Leveraged Chinese Stock Investors Learning Painful Lesson

Stock-Markets / China Stocks Jul 08, 2015 - 12:54 PM GMTBy: GoldCore

- Shanghai Composite has lost over 32% of its value in less than month

- Shanghai Composite has lost over 32% of its value in less than month

- Investors selling on “panic sentiment”

- Persistent intervention by government agencies has failed to support market

- Market has doubled over past year while real economy struggles

- Chinese Market had been boosted by participation of market-illiterate savers

- May morph into wider crisis

China’s stock markets continued their decline overnight with the Shanghai SE Composite falling another 4.64% and down of 32% since June 12. Markets have begun seizing up as sellers overwhelm the system.

The Chinese regulator, the China Securities Regulatory Commission, has described market participants as being “irrationally” driven by “panic sentiment” despite there having been no rational basis for the run up in Chinese markets before they peaked last month.

Indeed, in these past two weeks the government itself has taken a series of panic measures to prop up the system but, thus far, to no avail. These measure include cuts in reserve requirements, and a rate cut to boost lending for the purpose of further speculation, easing regulations on margin financing, reduction on transaction fees and providing liquidity to brokerage firms to prop up shares. Which is more or less what western agencies have done to prop up their markets. They have even directed state companies to not sell public companies stock that they might own.

The Shanghai Composite had surged to 5,166 on June 12 from just over 2,000 a year previously. In the same period China’s official GDP growth rate has declined from 1.9% to 1.3%. Commodity prices have been languishing as the economy of the world’s largest importer of raw materials has slowed down.

The past year has seen an influx of unsophisticated and inexperienced investors pouring into the market with the active encouragement of the Chinese government. Many are trading on leverage – borrowed cash – and few have the the capacity to weather margin calls as their positions nosedive.

The internet abounds with anecdotes from China reminiscent of those stories told about the atmosphere in the run up to the 1929 Wall Street crash where shoe-shine boys were giving investment advice to their customers.

The failure of the government to successfully intervene may have profound psychological consequences across the nation. China’s gargantuan property bubble, propped up by confidence in the power of the state, is yet to burst. The effect on China’s banking system of the evaporation of all this borrowed cash remains to be seen.

“Only when the tide goes out do you discover who’s been swimming naked” – Buffett

Some analysts view the crisis brewing in China to be of more significance globally than the on-going Greek crisis.

Why, well because contagion is now a real risk. You have far more connections with the Chinese economy then you do with the Greek one. For Europeans, Greece is in our currency boat and they are causing it to sink. The Chinese though own a big part of our boat and what we have in it, so a crisis in China very quickly becomes a big problem here.

Chinese consumer demand is becoming increasingly important to the global economy. As 1.5 billion people move up the food chain to the middle class they become a driver for global economic growth far into the future. Should the average Chinese household balance sheet take a bath in this market sell off it will have a significant effect on consumer sentiment and thus Global GDP growth.

Furthermore, this could be just the beginning. The Chinese government has not really been tested. They have enjoyed a massive year on year growth for over a decade. How will they manage a sharp downturn in their economy, discontentment on the streets, a perception that they may not have the skills to manage the crisis? How will they react to popular protests? Time will tell, but this crisis may be their greatest test yet and without an institutional memory of crisis management to rely on they will have to find their way through.

We believe that China stock crash is symptom of dangerous debt dynamics sweeping the world. The western markets are equally positioned. Investors should consider diversification strategies if they haven’t already done so. Call our office today to discuss.

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,154.25, EUR 1,045.61 and GBP 749.46 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,166.25, EUR 1,063.22 and GBP 752.10 per ounce.

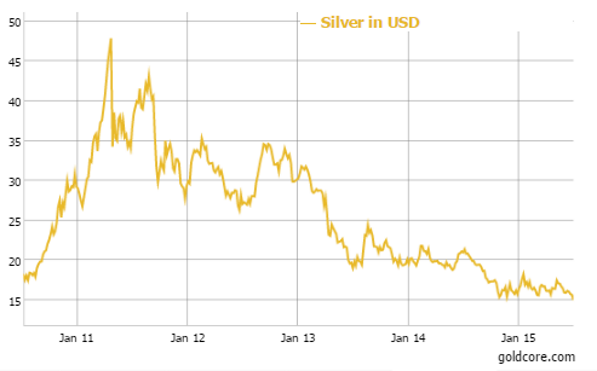

Silver in USD – 5 Year

Gold fell $13.10 or 1.12 percent yesterday to $1,155.80 an ounce. Silver slid $0.59 or 3.76 percent to $15.10 an ounce.

Gold in Singapore for immediate delivery inched down 0.6 percent to $1,147.75 an ounce near the end of the day.

As Europe called an emergency summit on Greece, the dollar rallied and gold dipped to a four month low. Silver slipped almost 7 percent and platinum fell to a 2009 low.

For the second time in the past year the U.S. Mint has run out of its popular 2015 American Eagle silver bullion coins due to a “significant” increase in demand. A signal that there are bargain hunters out there who want to buy on the dip.

In a statement sent to its biggest U.S. wholesalers, the Mint said its facility in West Point, New York, continues to manufacture coins and expects to resume sales in about two weeks.

In late morning European trading gold is up 0.08 percent at $1,155.40 an ounce. Silver is down 0.56 percent at $15.00 an ounce and platinum is also off 0.88 percent at $1,020.00 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.