Gold Bashers – Just For You!

Commodities / Gold and Silver 2015 Jun 10, 2015 - 05:09 PM GMTBy: DeviantInvestor

There is no shortage of negative commentary on gold and silver. A quick google search will produce such headlines as:

There is no shortage of negative commentary on gold and silver. A quick google search will produce such headlines as:

“Gold is the Worst Investment in History”

“Gold – Bad Investment: 3 Reasons Why I Don’t Buy Bullion”

“Seven Reasons to Hate Gold as an Investment”

“Gold Was a Horrible Investment from 1500 to 1965”

“Gold Has Been a Bad Investment for Many Years”

“You Are About to Make a Bad Investment [Gold]”

“Why Investing in Silver is Usually a Bad Idea”

“Buying Silver the Stupidest Move I Ever Made”

The above are representative of the mindset that denigrates gold and silver as investments, insurance against devalued fiat currencies, and as a store of value.

From the above articles, the following are typical objections to gold:

You can’t eat it or buy groceries with it.

Gold pays no interest or dividends.

We mine it, refine it, and store it in a vault. This is pointless.

Gold is an unproductive asset.

Gold prices are volatile.

Gold has few uses except in jewelry.

It has no real, intrinsic value.

Gold does not keep pace with stocks in the long term.

Gold does well in inflationary times, but we are facing deflation.

Gold does well in deflationary times, but we are facing inflation.

You must store it at a substantial cost.

Gold has to be tested to prove its purity before sale.

Gold is heavy and inconvenient to store.

Gold is only valuable because people believe it is valuable.

Betting on gold is a bearish bet on human productivity and innovation.

There is some truth in the above objections to gold, but as usual, there is more to the story. I have rephrased and condensed the above objections into the following nine statements. Consider those objections in red and my commentary:

- Gold and silver are not money because we can’t purchase groceries, fuel, or other necessities with either gold or silver.We also can’t purchase groceries with hundreds of other paper currencies that are now worthless. Even if gold or silver are not the primary currency in use, they certainly can be converted into hundreds of currencies and used to purchase groceries. In short, gold “spends” everywhere.

- Gold is an unproductive asset. It does not produce income like an investment in a business. This is correct – it sits in a vault and becomes more valuable every year, on average, as fiat currencies are devalued, which has happened continuously for over 40 years.

- Gold pays no interest or dividends. Correct, but how much interest is your savings account paying in dollars, euros, yen, or pounds that are obviously worth less each year?

- Gold must be stored in a vault or safe at considerable expense.This is correct but the expense is small and probably far less than the average annual devaluation that fiat currencies have experienced in the past 40 years.

- Gold has no intrinsic value. It is only worth what someone else will pay for it. Many people would disagree and argue that gold has intrinsic value – it is stored monetary energy. What is the intrinsic value of an Enron stock certificate? The market will inform you that Enron stock is worth what another person will pay for it. In practice Enron stock has gone to zero while gold almost certainly will not.

- Gold has been a poor investment for much of history. Pick the time period that you want and that statement might be partially true. But the important question is do you think gold will be a poor investment in the upcoming decade where central banks and governments are “printing” currencies as never before?

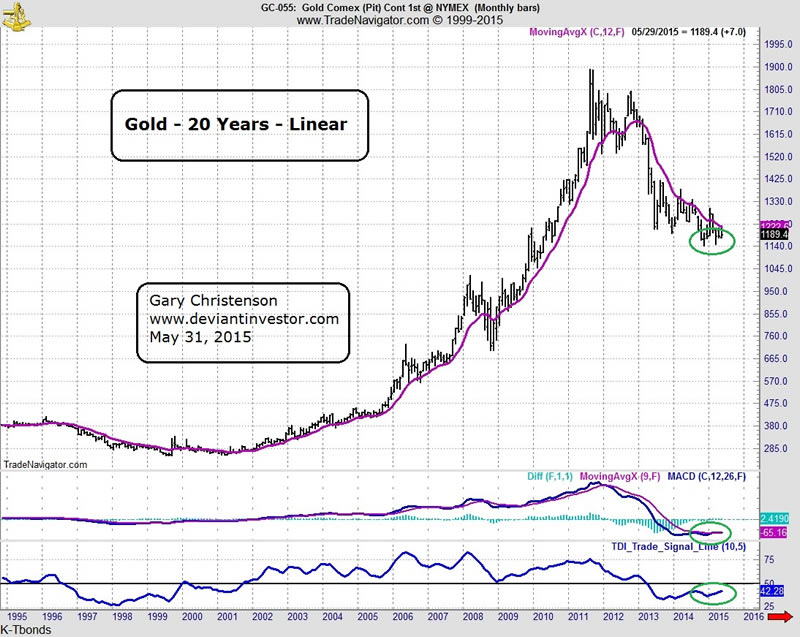

- Gold prices have not kept pace with stocks or bonds, on average, for centuries.Gold has done well since 1971 ($42 to $1,200). I think the decades before 1971 are much less relevant because prior to 1971 the dollar was partially backed by gold.

- Gold can be confiscated and therefore is a dangerous investment. Digital dollars and euros can be confiscated more easily.

- Gold is inconvenient to use in international transactions. Can you imagine shipping millions of ounces of gold to various trading partners, instead of instantly transferring digital assets? There are other ways to create an honest currency partially backed by gold that would function efficiently. I suspect the financial and political elite would strongly resist a system that restricted their ability to manipulate and strip-mine the financial system.

Not all objections and criticisms of gold are intellectually honest – they slant the narrative to support their bias in favor of the status quo, stocks, bonds, and central bank issued currencies, such as Federal Reserve Notes (dollars). The dishonesty is understandable since gold is often viewed as an anti-dollar and gold prices sometimes function as a check on the excessive debt creation and currency “printing” of central banks. Of course central banks and governments want no such restrictions on their creation of currencies so they downplay the importance and value of gold in the modern financial world.

Assuming you still believe that gold is a poor choice for whatever reason, ask yourself why:

- China has aggressively purchased massive quantities of gold (with devaluing dollars) during the past seven years and has allowed no exports of gold from China. Why is gold so important to the Chinese government and the Chinese people?

- Russia has aggressively purchased gold almost every month for many years. Why is gold so important to the Russian government?

- Central banks have purchased gold during the past four years. From the World Gold Council. “This was the 17th consecutive quarter that central banks have been net purchasers of gold as they continue to seek diversification from the U.S. dollar.” Why would central banks purchase gold (not the Fed) if gold were useless and merely a relic of the past? Why is gold so important to central banks, not including the Federal Reserve?

- If the PhD economists who run central banks were doing a competent job regulating, managing, and stabilizing global currencies, why is the financial world in such a mess, why are interest rates near or below zero, why were bank bail-outs required, why will bail-ins be needed, and what will happen when the bond, currency, and derivatives bubbles collapse?

Gold may be an unproductive asset but I think it is necessary insurance to protect assets from further devaluation of purchasing power and the inevitable crashes that are built into our fiat currency systems.

WHEN governments spend less than their revenues, when non-productive debt has been largely extinguished, when purchasing power is relatively stable, when bond yields regress to their historical means, and “printing money” is ancient history, then gold may not be a good place for your savings. Until then, you can trust your government, your central bankers, OR your gold.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.