EXPOSED: The Biggest Threat to Your Retirement

Stock-Markets / Inflation Jun 07, 2015 - 12:18 PM GMTBy: Investment_U

Rachel Gearhart writes: This week, we are doing something different.

Rachel Gearhart writes: This week, we are doing something different.

We are analyzing two charts - one that exposes a huge threat to your retirement and another that shows how you can protect yourself.

First, the bad news...

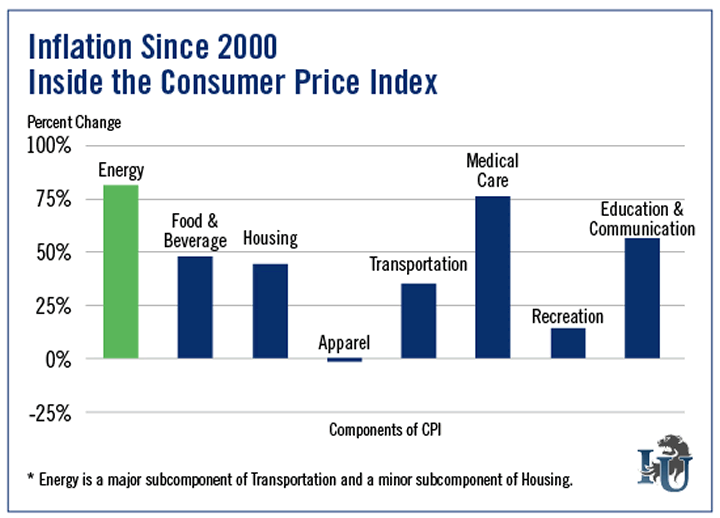

Since 2000, inflation has significantly increased prices in nearly every component of the consumer price index (CPI). The only exception is Apparel.

This hits people who rely on fixed income the hardest. As prices go up, there is no cost of living raise to offset them. And with retirees consuming 36% of total U.S. medical expenses, the 75.7% rise in Medical Care costs is especially concerning.

Of course, retirement age or not, inflation can also wreak havoc on your portfolio. The higher the inflation rate, the higher return you’ll need to maintain your standard of living. (For example, if you held an energy stock that returned 4% and inflation was 5%, your return on investment would be -1%.) That bring us to our second chart...

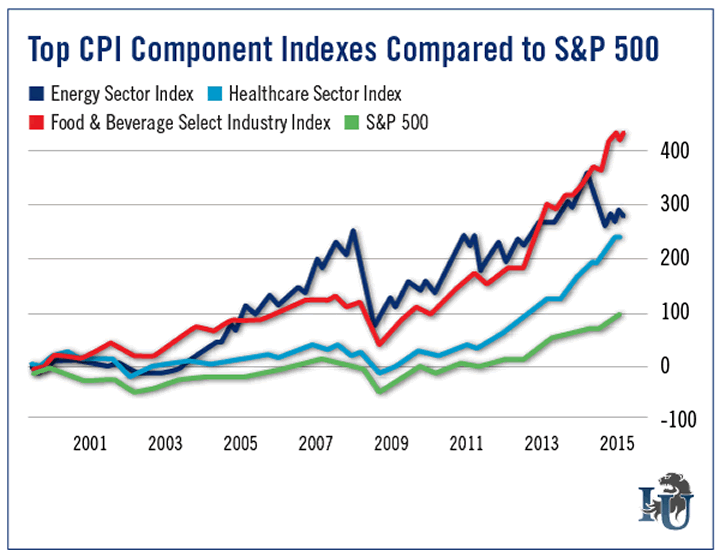

In it, we compare indexes for the three fastest-rising CPI components - Energy, Healthcare and Food & Beverage - to the broader market.

While food, healthcare and energy costs have risen more dramatically than other CPI components, these sectors have historically outperformed the S&P 500.

Since 2001, the Food & Beverage Select Industry Index (SPSIFB) has shot up more than 427 points. That’s more than four times the S&P.

Why?

It’s actually quite simple. A growing population... shortage of water... and rising demand for meat in emerging markets have steadily driven up food costs.

This is partly why The Oxford Club’s Emerging Trends Strategist Matthew Carr has recently advocated investing in the Food & Beverage industry. He’s particularly bullish on fast-casual restaurants like Chipotle Mexican Grill (NYSE: CMG).

While it may feel a bit backward, the charts speak for themselves. Investing in the sectors that are most susceptible to price increases is a great way to hedge against rising inflation.

Editorial Note: By now, you've no doubt heard about the massive data breach that just hit 4 million federal employees. According to officials at the U.S. Senate Intelligence Committee, last names... birth dates... and Social Security numberswere all compromised. This is just the latest in a string of foreign cyberattacks on the U.S. And the worst part is: Their frequency is increasing.

Fortunately for investors, crisis breeds opportunity. To find out which publicly traded companies are helping put an end to cyberterrorism - and making a fortune doing it - click here.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.