What's Next for The U.S. Dollar and Currencies?

Currencies / US Dollar May 06, 2015 - 01:17 PM GMTBy: Axel_Merk

In anticipation of higher U.S. rates and lower rates elsewhere, the greenback had enjoyed a dramatic rally. Has the tide turned, or is the dollar merely taking a breather? We believe there are threats and opportunities hidden underneath recent market action. Below is a closer look in an effort to allow investors to better understand the dynamics that might be unfolding.

In anticipation of higher U.S. rates and lower rates elsewhere, the greenback had enjoyed a dramatic rally. Has the tide turned, or is the dollar merely taking a breather? We believe there are threats and opportunities hidden underneath recent market action. Below is a closer look in an effort to allow investors to better understand the dynamics that might be unfolding.

Is the world flat? At 0%...

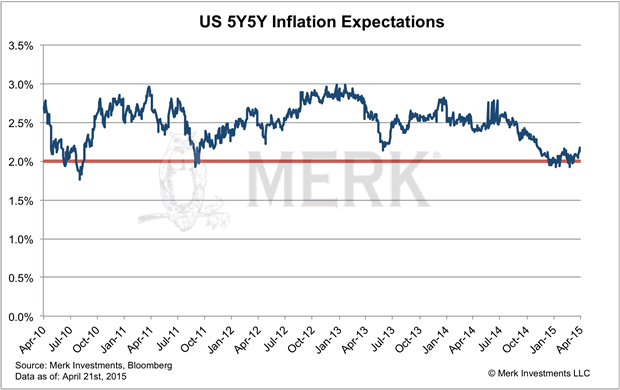

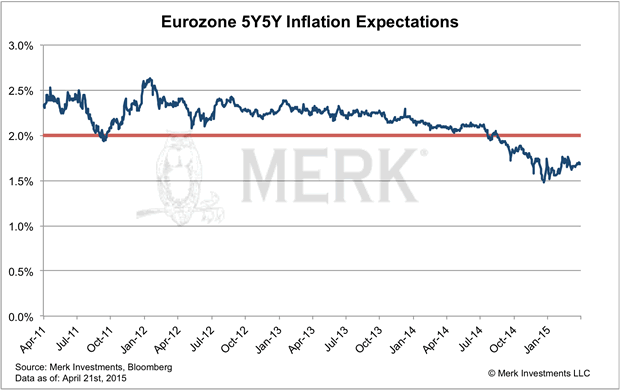

Although we have had a 'taper tantrum' before, it was European Central Bank (ECB) President Mario Draghi that kicked the theme of rate divergence into high gear. As the Fed was contemplating an "exit", the ECB was contemplating QE. What was interesting at the time is that the glass was perceived to be half full in the U.S., while half empty in the Eurozone. What we mean to say with that is that while there are clearly differences in the regions, they weren't as dramatic as they were made out to be. Consider the following two charts on forward inflation expectations in the U.S. and Eurozone:

In the Eurozone, Draghi raised alarm bells as some measures of future inflation expectations dipped below the ECB's target of "close to, but below 2%." The plunge in commodity prices exacerbated this decline. However, it was what I would call a convenient excuse to announce QE. The context in which Draghi presented it suggested he targeted the exchange rate as a way to induce inflation. The logic he presented last summer stipulated that weaker Eurozone countries must become more competitive; as achieving greater competitiveness through lower wages has a tremendous political cost, the better alternative may be to increase competitiveness through a weaker euro which - incidentally - may also help boost inflation.

However, I would like to point out that the chart for the U.S. above shows a picture that isn't all that different. When Bernanke was at the helm of the Fed, he would announce another round of QE when forward inflation expectations on the chart above were coming down towards the 2% target. But instead of talking about QE, we were told to be patient, as the recovery must surely be under way. In fact, for those that haven't noticed, the U.S. has not raised rates as of yet. But we have been told over and over again that the U.S. is on its way of raising rates.

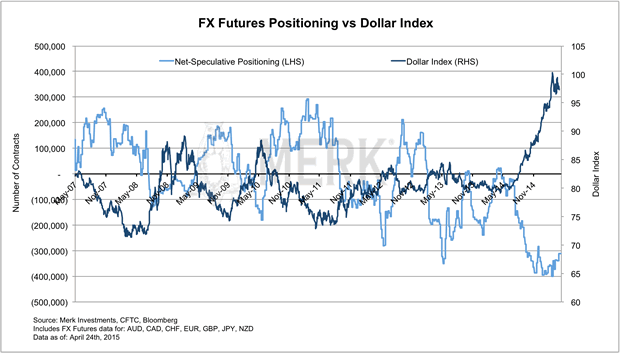

I'm not suggesting that policies haven't diverged in the U.S. and Eurozone, but I am suggesting that the market may have gotten way ahead of itself. Consider the following chart that adds up the number of speculative positions betting on the dollar rising based on CFTC data:

This chart shows that we reached extremes, with the market suggesting a meteoric rise of the U.S. economy while the Eurozone and the rest of the world crash and burn. In many ways, this is a symptom of the types of markets we have experienced with ever more people jumping on the same trade. In fact, in just about any market class, it appears that investing based on momentum has been one of the more profitable strategies. However, be warned: in our analysis, asset bubbles tend to be popped after too many people have piled into the same trade. In this context we think stocks, bonds and the dollar are all vulnerable.

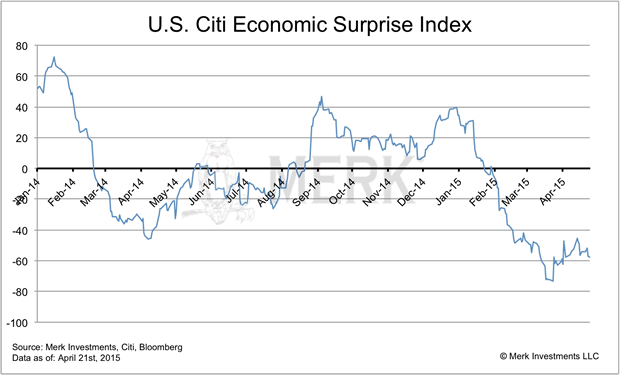

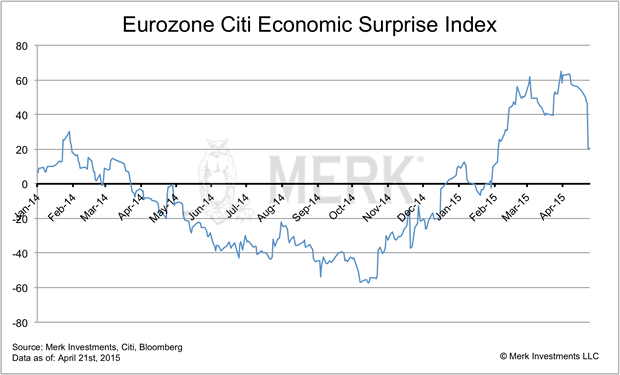

Let's look at what's happening underneath the surface. Consider the Citi Economic Surprise Indices for the U.S. and the Eurozone that are measures of how economic measures have come in versus what had been expected:

With regard to the U.S., this index suggests things might be developing worse than anticipated. Conversely, in the Eurozone, the economy may be developing better than anticipated, although that drop in the last data point is a reminder that one has to be cautious in interpreting too much into shorter term trends. Still, to us, it drives home the point that the market got way ahead of itself. As such, the sharp bounce in the euro off its lows can be explained by profit taking, a short squeeze, and a re-pricing of expectations. But is it a dead cat bounce for the euro, or is it a sign of other changes to come?

A messy world

Many say Europe is pretty messed up. That may well be, but isn't much of the world messed up? Even back in the U.S., don't we have our share of a "mess"? Furthermore, does anyone really believe Greece, or, for that matter, that China, Japan or the U.S. would jump over its own shadow and adopt a different culture? Our view is that changes will happen, but always in the respective cultural and political context. As such, to continue using the eloquent term: Europe has always been a mess and will likely continue to be a mess. And in the U.S., we are unlikely to address the sustainability of our entitlement obligations anytime soon. And Japan won't be able to find a way to move towards what we may deem sustainable deficits anytime soon, either.

In our assessment, the real question investors should ask themselves is: what is the relationship between a company, or currency, versus the market value/price. There are great businesses, but they might be overvalued; similarly, the greenback may have a few things going for it, but is what appears to be an ever-stronger dollar justified?

Looking at the Eurozone, Greece disappeared from the headlines for a few days. But as I write this, the IMF warns it will only give Greece more money if other creditors take a haircut on their sovereign debt. The argument being that as Greece has moved away from a credible path towards delivering primary surpluses, it may not be warranted to throw good money after bad. The creditors may now be faced with the unpleasant choice of agreeing to a voluntary haircut; or to let Greece go bust, upon which a haircut will be imposed on the creditors. Yet the euro's recent rally has - at least as of this writing - not been broken. In our assessment, there are two key dynamics playing out here:

- First, the euro is unfazed by what's happening in Greece because the threat of contagion due to a Greek default has diminished. That's because outside of Greece, Greece's creditors, to a large extent, are no longer financial institutions, but the ECB, the European Union and the IMF. As a result, a Greek default is a political problem, but no longer risks the toppling of large financial institutions. Any losses will be "socialized."

- The force acting against this is speculators that continue to have dramatic short positions in the euro. Those bears are unlikely to leave without a fight.

Note that I carefully wrote that the "threat of contagion due to a Greek default has diminished." As such, I consider a Greek default one of the better outcomes for the euro. At the other end of the spectrum would be significant debt forgiveness without anything in return. This "easy" path out would encourage other weak countries to follow suit and may cause havoc in the respective bond markets that, in turn, could make the euro the favorite place once again for investors to express their dismay. As such, it is important to continue monitoring how peripheral Eurozone debt trades for any spillover effects.

Commodities 101

While much attention has focused on the euro, commodity currencies, such as the Canadian Dollar, Australian Dollar and Norwegian Krone suffered rather substantially as the price of oil was plunging. Similarly, they've had a bit of a comeback since oil prices have rebounded. Just about anyone who has tried to forecast oil has been wrong over the past year, so I'm not going to throw out a price target. However, what we do know is that access to credit to smaller players (the fracking industry mostly has small players) has become far more challenging. Similarly, anyone with a high cost of doing business (this includes the oil sands) may continue to face significant challenges. We also know that storage bottleneck has not been fully resolved. As such, challenges remain.

Of the currencies mentioned, the Australian dollar may be least dependent on the price of oil; Australia's economy is very much dependent on copper and other hard commodities, notably exporting those to China. As such, the Aussie has often been considered a proxy for the health of China's economy. What we see when we look at the Aussie is a central bank that has been desperate to weaken its currency. In its most recent statement, the Reserve Bank of Australia (RBA) tried to talk down the Aussie yet again, writing: "Further depreciation seems both likely and necessary..." Yet the currency rallied on the RBA's decision to cut interest rates to 2% (yes, there's a central bank that's not at zero!).

Back to Reality?

If market prices are distorted, what will get them back? As just mentioned, the RBA has been keen on weakening its currency. But the RBA is not alone. The most egregious example may well be the Swedish Riksbank: next to the Norwegian Krone, the Swedish Krona was the worst performing major currency in 2014, the central bank says it's most concerned about currency appreciation versus the euro. It then says that it must drive rates to negative territory and engage in QE because inflation has come down too much. While other central banks have similar narratives, what's different in Sweden is that, according to the Riksbank's own press release from their most recent meeting:

- "GDP growth in Sweden is good and the labour market is continuing to improve."

- "The recovery in the euro area appears to be on firmer ground."

- "Inflation is rising from low levels."

- "Inflation expectations have increased"

And yet, they decide that more QE is going to be undertaken. On April 29, when the above press release was issued, the Swedish Krona surged over 2% versus the dollar (and almost 1% versus the euro). The reason? This much hogwash was too much: those "low" inflation numbers are based on headline inflation that includes energy prices. And while those have plunged, the year-over-year drops are going to phase out starting late summer. That is, the one excuse, low inflation, will be dropping by the wayside. As such, we believe the Swedish Riksbank, more so than many others whom might still have the excuse of a weak underlying economy, will have to do a U-turn on policy.

So where does that leave us? Later this summer, various central banks may have to start back-peddling on their ultra-loose policy as inflation is inching up yet again. At this stage, the ECB is shrugging off calls for a premature ending of QE; the reason is obvious: QE is less aimed at inflation, and more at inflation expectations. As such, if there wasn't an "absolute" commitment to printing money, the fear may be that inflation expectations plunge right back down. As such, expect mostly dovish talk, then a change of heart that might come rather suddenly. We haven't talked about the UK today, but Bank of England chief Carney is the master at turning on a dime, pardon, penny. Except that in the UK, economic headwinds are actually increasing; their economy, very much dependent on housing, is also vulnerable due to Russian sanctions as oligarchs are no longer gobbling up London real estate (London real estate was long considered a 'safe haven' for Russian money).

In the U.S., we might see our first rate hike later this year. But the question will be how much is priced in already and what will be the rate path?

In the context of major revisions that in our assessment may be necessary in much of the world - some to the upside (such as Sweden), some to the downside (such as the UK), it will create opportunities, but also threats. On the threat side, given that positioning in the markets continues to be extreme, two words of caution:

- First, the old adage that markets can stay irrational longer than investors can stay solvent still applies. Momentum based bubbles can take on a life of their own, as the tech bubbles in the 90s and housing bubble last decade showed. I would add to that the 35-year rise in bonds; and also what appears to be a relentless rise in stock prices currently.

- When the tide turns, don't think you can time it right. Don't count on a government bailout, either.

Investors may want to consider true diversification to be ready when the tide turns. But that's not so easy when lots of asset classes have been rising in tandem. Even in the currency space, where we so often praise the merits of diversification, be careful: some of the more successful currency strategies in recent months have been based on momentum. Should risk sentiment change violently in the markets, many of these strategies that appear to provide diversification on paper may all falter at once.

To continue this discussion, please register to join us for our "What's next for the dollar, gold & currencies?" webinar on Thursday, May 14. Next week, we will be providing out outlook for gold; if you haven't already done so, ensure you don't miss it by signing up to receive Merk Insights. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.