China Crash, Can You Imagine The Fed Raising Rates In This World?

Interest-Rates / US Interest Rates Jul 08, 2015 - 11:34 AM GMTBy: John_Rubino

$1.4 trillion of Chinese stocks have stopped trading. Greece is finally imploding. The US trade deficit is widening on falling exports.Copper just fell back to 2009 levels. And safe-haven capital flows are revving up again, with Swiss 10-year bonds once again trading with negative yields.

$1.4 trillion of Chinese stocks have stopped trading. Greece is finally imploding. The US trade deficit is widening on falling exports.Copper just fell back to 2009 levels. And safe-haven capital flows are revving up again, with Swiss 10-year bonds once again trading with negative yields.

Yet somehow a majority of economists and money managers continue to believe that not only will the fed hike rates at its next meeting, but that it should do so.

The IMF isn’t normally the voice of reason on major financial issues, but in this case — perhaps because it has its hands full with Europe — its caution seems appropriate:

IMF Reiterates Call for Fed to Hold Off on Rate Rise Until 2016

WASHINGTON—The Federal Reserve risks stalling the U.S. economy by raising interest rates too early, the International Monetary Fund warned Tuesday as it detailed further its call for the central bank to delay a move until 2016.The IMF’s push for a delayed rate increase is at odds with the current signals Fed officials are sending for a move later in 2015. Last week’s job numbers bolstered the Fed’s plans to increase short-term rates in the months ahead.

The IMF, which cut its growth forecast for the U.S. last month, said the Fed could be forced to reverse course next year if the central bank proves overly optimistic about the health of the American economy. IMF staff argue that, barring upside surprises, there is still too much uncertainty around inflation, employment and wage prospects for the Fed to pull the trigger in coming months.

“Raising rates too early could trigger a greater-than-expected tightening of financial conditions due to some combination of a further upward swing in the U.S. dollar, lower equity prices, and/or a repricing of risk premia and the yield curve,” the IMF said in its detailed annual analysis of the U.S. economy.

“There is a risk that the tightening impact on the economy could go well beyond the initial [0.25 percentage point] increase in the fed-funds rate, creating a risk that the economy stalls,” fund staff said.

A policy U-turn wouldn’t be without precedent. Both the European Central Bank and Sweden’s Riksbank were forced into rate reversals in 2011, and the Bank of Japan seesawed through rate moves in the 1990s and 2000, fund economists noted.

Such an about-face puts the Fed’s all-important credibility at stake, the IMF said.

The emergency lender also said the crises in Greece and Ukraine represent “unpredictable wild card” risks to the U.S. economy. So far, the impact in U.S. markets from the Greek crisis has been limited. The country has little direct exposure. But if it deteriorates further, it could hit broader European growth, which could weigh on the U.S. recovery.

Weaker global growth or a faster slowdown in China could also hit the U.S., sparking a selloff in equity markets, the IMF said.

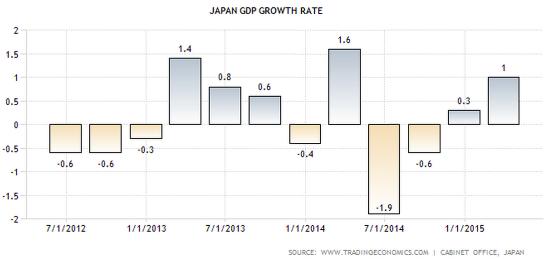

“Weaker global growth” indeed. The next two charts show GDP growth for Japan and Germany. Note that they’re both positive (barely) but are also lower than the previous year. So momentum was already slowing before Greece blew up and China’s stock bubble burst.

For the world’s biggest economy to respond to the above with steps to slow down its growth would be at best ill-mannered and at worst the kind of slap in the face that sets off global contagions. So yeah, it’s kind of hard to imagine.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.