The Epicenter of the Next Global Financial Crisis - Financial Dreadnoughts

Stock-Markets / Credit Crisis 2015 Jul 23, 2015 - 05:19 PM GMTBy: Jesse

The 'trigger event' for the next crisis could be elsewhere, someplace distant, and out of the way. The first World War was ignited by a political assassination over a fractious disagreement in Sarajevo that engaged an international web of interconnections.

The 'trigger event' for the next crisis could be elsewhere, someplace distant, and out of the way. The first World War was ignited by a political assassination over a fractious disagreement in Sarajevo that engaged an international web of interconnections.

Granted that hubris was on a high note, particularly in Germany, and the system itself was fragile and deeply interwoven.

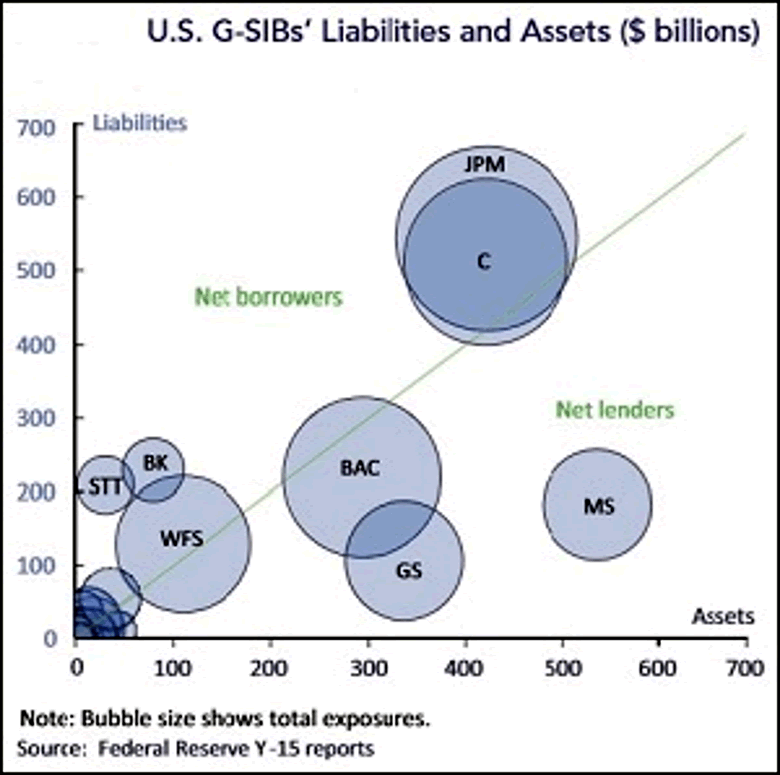

In the current global financial scenario, if the ripple of global interconnectedness reaches the New York (and European NationalBank Holding Companies), then the real crisis can take root and begin to knock down banks and national economies around the world.

12 Systemic Importance Indicators For US Bank Holding Companies

At that point the only rational response by the government would be to nationalize these Banks, and begin their orderly restructuring with losses ringfenced to investors and principals and creditors.

Of course that might not happen, since that was also the only rational response in 2008, and political power and influence and soft bribery prevailed. And there has been very little reform, with the Too Big To Fail Banks becoming Too Big To Jail, and the real lords of the land.

Why do democratically organized nations allow such behemoths to grow even larger, and act with virtual impunity over the laws, and imperil their national health and welfare. Because these outlandish financial monstrosities are the new battleships in a financial landscape in which political will controls money and wealth in ways never before seen, but far too often for the private gains of commercial moneyed interests. War never changes.

And like the dreadnoughts from the last wars of the 20th century, they are already anachronisms, costing much more than they are worth. The generals always seek to employ the old methods of warfare, even on unfamiliar landscapes.

Next time it looks like not only a 'bailout' but a 'bail-in' as well. And the destruction of a free and honest financial system in the US will be complete.

Special thanks to Wall Street On Parade For this chart and the report link.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.