JP Morgan Cornering Silver Bullion Market?

Commodities / Gold and Silver 2015 May 01, 2015 - 02:29 PM GMTBy: GoldCore

- Why is JP Morgan accumulating the biggest stockpile of physical silver in history?

- Why is JP Morgan accumulating the biggest stockpile of physical silver in history?

- Legendary silver analyst Ted Butler believes JP Morgan are in a position to corner silver market

- JP Morgan may be holding as much as 350 million ounces of physical silver

- JP Morgan realises the value of owning physical silver bullion today

- Silver at $16 today – Set to soar to over $50 again

JPMorgan Chase, the largest U.S. bank, one the largest providers of financial services in the world and one of the most powerful banks in the world has accumulated one of the largest stockpiles of silver the world has ever seen.

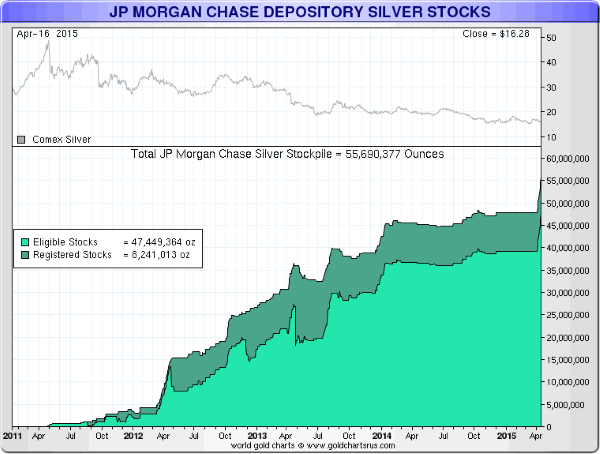

The total JP Morgan silver stockpile has increased dramatically in the last four years. In 2011, JP Morgan has little or no physical silver. By 2012, they had acquired 5 million ounces of silver bullion.

Incredibly, in the last 3 years their COMEX silver stockpile has increased tenfold and is now over 55 million ounces (see chart below)

Here’s a breakdown of the Comex’s recent physical silver deliveries to JP Morgan:

April 7th: 1,110,000 ounces

April 8th: 1,280,000 ounces

April 9th: 893,037 ounces

April 10th: 1,200,224 ounces

April 14th: 1,073,000 ounces

April 15th: 1,191,275 ounces

April 16th: 1,183,777.295 ounces

This is a huge bout of deliveries in a very short space of time. It’s such a large amount, that it even creates a spike on the long-term chart of JP Morgan’s silver stockpile (see chart).

JP Morgan has accumulated another 8.3 million ounces of silver in just the past 2 weeks alone.

Is JP Morgan accumulating silver at these depressed levels in anticipation of geopolitical and financial turmoil?

It seems likely. JPMorgan Chase Chairman and CEO Jamie Dimon in his recent letter to shareholders warned

“Some things never change – there will be another crisis, and its impact will be felt by the financial market”.

Dimon warned that the trigger for the next crisis may not be the same trigger as the last one – but there will be another crisis.

“Triggering events could be geopolitical (the 1973 Middle East crisis), a recession where the Fed rapidly increases interest rates (the 1980-1982 recession), a commodities price collapse (oil in the late 1980s), the commercial real estate crisis (in the early 1990s), the Asian crisis (in 1997),so-called “bubbles” (the 2000 Internet bubble and the 2008 mortgage/housing bubble), etc. While the past crises had different roots (you could spend a lot of time arguing the degree to which geopolitical, economic or purely financial factors caused each crisis), they generally had a strong effect across the financial markets.”

The preference for silver instead of gold may be explained by the current depressed prices.

In the last two weeks JP Morgan Chase has accumulated more than eight million ounces of physical silver.

At the same time, JP Morgan Chase restricted the use of cash for selected markets and went so far as to restrict clients from using cash for credit card payments, mortgages, equity lines and auto loans. There will also be no ability to store cash or bullion in their safe deposit boxes.

JP Morgan’s massive silver buying brings to mind the Hunt Brothers’ attempt to corner the silver market in the late 1970s. The Texas oil-tycoons tried to corner the silver market by accumulating a massive silver futures position.

Regulatory authorities increased margins which saw silver prices fall and the trade go against them. When they failed to meet a $100 million margin call they were almost completely wiped out.

The Hunts faced losses of $1.7 billion and a widespread panic on Wall Street was averted when a consortium of U.S. banks bailed out the main brokerage firm involved.

The story has become the stuff of legend in the annals of precious metals trading and indeed trading. Before their buying on the COMEX, silver traded at $6 an ounce. It gradually rose in price before a blow off spike to $48.70 in January 1980.

At the time the Hunt brothers were believed to have acquired futures contracts worth one third of total annual global mine supply on leverage. Had they been in a position to meet the margin call the outcome may have been quite different.

Had they accumulated physical silver rather than paper silver in the form of futures contracts, as JP Morgan are doing, the Hunts would likely have made an absolute fortune.

So, it is interesting to note that legendary silver market analyst Ted Butler has estimated that JP Morgan may currently hold far more than their official figure of 55 million ounces.

Butler believes the true figure to be closer to 350 million ounces. Annual global silver production is 820 million ounces which, if Butler is correct, puts JP Morgan in a position to corner the physical silver market today, unlike the Hunt brothers back in 1980. As this would equate to a holding 42.7% of total annual supply.

JP Morgan has been acquiring this vast hoard of physical silver while holding the largest short position in the silver futures market, i.e. while suppressing the silver price with its unlimited access to free money, according to Butler.

What motivation could one of the key insiders on Wall Street have to accumulate such vast quantities of physical silver? It seems clear JP Morgan anticipates strong demand for physical silver in the not too distant future – either due to another crisis or purely due to the tiny size of the physical silver market and very favourable supply demand dynamics.

In the event of more market dislocations, demand for silver and gold will surge again. Heretofore – in similar circumstances – demand has been dampened by institutions dumping contracts for massive volumes of silver, paper or electronic silver, onto the futures markets.

Silver in USD – 10 Years (Thomson Reuters)

However, it would appear that JP Morgan now have less motivation to cap silver in the paper markets and indeed are set to make enormous profits from the physical position they have taken. Indeed, they are likely to reverse their leverage short positions and also go long in the silver futures market in order to maximise profits.

When JP Morgan chooses to exploit this advantage remains to be seen. It seems likely that a major event is imminent in the markets and demand for physical gold and silver will likely soon surge again.

Will banks take their thumb off the electronic silver market and allow prices to rise in the near future?

This is hard to know but seems increasingly likely. However, it would seem like a good opportunity to take a similar position to an institution which is very well connected and very well informed due to its relationship with and influence over the U.S. government, the U.S. Treasury and the U.S. Federal Reserve.

Silver is no longer regarded as a good investment and it is only owned by a small minority of hard money advocates and bullion buyers who realise its importance as a hedging instrument and a safe haven, store of value asset.

JP Morgan, however, seems to realise the value of owning physical silver bullion today.

Conclusion

Precious metals look the most undervalued of all the asset classes – particularly silver.

The fundamental reasons for our very bullish outlook on silver is due to continuing and increasing global macroeconomic, systemic, geopolitical and monetary risks; silver’s historic role as money and a store of value; the declining and very small supply of silver; significant industrial demand and most importantly significant and increasing investment demand including from the largest bank in America.

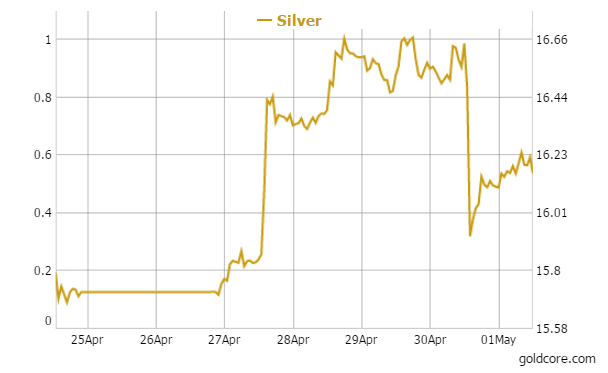

Silver is currently trading at just over $16 per ounce. GoldCore continue to believe that silver will surpass its non-inflation adjusted high $50 per ounce in the coming years. Indeed, we believe that silver will surpass its inflation adjusted high or real record high of over $150 per ounce in the next 5 to 7 years.

JP Morgan’s silver accumulation suggests another economic crisis looms large and that silver is set to soar … again.

Important Guide: 7 Key Gold and Silver Storage Must Haves

MARKET UPDATE

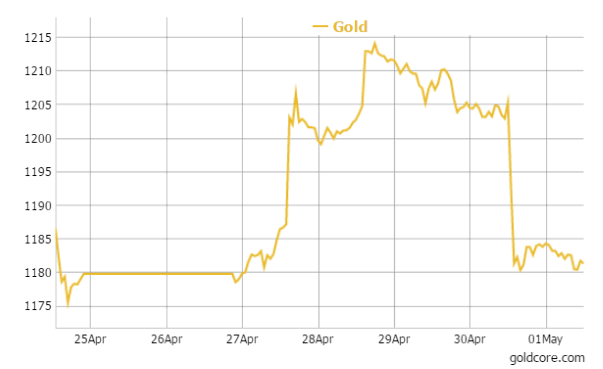

Today’s AM LBMA Gold Price was USD 1,179.00, EUR 1,049.24 and GBP 771.04 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,204.80, EUR 1,075.99 and GBP 779.73 per ounce.

Gold fell 1.76 percent or $21.20 and closed at $1,182.80 an ounce yesterday, while silver slid 2.48 percent or $0.41 closing at $16.12 an ounce. In Asia overnight, Singapore gold prices were flat and inched down 0.1 percent to $1,182.50 an ounce near the end of day trading.

Gold in U.S. Dollars – 1 Week

Gold recovered after an almost 2 percent drop yesterday when stop loss orders were triggered in a brutal sell. The sell off was blamed on the better than expected employment figures but the scale of the losses were more than would have been expected – especially given that the data has been very negative this week – especially the poor GDP number.

A tumultuous week saw the dollar and bonds fall sharply, bond yields soar and stock markets in Europe and the United States weaken.

Japanese manufacturing activity contracted in April for the first time in almost a year as domestic orders and output fell, adding to fears that QE has failed and the large Japanese economy is on the verge of another recession or depression.

Yesterday’s U.S. jobless claims were at their lowest level in fifteen years at 262,000 below analysts consensus of 288,000. This surprise would suggest that the labour market is recovering which would be positive for the U.S. economy. However, the veracity of some of the jobs numbers remains in doubt with some analysts concerned that figures are being “hedonically adjusted” and manipulated.

The Fed at their policy meeting this week said that the health of the economy is dependent on the jobs market and inflation data. Next week’s non farm payrolls number will be watched for more signals but the poor GDP number this week should be a real alarm wake up call.

The weaker than expected GDP number suggests that the Fed will be slower to increase interest rates than was previously expected. This is something we have been warning of for some time as we believe the U.S. recovery is far more fragile than is realised.

Silver in U.S. Dollars – 1 Week

Interest rates remaining near record lows for longer than had been anticipated should be bullish for gold and silver.

In Europe in late morning trading gold bullion was off 0.34 percent at $1,180.44 an ounce. Silver was up 0.6 percent at $16.23 an ounce and platinum fell 0.29 percent at $1,137.49 an ounce.

Gold and silver are higher in dollar terms this week after the sharp falls seen in stock markets and in the dollar after the poor GDP number sent shivers through markets globally.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.