Bad News For China: Bernanke Says It’s Okay

Economics / China Economy May 27, 2015 - 04:19 PM GMTBy: John_Rubino

Former Fed chairman Ben Bernanke will be remembered by future generations as the guy who didn’t see a housing bubble while he was creating it.

That is, unless he says something even dumber, like this:

Bernanke: No risk of hard landing in China

(CNBC) – Former Federal Reserve Chairman Ben Bernanke said that China’s economic slowdown should not worry markets as there was no risk of a hard landing, and emphasized that a move to raise U.S. rates should be viewed as a positive sign for the world’s largest economy.Bernanke also said the economic slowdown in China is necessary as it needs to change its growth model to be more sustainable in the long term.

“China was growing 10 percent a year. And it was doing that through heavy capital investment, steel plants and so on. Very export oriented,” he said.

“As the country gets more rich and sophisticated that kind of growth is no longer successful.”

He added he was “optimistic” China’s economy would not experience a hard landing.

Annual economic growth in the world’s second-biggest economy slowed to a six-year low of 7 percent in the first quarter, prompting a range of stimulus measures from Beijing.

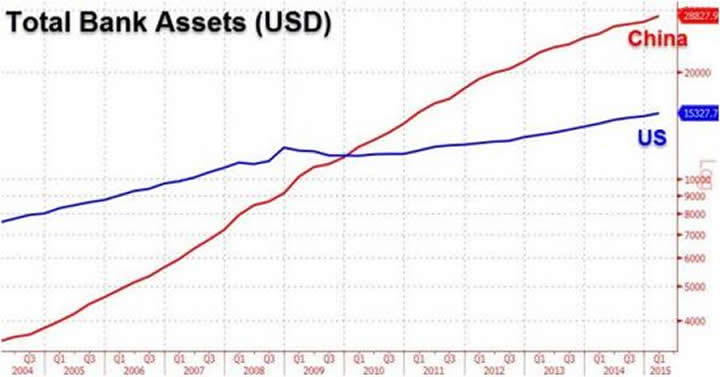

That these bland assertions are unencumbered by any actual data might be because the numbers are terrifying. Just yesterday Zero Hedge posted a long, must-read analysis of exactly how much debt China’s infrastructure/export capacity build-out required. Here’s one representative chart:

What this means is that the Chinese economic miracle of the past decade has been driven by a huge increase in borrowing, much of which went to projects — including entire “ghost cities” — that aren’t now generating much in the way of cash flow. In the absence of even more debt those projects will default, leading to…who knows what. China has never been through a major credit crisis so it’s not clear how its mostly brand-new and untested institutions will manage.

So to say “there’s no chance of a hard landing” implies an understanding of a situation that can’t be understood, since it has no historical precedent. In other words, it’s even dumber than dismissing the obviously-raging housing bubble in 2005, and therefore even more likely to be wrong.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.