Gold and Silver Policy Will Continue until Pitchforks and Torches Appear

Commodities / Gold and Silver 2015 Apr 12, 2015 - 09:06 PM GMTBy: Jesse

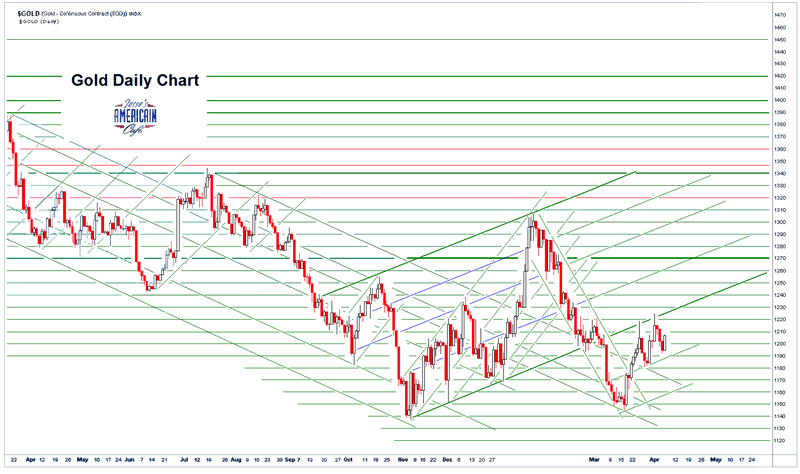

Gold led the way as it popped back over 1200 on news that India showed record gold imports in March of 125 tonnes.

Gold led the way as it popped back over 1200 on news that India showed record gold imports in March of 125 tonnes.

Gold is flowing from West to East. The data shows this without much room for error, unless you are an economist or analyst whose paycheck has willfully obscured their vision. How this ends I do not know and no one can really say. But it will end. I would like to think that at some point the central planners will go so far off into the weeds of their own obfuscation that the people will generally rise up and tell them to take them models and use them to pound sand.

If you watch the financial news, as I do, the divergence between valuations and reality is getting to the absurd point where the tech bubble had gotten. I remember chatting in the business class section of transcontinental and international flights back in the day with some of the Wall St analysticals and presstitutes.

They would give the cynical wink wink, nod nod to the valuation bubble that was about to rock the world. Knowingly they would admit, 'of course it's a bubble, but don't get in front of it.' And they apparently are not afraid to do it all over again. Got to keep dancing when the music is playing, and the devil take the innocent into the abyss.

I see where Willem Buiter would like to eliminate cash and tax all currency in general. The purpose would be to remove that ability to store wealth as cash, safely from the negative interest rate confiscation of central banks. If we do that, maybe we can assign everyone a number and implant a chip in their arms and force them to transact all their business with it. Just joking. When it comes to money, he's a statist, par excellence.

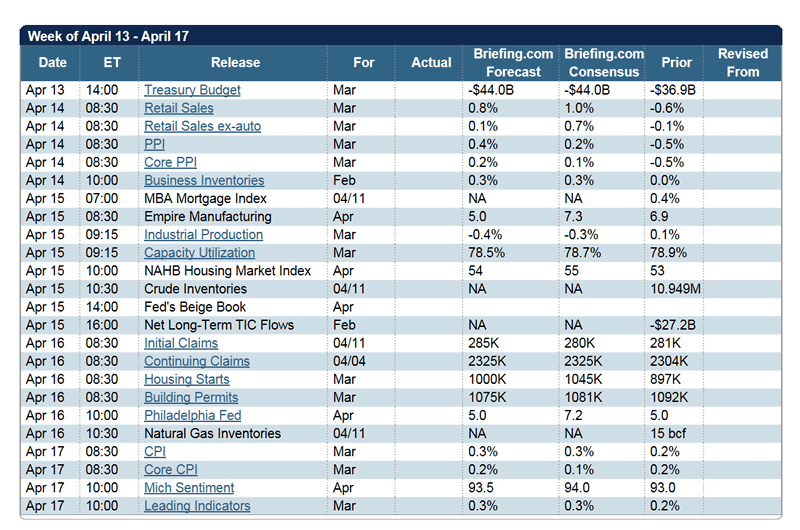

Next week we will see earnings news dominating the stock market I would like to think, although the latest antics from Draghi in Europe may make their own mark. There will be a bit more economic news as noted in the calendar shown below.

Given the wobbly state of the real economic recovery, and the weakness of the domestic jobs market, and the almost moribund state of almost every sector except financial, any policy actions that encourage a stronger dollar in the face of the rest of the world's devaluation race to the bottom is beyond economic malpractice, and almost insane if the general good of the country is considered.

Never mind that the strong dollar favors the international creditors, and the acquisitive desires of the monied class, hungrily eyeing the income producing assets of their victims prospective sellers.

You could make the case that the Fed's stimulus has been more than useless, and actually destructive to the real economy, so ending it might not be a bad thing. That seems to be a weak argument, but certainly more honest than claiming that it has actually worked.

Well, what can one expect from a den of vipers.

Have a pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.