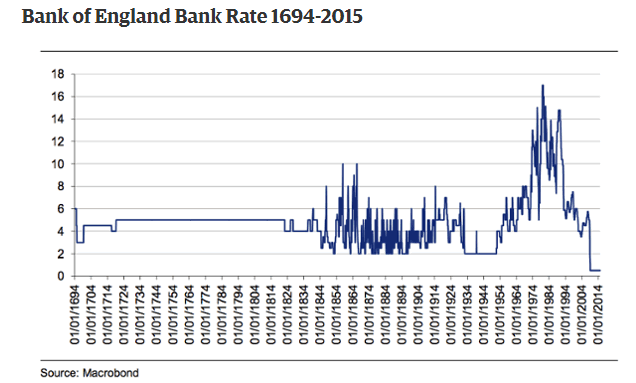

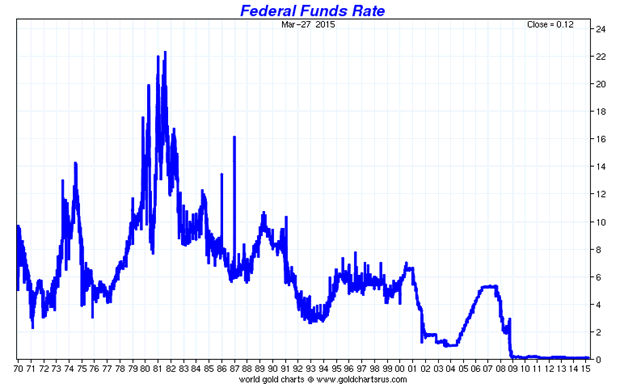

This was clearly seen in the 1970s (see chart) when interest rates and gold rose very sharply during the decade and stocks and bonds has a torrid time. Gold becomes vulnerable towards the end of an interest rate tightening cycle as was seen in 1980 when real interest rates are meaningfully positive – nominal interest rates are 2 or 3 per cent above the rate of inflation.

Nominal interest rates more than doubled in the course of the 1970s to over 20%. At the same time, gold prices rose 24 times – from $35 to over $850 per ounce (see chart above and below).

Indeed the period of most aggressive interest rate increases were from 1977 to 1980 when interest rates rose from 4% to over 20% and this corresponded with the period of gold’s greatest gains – from below $200 to over $800 per ounce.

Also of importance is the fact that due to the emergence of China as the world’s leading gold buyer and other emerging markets (India, the Middle East, Turkey etc) now accounting for more than 70% of gold demand yearly, higher U.S. interest rates will have less influence on gold prices than is commonly expected.

Besides the example of the 1970s, another example of gold performing well in terms of rising interest rates is in the period between October 2003 and October 2006, when gold posted a cumulative return of almost 60 per cent when U.S. real interest rates jumped from -1 percent to 3 percent, the report showed.

During periods of rising U.S. interest rates, gold’s relative low volatility also makes it a valuable asset in a properly diversified investment portfolio.

Both stocks and bonds are likely to deliver lower than average returns in the coming years and there is indeed a real risk of material corrections and even crashes in stock and bond markets.

In this increasingly mad monetary world, a world which looks likely to be seen in most western countries, gold will serve its function as a secure store of value and also as a hedge against a currency crisis. ZIRP and NIRP are positives for gold as will be rising interest rates when eventually they come.

Not owning gold in the unprecedented interest rate environment of today is imprudent in the extreme. It will be costly both in terms of returns but also in terms of wealth preservation.

It is not regarded as such now but it would appear to be only a matter of time before the penny drops about the inherent risks of not having an allocation to gold today.

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,201.90, EUR 1,133.49 and GBP 820.58 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,196.00, EUR 1,113.33 and GBP 808.49 per ounce.

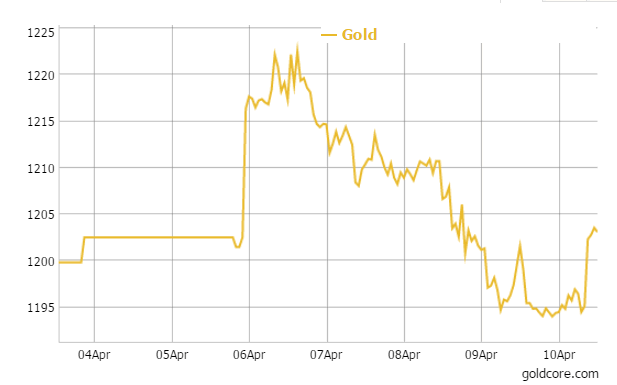

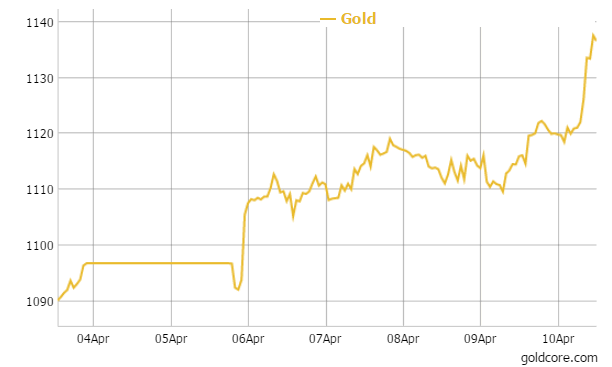

For the week, gold is headed for a slightly higher close in dollars and strong gains in euros, pounds and other currencies (see charts).

Gold fell 0.67 percent or $8.10 and closed at $1,195.10 an ounce yesterday, while silver slipped 1.94 percent or $0.32 closing at $16.20 an ounce.

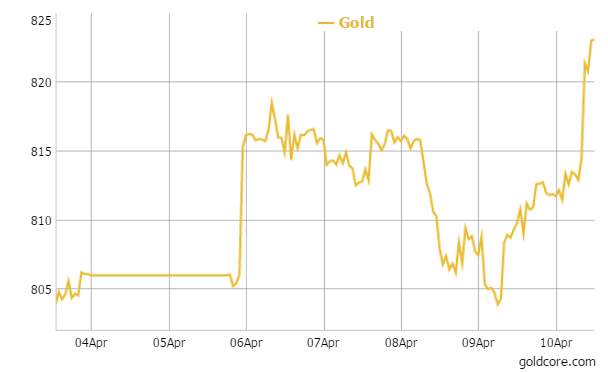

Gold in US Dollars – 5 Days

Gold prices in Singapore reached $1,194.10 an ounce near the end of day trading, after reaching a low yesterday of $1,192.30 per ounce. Gold in London suddenly surged above the key $1,200 level on no breaking news this morning. It was likely a combination of traders going long before the weekend and a short covering rally after recent weakness.

Gold regained ground despite a strengthening US dollar. The U.S. dollar is hovering at a three week high against other currencies.

Gold Technical Levels

The metal has an immediate resistance at 1205.78 (5DMA) and 1210 levels. Meanwhile, support stands at 1195 (20DMA) levels below which doors could open for 1193.41 (50DMA) levels.

Gold in Euros – 5 Days

The U.S. Fed minutes released this week were as obtuse and unclear as ever and as usual investors are left scratching their heads as to when U.S. interest rates will be raised for the first time in many years. The economic data from the U.S. economy is so mixed that its still a guessing game.

As we said yesterday, the Fed talks a good hawkish talk but has yet to walk the hawkish walk. The Fed knows that markets and a fragile, debt laden U.S. economy will struggle with even a small rise in interest rates. Hence all the talk and the very little action. As one Twitter correspondent said the Fed cannot “do anything but kabuki and pray the market doesn’t catch wind of no bullets left to fire.”

Gold in British Pounds – 5 Days

The monetary gun is shot and they are out of ammo with little options should we have a new recession or a new financial crisis – both of which seem increasingly likely.

Comex U.S. gold for June delivery remained unchanged at $1,193.90 an ounce. Chinese demand has waned a bit as premiums for physical gold at the Shanghai Gold Exchange were $1-$2 an ounce over the global spot benchmark today.

Gold in late European trading is up 0.64 percent or $1,202.14. Silver is $16.51 or up 1.98 percent and platinum is at $1,166.18 or up 0.95 percent.

Gold is up 3.1 per cent in euro terms this week and 2.2 per cent in sterling terms.

Astute investors continue to dollar, pound and euro cost average into an allocation to gold.

Gartman: Gold Going Higher – CNBC

Gold A Big Buy Here: Trader – CNBC

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.