The Great Greek Economic Depression

Economics / Great Depression 2010's Jul 04, 2015 - 09:04 PM GMTBy: Investment_U

Sean Brodrick writes: Did you know there’s a Great Depression taking place? Not here in the United States, but in Greece.

Sean Brodrick writes: Did you know there’s a Great Depression taking place? Not here in the United States, but in Greece.

The cradle of Western democracy has tumbled hard in the past six years, and it looks like it has a lot more pain to bear.

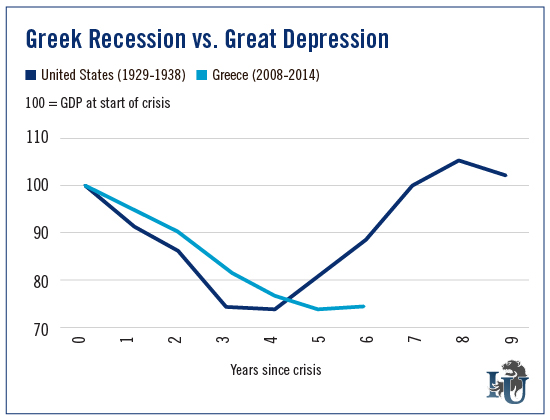

Why is Greece in a Great Depression? Take a look at this chart comparing gross domestic product in Greece now with the “gold standard” of Great Depressions, the U.S. back in the 1930s.

Here are some hard numbers...

- Greece’s economy has shrunk by a staggering 25% in five years.

- Unemployment is above 25% (and 50% among young people).

- The country’s debt-to-GDP ratio has jumped from 120% to 180%.

- Suicide rates are skyrocketing, up 35% in less than two years.

So yeah, Greece is in a Great Depression. How did they get in this mess anyway? That’s a long story – one I cover in great detail in my latest report (click here for details on that) – but here’s the short version...

The Making of a Crisis

The current crisis is rooted in the bungled handling of Greece’s previous debt default crisis.

The country was unable to pay back the money it owed European private banks. But if Greece defaulted, other European governments would have to bail out their own banks. So instead, they gave Greece huge loans so it could keep paying the foreign banks.

The end result? The can was kicked five years down the road... to today. Now Greece owes even more money than it did before – this time to foreign governments.

Greece and the rest of Europe are at loggerheads over what to do about the debt. Greece wants debt forgiveness. Europe wants to be paid back. And in the meantime, burdened by debt, Greece’s economy has slumped into ruin.

But here’s an important difference between Greece now and the U.S. back in the ‘30s...

The U.S. economy bounced back once FDR devalued the dollar and opened up the throttle on spending.

Greece is saddled with the euro – at least for now. So that means it can’t devalue its way out of this mess. It’s also under the thumb of "the Troika" – the European Commission, the European Central Bank and the International Monetary Fund. Their solution, led by Germany’s bankers, is to impose tighter austerity on Greece. So there won’t be more spending, either.

Greek GDP is 2.5% of Europe’s total GDP. So if Greece’s economy contracts another 25%, that would be just 25% of 2.5% for the rest of Europe. The Germans, fixated on austerity, are willing to take that risk... and make the Greeks bear the brunt of the pain.

Is there any end in sight? The European Commission projects that Greece’s economy will remain below its pre-crisis peak through the end of 2016.

At that pace, it could take till 2022 for Greece to fully recover. And if those numbers hold up, Greece is only halfway through its Great Depression.

But there is hope for the Greeks. And opportunity for global investors...

Turn a Greek Tragedy Into a Profit Boom

Greece is holding a referendum on July 5. If the Greek people can do the hard thing and leave the euro, then they can issue their own currency (a possibility I covered here back in May). This will devalue automatically. So, Greece can become a dirt-cheap tourist destination.

What’s more, its manufacturing will be able to compete with the vastly more efficient factories in Europe, France and other parts of Europe.

But, like I said, this would be a very hard thing for Greeks to do. They’d be voting to stop paying themselves in euros and instead get paid in some cheap knock-off currency. It may not be realistic to expect them to do that.

On the bright side...

Even if things go from bad to worse in Greece, it’s still just 2.5% of Europe’s total GDP. The market is pricing in Armageddon on a pita roll. In other words, the recent sell-off is overdone.

There’s a lot more to it than that, but bottom line: This isn’t the end of the world – even if the market is acting like it is.

I certainly wish the best for the Greek people. I hope they find their way out of this mess. But no matter what happens, I know there are opportunities for savvy investors. They just need the courage to reach out and grab ‘em!

Good investing,

Sean

Editorial Note: The people of Greece are lining up by the hundreds to withdraw their hard-earned cash from ATMs... only to be faced with a 60 euro limit. Even worse, many are having to walk away from out-of-service ATMs empty-handed. Think it couldn’t happen here? Think again...

Our friend Bill Bonner, founder of The Oxford Club, has uncovered disturbing details about a critical problem that our government has quietly spent $4.5 trillion to resolve (so far to no avail). To get the full details on what Bill calls the Great American Credit Collapse, click here.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.