Ongoing Battles In Markets And Gold

Commodities / Gold and Silver 2015 May 28, 2015 - 07:06 AM GMTBy: SecularInvestor

2015 has been an unusual year characterized by directionless markets. The U.S. stock market has barely moved since December / January, precious metals and copper are trading at the same prices as on the first days of the year, and we see a similar picture in most grains. Bonds in the U.S. are trading at the same level as half a year ago. Only a few soft commodities are significantly lower for the year.

2015 has been an unusual year characterized by directionless markets. The U.S. stock market has barely moved since December / January, precious metals and copper are trading at the same prices as on the first days of the year, and we see a similar picture in most grains. Bonds in the U.S. are trading at the same level as half a year ago. Only a few soft commodities are significantly lower for the year.

The most prominent “winners” so far in 2015 are the U.S. dollar and stocks in Europe, Japan and China. The inflationary effect of weakening currencies has driven most stock markets higher, except for those in the U.S.

We are witnessing serious conflicts (“battles”) in the markets. The monstrous rally in the U.S. dollar has created a deflationary trend, while global central banks are engaged in monetary inflation. Europe, Japan, and China have recently rolled out their version of “quantitative easing,” but real growth remains absent. As explained in our recent column, “This Financial Seismograph Signals A Monetary Earthquake” (also released on Zerohedge where it was read by more than 40,000 readers), global growth has returned to 2009 levels. The Baltic Dry Index, a global transportation index and indicator of global economic prosperity, has also collapsed to 2009 levels.

Moreover, the U.S. stock market shows a huge divergence: the transportation segment is truly suffering while the Dow Jones is at all-time highs. That hasn’t happened in the last 100 years. High readings in the stock market should result from a growing economy which is always associated with more transportation. Apparently those “classic” rules no longer apply in 2015.

The conflicts in the markets are intense. The credibility of the exceptional monetary policies from central bankers is clearly at stake.

Bullish and bearish forces in the gold market

The gold market is also in the midst of a strong battle, which is exactly what we told MarketWatch on Friday and were quoted. Secular Investor provides regular commentaries to large financial sites (find our quote in this MarketWatch article). Below we describe the bullish and bearish forces we currently see.

The price of gold has gone nowhere in the last two years and has created a 2-year basing pattern. That is constructive for gold prices as the stronger the base, the stronger the next trend. But a trendless market also indicates a battle between bullish and bearish forces.

The strong U.S. dollar has pressured precious metals since last summer. Also, the talk of interest rate hikes by the Fed is said to have negatively influenced gold. We have explained previously that we hold an alternate view on the relationship between interest rates and gold, as detailed in “What Is Really Driving Gold.” Our opinion is that the inverse relationship between interest rates and the price of gold is primarily a narrative, rather than a fundamental market dynamic, because rising rates are likely to mark a new rate cycle and a new economic cycle.

A standout feature this week, negatively impacting precious metals, is the latest COT report (Commitment of Traders), which reveals the positions of large traders in the gold and silver futures markets. This week’s COT report, for positions at the close of trade on Tuesday May 19th, shows a very strong accumulation of short positions by commercial traders, which indicates the capping power that can oppose this rally. It is no coincidence that gold’s recent rally was stopped this week. Do not expect a strong continuation of the rally in the very short term.

On the other hand, more gold-friendly factors include global monetary inflation and weakening currencies, which resulted in higher gold prices in those currencies. Moreover, we are seeing the first breakouts through long term declining trendlines in the precious metals complex. Charts can reveal extremely valuable information; the key is to identify the strongest trends on the charts, which is market trend analysis, in contrast to technical analysis.

From an intermarket perspective, gold appears to be preparing for a new trend. Our recent analysis shows that we should see new trends in the markets in the coming months, as featured on Financial Sense “Gold Is Nearing an Important Pivot Point in 7 Charts.”

The first half of 2015 was quite boring in most markets, but we expect a totally different picture in the second half of the year.

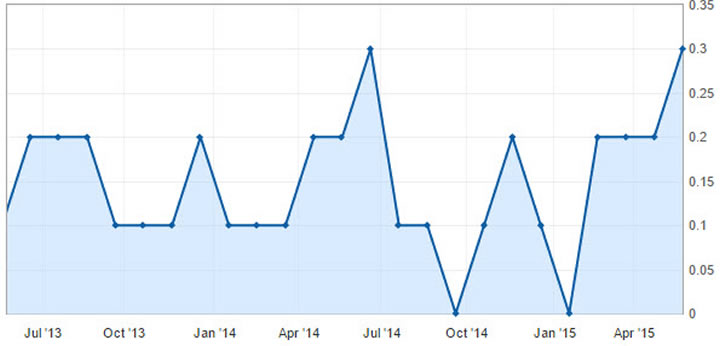

Gold could receive an assist from a very positive development this week. The CPI reading for April in the U.S. came in higher than expected. While the CPI stood at 0.0% in January of 2015, it increased to 0.2% in February and went up to 0.3 in April. That is the highest reading since the crash of the precious metals.

As explained before, gold performs best in an inflationary environment. Are the central banks getting what they wanted, i.e. a rise of the inflation rate to 2%? It could be a trend change, and in an environment where inflation is going up, interest rates can rise with an inflationary net effect. If that were to happen, it would mark the end of the ongoing narrative about interest rates and the price of gold.

The gold price indicator we rely upon is TIP; it has the strongest correlation with the price of gold. As explained before, this is a pressure cooker that will soon indicate a direction.

[quote from May 8th] ”Inflation expectations, the key driver for gold’s price in the last decade, has shown a divergence with the yellow metal for 1.5 year now. Inflation expectations are also nearing a breakout or breakdown point as seen on the chart (red line, red triangle). Note the divergence between gold and inflation expectations on the chart, which is not yet providing a clue about the future direction. The only observation on this chart is a rising level of inflation expectations.”

All signs point to the same conclusion: gold is about to start trending. Secular investors are not anticipating a move, but are preparing themselves for an upcoming trend. Our role is to help investors by offering a selection of the very best miners.

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.

Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

© 2015 Copyright Secular Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.