Banksters Responsible for Irish Crash

Politics / Banksters Jun 23, 2015 - 08:48 AM GMTBy: Antonius_Aquinas

In testimony before the Oireachtas Banking Inquiry, Thomas O’Connell, the ex-head economist of Ireland’s central bank, attempted to deflect blame for the part he played in the financial crisis of 2008 and the subsequent bust that occurred.

In testimony before the Oireachtas Banking Inquiry, Thomas O’Connell, the ex-head economist of Ireland’s central bank, attempted to deflect blame for the part he played in the financial crisis of 2008 and the subsequent bust that occurred.

O’Connell had the nerve to say that “[It] should never have been allowed to happen with all the consequences of huge increases in unemployment, rising emigration, enormous debt, suicides . . . that we have seen.”* No kidding, Sherlock!

O’Connell believes that the financial crisis occurred not because of the policies of the central bank per se, but because it was the failure of the government and “regulators” to curb the excesses and bubbles that were forming mostly in the real estate sector, “any concerns or issues raised by staff for airing in the public arena were invariably watered down so as not to reflect adversely on matter of concern to Government.” He added that it was “difficult to get views through that might impinge on vested interests.”

Naturally, since O’Connell was a paid employee of the central bank, he would want to divert attention or critiques of its role in the calamity. O’Connell wisely (for his sake) focused on periphery issues, but failed to discuss the actual genesis of the crisis which rests in the explosive expansion of the money supply generated by the European Central Bank (ECB). The “new” money and credit was then facilitated by the Irish central bank and funneled through the country’s banking system that ignited the boom.

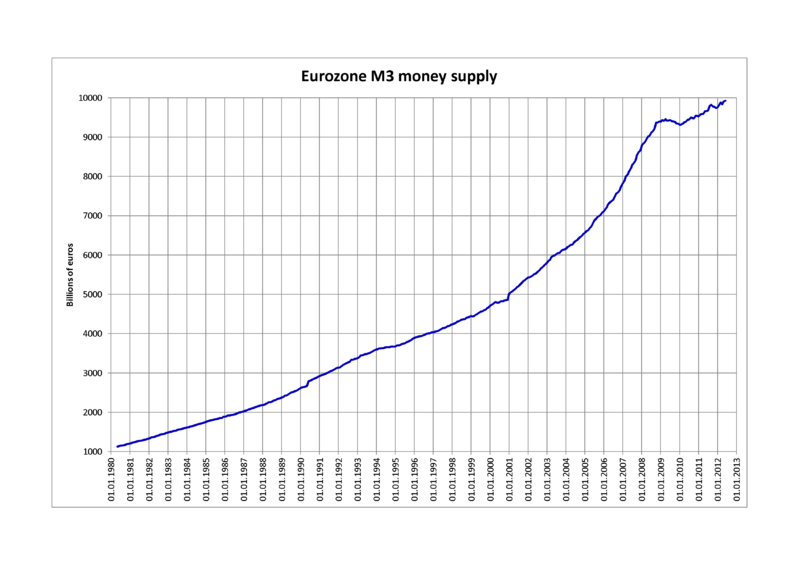

The graph below shows the dramatic growth in the money supply during the boom period. Unfortunately, Ireland adopted the Euro in 1999, but it did not begin to circulate internally until 2002.

From 2002 to the onset of the financial panic, the money supply almost doubled from €5 ½ trillion to nearly €10 trillion. The new “liquidity” drove up asset prices and inflated real estate markets, especially in Spain and Ireland. Despite this fact, O’Connell remained silent on the ECB’s reckless monetary policy in his address.

When asked about how the crisis could have been avoided, O’Connell suggested (apparently with a straight face) that there were too few economists employed by the regulatory agencies and the government and that those that were on staff were largely ignored: “This would have been less of an issue if there was a willingness to listen to the view of economists. In addition, the Financial Regulator employed very few economists.”

Yeah, right, that is definitely what Ireland needed – more economists such as the likes of O’Connell who are nothing but apologists and spinmeisters for the global financial elite who enable them to continue their endless rounds of money printing for their own enrichment and power to the detriment of the poor and middle classes!

Instead of more economists as O’Connell ridiculously recommends, the financial crisis could have been avoided, or more accurately would have never taken place, had Ireland and the rest of Europe followed sound economic theory long spoken of and taught by real economists, and ignored monetary cranks like O’Connell, Benjamin Bernanke, Mario Draghi and Janet Yellen. The financial crisis of 2008, and the far greater one to come, would never have occurred if Ireland was devoid of the plague of central banking, and money was once again a commodity.

If Ireland ever wants to get out of the financial quagmire it now finds itself in, it must stop listening to or give any credence to the very people that are responsible for the creation of the mess in the first place. Instead of recognition, the likes of Thomas O’Connell should be ignored, ridiculed, or, better yet, prosecuted for the incalculable economic and social damage that he and his fellow banksters have perpetrated.

Before economic recovery can occur, there must first take place intellectual change and the acceptance of policies and institutions that have stood the test of time. Gold and silver have been monies for some five thousand years, their re-adoption as the medium of exchange in Ireland will go a long way in the Emerald Isle’s economic and social restoration.

*Claran Hancock, “Banking and Economic Crash ‘Should not Have Happened.'” The Irish Times. 10 June 2015.

By Antonius Aquinas

© 2015 Copyright Antonius Aquinas - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.