Gold and Silver Falling, Coiling - The Slow Blues

Commodities / Gold and Silver 2015 Jul 23, 2015 - 05:26 PM GMTBy: Jesse

"At its very inception this movement depended on the deception and betrayal of one's fellow man; even at that time it was inwardly corrupt and could support itself only by constant lies...

"At its very inception this movement depended on the deception and betrayal of one's fellow man; even at that time it was inwardly corrupt and could support itself only by constant lies...

If at the start this cancerous growth in the nation was not particularly noticeable, it was only because there were still enough forces at work that operated for the good, so that it was kept under control. As it grew larger, however, and finally in an ultimate spurt of growth attained ruling power, the tumor broke open, as it were, and infected the whole body.

The greater part of its former opponents went into hiding. The German intellectuals fled to their cellars, there, like plants struggling in the dark, away from light and sun, gradually to choke to death.

Now the end is at hand. Now it is our task to find one another again, to spread information from person to person, to keep a steady purpose, and to allow ourselves no rest until the last man is persuaded of the urgent need of his struggle against this system. When thus a wave of unrest goes through the land, when "it is in the air," when many join the cause, then in a great final effort this system can be shaken off."

White Rose, Second Leaflet, Munich, 1942

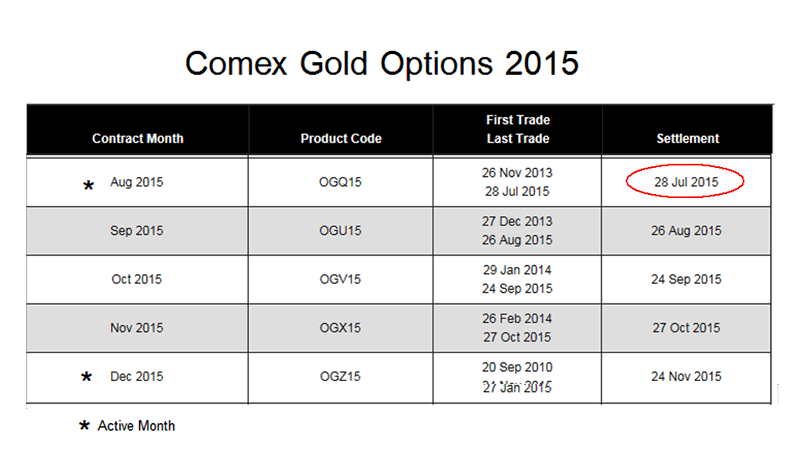

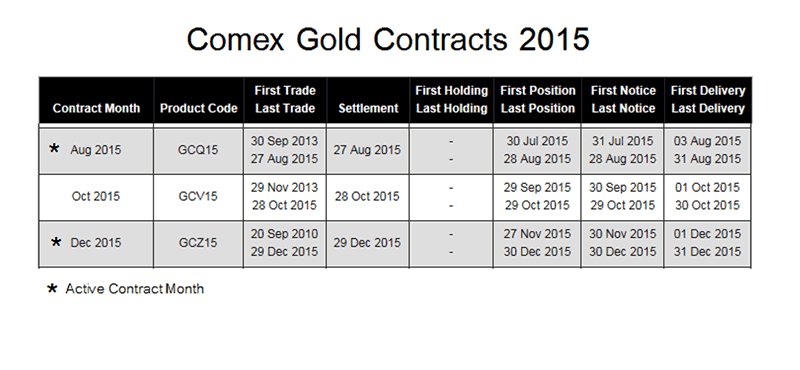

There was little activity in warehouses, the few substantial portions of The Bucket Shop, relatively speaking.

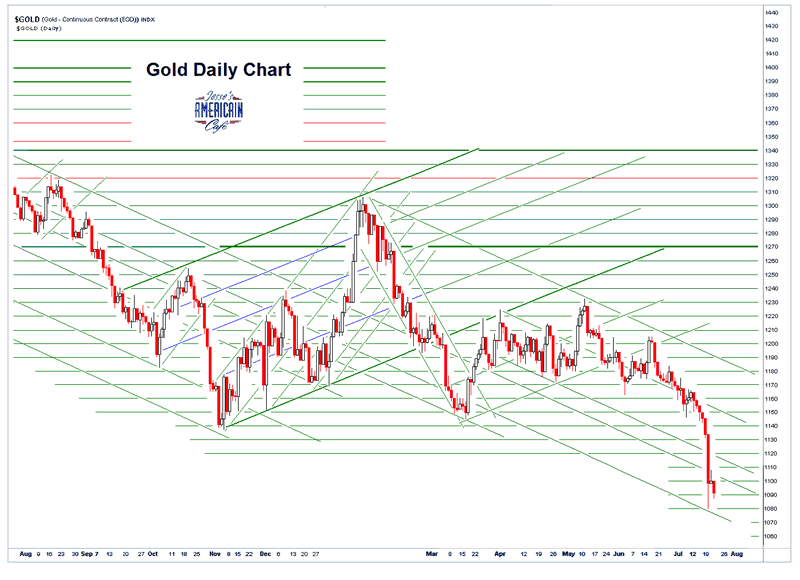

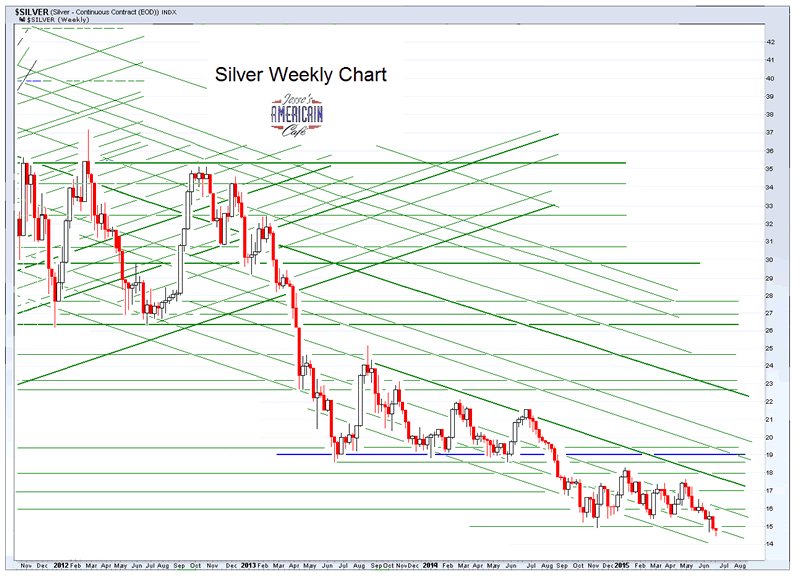

The oversold extreme in the precious metals is setting up for a rally.

This is an exercise in knocking down the long positions as reflected in the open interest, against a dwindling supply of metal available at these prices.

In an honest market prices would rise to match supply with demand. This is not how it is in The Bucket Shop, which is run by insiders for insiders.

It is utterly artificial. But most things in the US markets are these days.

The markets, like the public, seem restless, tired of this status quo of deception and rigging.

I sense a 'break' is coming. The timing is hard to predict.

Have a pleasant evening.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.