Gold And Silver - Elite NWO Checkmate? US Lacks Direction

Commodities / Gold and Silver 2015 Jun 13, 2015 - 09:57 PM GMTBy: Michael_Noonan

We live in a dysfunctional world.

We live in a dysfunctional world.

The entire United States media, TV, radio, and print are massive purveyors of misinformation and lies. The truth is not allowed to exist, which is incredibly ironic, for when the public is told the truth, it is not believed for the truth does not reconcile with all of the media-fed lies. Truth is non-existent in politics where lies are protected by the Supreme Court, [if you did not already read it, see Barack Obama - Liar In Chief, Backed By Supreme Court].

Ever since the Constitutional United States of American was taken over by the de facto corporate federal government, aka THE UNITED STATES, spelled in all capitalized letters to denote its status as a corporation, the elites have been in charge of all politicians, and in a news flash for the vast uninformed public, that includes the president. We drop these occasional gems on the uninformed without providing in-depth explanations because they have been a waste of time on a public adamant in their desire to remain politically challenged.

A corporation is a fiction. It is created by state governments, and as just mentioned, all corporations are spelled in all capitalized letters. Have you ever noticed how your driver's license has your named spelled in all capitalized letters? Voter registration? Birth/death/ marriage certificate? Because all governments are corporate fictions, they can only deal with other corporate fictions. Whether you know it or not, believe it or not, as far as any and all government are concerned, you are a corporate fiction, not human. You lose that form when dealing with government on any level.

We digress.

The corporate government is answerable to the moneychangers, the banking elites who own and run this country, the UK, EU, Canada, Australia, et al. Voting is an illusion for the masses who believe otherwise. Who is really in charge? A relatively small number of faceless people who own and are behind the entire world banking system.

Obama forced his Obamacare through against widespread public rejection. It is nothing more than giving the medical industry, Big Pharma, total control over the healthcare system and total control over what you will be charged, and one of the largest increases in family expenses over the past year or more has been the skyrocketing costs of healthcare, coupled with a commensurate decline in actual health care by doctors/hospitals. Do you still think Obama had the US public in mind? His sole purpose is to serve corporate interests.

On a smaller scale, last week, Texas police shut down a lemonade stand run by two sisters, ages 7 and 8. They wanted to earn some money to buy their dad a father's day gift. They did not have a license permit to sell lemonade.

The Obama Department Of Justice has been unable to find any wrongdoing in all the Too Big To Fail Banks since he has been in office, despite all the massive mortgage fraud, the displacement of countless millions of homeowners that resulted, but two kids got nailed for not having a permit to sell lemonade.

How about the 11 year-old boy whose parents were delayed getting home? He did not have a house key, so he played basketball in his back yard for about 90 minutes. Some neighbor called the police. When the parents arrived, they were arrested, strip-searched, and finger printed, spending a night in jail for child neglect. It was almost a month before the boy and his 4 year-old bother were reunited with their parents. Both kids were taken by Child Protection Services.

How about that neighbor? Why not go over and ask the child if he were okay, or invite the child to stay at the neighbor's house until the parents arrived? Nope. The idiot called the police and created havoc for this family that is still on-going. This is life in America.

No one, or very few have any direction. Politicians are directed by money-interests, fed by the elites.

On a global scale, the IMF, Germany, EU are playing Greece in order to strip that already impoverished country of as much of its remaining assets as possible. It is our mistake to call this Kabuki theater. It is simply the theater of the absurd.

Germany's Machiavellian position to publicly huff and puff over Greece's unwillingness to repay debts and engage in yet more austerity, over the past several months, has helped to keep the Euro dollar low, thereby making its exports cheaper. With the recent announcement of Deutsche Bank's leaders resigning, like rats deserting a sinking ship, their escape may be tied to the "Grexit" situation.

Deutsche Bank has over $75 trillion in derivatives exposure, which is 20 times larger than the German GDP. All banks are unofficially bankrupt with their Ponzi fiat schemes and run amok financial wheeling and dealing, especially in off-balance sheet derivatives that have no hope of ever being resolved.

If it takes a Greek default to force Deutsche Bank into public insolvency, "Go Greece!"

Push those bankers into bankruptcy. Start the domino-effect of bringing down the bankers like a house of cards. May they all rot in hell for the damage they have wrought on the rest of the world. None of them cared about the path of destruction being left behind, as long as they got their bonuses and added wealth in the process.

People should also stop blaming the Greeks as freeloaders, unwilling to pay their debts. The "money," actually digitalized "currency" created out of thin air by the IMF, never existed until it was "loaned" to Greece. Greece received Ponzi fiat and has to pay back actual real [still Ponzi fiat] money, with interest, to elite's IMF that created the fiat as a bookkeeping sleight of hand. The EU, IMF, and Germany all knew Greece would never be able to pay back what was "loaned." The whole thing was a charade to enslave Greece, and not only Greece. Think PIIGS.

Always, always follow the "money." The entire Western banking system, from the BIS, IMF, and every other member central bank is the NWO master plan to enslave the world under a single digital currency. Cash will disappear. Everyone's financial records will be known by the banking elite. This is Big Brother squared by a factor of 100, 1,000, pick a number, it does not matter.

The plan is to make the overtly aggressive and war-minded corporate US, and by extension the lap dog EU, ultimately the major problem creator, a task already accomplished, while China, Russia, with all of their financial dealings, plus their acquisition of vast amounts of gold and silver, establishing the Asian Axis, Silk Road, AIIB, BRICS and its Development Bank, etc, appear to be the new takeover winners. All of this is being orchestrated by the elites through the BIS, IMF to complete the takedown of the fiat US "dollar" to be replaced by a new monetary system, maybe Special Drawing Rights [SDRs]? Who knows? One thing is certain: it will lead to the establishment of a One World Currency.

Check mate, by the NWO.

As of today, there is a small wrinkle in the NWO progress of their head pimp, Barack Obama, for passing the Trans Pacific Partnership [TPP], Transatlantic trade & Investment Partnership [TTIP], and Trade In Services Agreement [TISA], just got derailed and the Obama full court press to pass his agenda on a "fast track" basis, meaning no one could know what the contents of the deals included, was slam-dunked against him.

The TPP does not include China or Russia. How can there be a "Pacific Partnership" without the two largest economies? The TTIP is purportedly a "free trade" deal with the crumbling de facto EU. The Obama administration is ever so clever in its diplomatic idiocy to try to pass these deals without public knowledge/consent because if the details were known he would be impeached for his attempted treason against this country. As a purported constitutional lawyer, Obama has to know that each of his proposed trade deals would give corporations the right to sue any individual, federal state, county and/or municipality for loss of potential income if that corporation were prevented from conducting its unwanted business. This completely violates Article III of the Constitution.

This is the dysfunctional world created by the international bankers who control everything, money, governments, media, all major corporations, and the mess keeps getting messier and decidedly worse.

If you do not own gold and/or silver, the above are some of the best reasons for pulling a China or Russia and buying as much as you can reasonably handle. When the Western world unravels economically, and it is in the process, already, one of your only means for financial viability will be having gold or silver to sustain you as others see their paper fiat and other "paper assets" become worthless.

If you do not think that is the direction in which this world is headed, watch programs like CNBC or Bloomberg News. They tell you what you want to hear about how wonderfully well the UNITED STATES is prospering.

Buy silver. Buy gold. It may take longer than you think before the SHTF scenario comes into full bloom. You have a choice. Put your faith in worthless fiat and other worthless paper assets, or put your faith and future into hard assets that have a proven history of wealth preservation.

Governments and all politicians lie, the media lies, charts do not. Why not? Charts are comprised of all the trading activity that develops each day. They accurately chronicle all buying/selling activity and nothing more. In that regard, charts are neutral, simply depicting the net results of all active participants.

It is important to understand that if a chart causes an emotional reaction: disappointment, fear, elation, unmet expectations, none of these emotions come from the charts but come, instead, from you as the observer adding your own interpretation/reaction. We do our best to present the observable facts, some of which may lead to potential conclusions, but at no time are charts used to predict the future, ever the unknown.

The fiat Federal Reserve Note, known to the world as the "dollar," being more and more shunned by the more reality-driven, pragmatic Eastern world, is still in survival mode and will remain so until the elite's BIS/IMF system is ready to fully let that fiat lose all credibility.

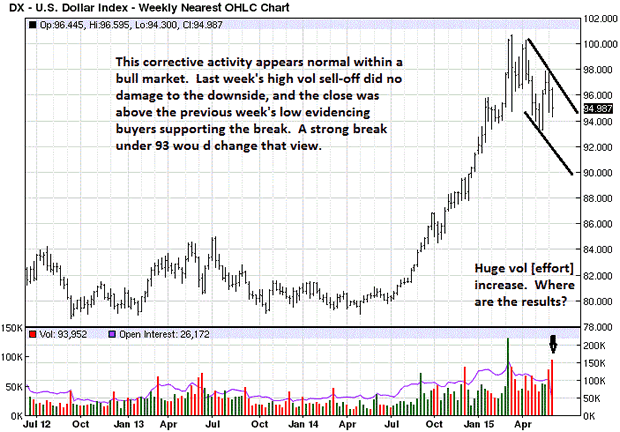

As an example of dealing with facts, note the sharp increase in volume, last bar, see arrow. Volume represents the effort between buyers and sellers. When a volume bar is red, it means price closed lower that the previous close, typically denoting sellers won the battle.

When the volume bar is green, price closed higher from the previous close, credit given to buyers for prevailing in that time period.

Last week was the highest down volume for the past few years. That is an observable fact upon which all can agree. However, note the impact of that volume [effort], on last week's bar. The range was smaller than the week before, and the close was above the prior week's low.

Armed with these facts, ask yourself, if last week was the highest volume for a down week, what was the payoff for the sellers? We do not really see one, for the reasons just cited. If all of that effort produced little in the way of results, what does that say about the selling activity? Their effort is being absorbed by the stronger buyers. Here it is important to remember the trend, which is up, because the trend tends to perpetuate until it changes.

Selling efforts tend to lose potency in an uptrend. This is the logical conclusion that can be drawn from the neutral information generated by developing market activity captured in chart form. Based on this read, it makes sense to say that the trend remains in effect, and for as long as it does, price will trend higher.

The chart cannot "predict" how the market will unfold higher, just that the probability of price going higher is greater than otherwise. How to take advantage of this information is the art form of reading/interpreting a chart. That is an entirely different issue.

USDollar Index Weekly Chart

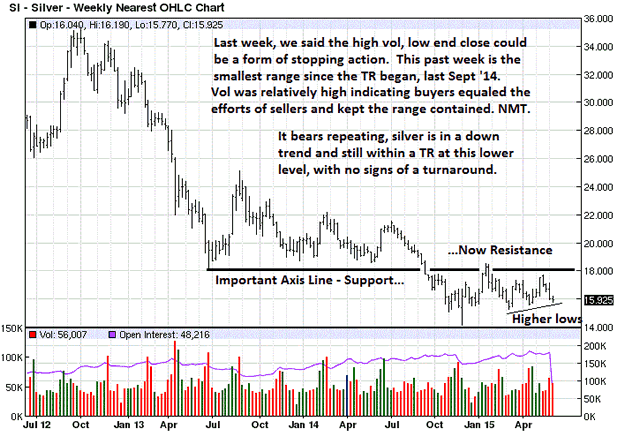

The dark horizontal line is called an Axis Line because price is respecting it over a protracted period of time, initially as support, now as resistance. It would not be unreasonable to say that until silver can regain above 18, it will remain in a down trend.

Of particular interest is the fact of how small last week's range was, the smallest bar since last September. Here again there is logic in the market. The range was small because sellers were unable to extend price lower, and that is true because buyers were meeting the efforts of sellers in what was a stand-off. If sellers could not move price lower, then that opens the door for buyers to rally the market next week?

Will that happen? No one knows, but the odds are more favorable for that event to occur, but that does not mean sellers cannot step up and push price lower immediately, next week. This is why charts are not predictive in nature because anything can happen. All one can do is gauge the probability of one event happening more than another.

Note where the small up slanting line to show where higher lows starts. The swing low in March was also a small range bar where the same conclusion was drawn: buyers stopped sellers from extending price lower, and that opened the door for a rally. The odds favor a similar event for next week, but not one that is guaranteed.

If you note last week's volume was still relatively high, it means sellers were making an effort, but buyers were overwhelming that effort, stopping sellers cold, at least for last week. Odds favor a rally, but one need not develop because sellers may come back in greater force and take back control. Anything can happen. It is a probabilities game.

Silver Weekly Chart

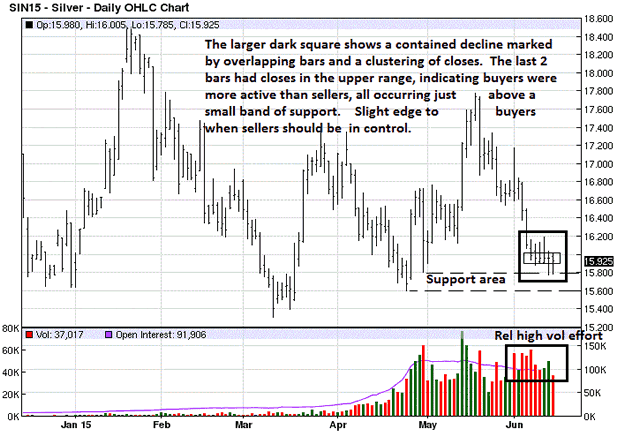

We see the daily chart amplifying the odds for a rally next week. The first seven TDs [Trading Days] in June had the highest volume, the greatest selling effort, all but one of the TDs were red. Typically, smart money [controlling interests], sells highs where you would expect to see selling volume greater. When volume is noticeably higher at a swing low, it would be smart money doing the buying and the public selling their longs at lower prices before they [may or may not] go lower.

That increased selling effort stopped at previous support. Note the smaller rectangular bar inside the square box. There is a clustering of closes, in addition to the overlapping of bars. Experience tells us overlapping bars means balance between buyers and sellers, and from balance comes unbalance. The clustering of closes is another form of balance, a resting of price before resuming the trend preceding it or reversing direction.

The last two bars show high end closes. Closes in the upper part of a bar tells you that buyers were more dominant in that time period. If we connect these pieces of factual observations, higher volume at support, overlapping bars, a clustering of closes, upper range closes for the last two bars, the odds are more favorable for buyers over sellers.

It is a logical conclusion based solely on developing market activity.

We used it to take a small position from the long side recognizing a limited downside risk by using a protective sell stop [never trade without stops], and an unknown potential for a rally to the upside, a favorable risk/reward situation within a down trend.

Silver Daily Chart

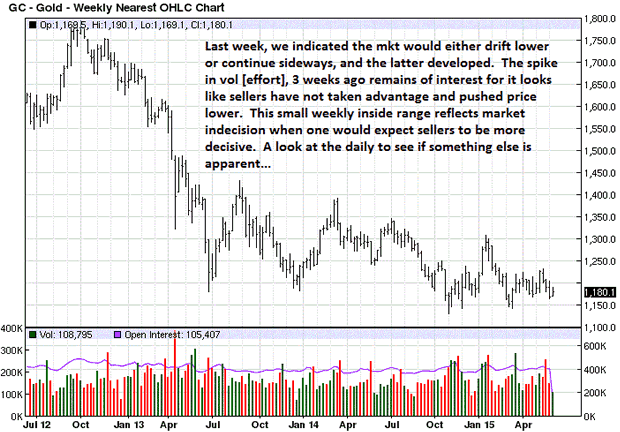

Gold is slightly different, but not by much. The weekly close, two bars ago, on declining volume told us sellers were not as active as price moved lower. That opens the door for buyers to attempt to rally price higher.

In this instance, price is in a TR. Back in December 2013, there was a similar set up, but price had been in a steady decline moving into that swing low. Nothing is ever the same because the participants are totally different so price will develop differently. We just cannot know how, nor do we need to know. A trade based on favorable probability odds either works or it does not. It is that simple. Over a large enough sample of favorable trading odds, the net result will be profitable. That is the Law of Probability.

Gold Weekly Chart

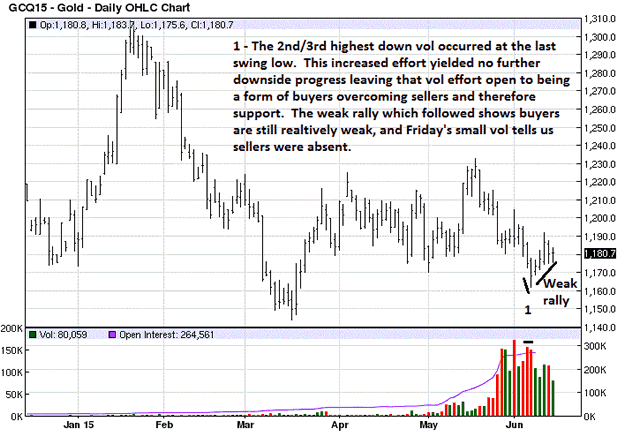

The biggest tell for us on the daily chart are the two high volume days at 1. That they occurred at the swing low, in a zone of support, is more indicative of buyers more active than sellers. The rally, last week, was weak, but that speaks to not being able to predict how a market will develop going into the future.

For disclosure, we also took a long position in paper gold, based on everything covered.

Time will tell. If it does not work, another trade potential will come along.

Gold Daily Chart

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.