Currency Devalution - It's China's Turn

Commodities / Gold and Silver 2015 Aug 13, 2015 - 11:07 AM GMTBy: Ashraf_Laidi

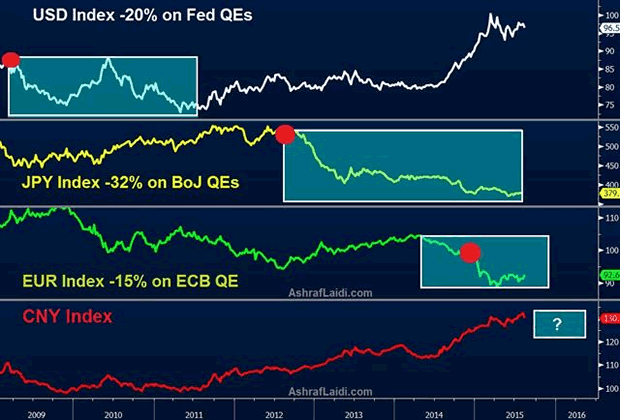

Devaluing currencies from the US to Japan, Eurozone and China. Although Japan started zero interest rate policy back in the mid-1990s, for a more relevant comparison, we start the analysis post-2008/9 crisis.

Devaluing currencies from the US to Japan, Eurozone and China. Although Japan started zero interest rate policy back in the mid-1990s, for a more relevant comparison, we start the analysis post-2008/9 crisis.

Fed in 2009

The Fed's ZIRP began in December 1998, before heading off QE in March 2009, followed by QE2, Operation Twist and QE3 in the ensuing four years. As a result, the US dollar index fell more than 18% on two occasions; in 2009 and in 2010-2011 with a brief pause during the eruption of the Eurozone debt crisis.Japan in 2012

Japan finally succeeded in combatting yen strength by voting in a new Prime Minister who's campaign was largely based on yen devaluation with the blessing of the IMF aka the US. Thanks to two waves of QE in 2013 and 2014, the Bank of Japan's asset purchases extended beyond government bonds to corporates and equity funds. The result was a 32% decline in yen's trade-weighted index and a 60% plunge against the US dollar.Eurozone in 2015

In March 2015, the European Central Bank inaugurated a full scale €1.1tn QE program, at the tune of €60.0 bn in monthly purchases of public and private sector assets until September 2016. The program aimed primarily at reversing deflation and easing financial conditions to revive growth in most recessionary Eurozone members.China in 2015

This week, the China reported the 9th consecutive monthly decline in imports (longest since 2008-9), the 5th decline in exports over the last seven months and a 7% decline in China's currency reserves to a 2-year low. With most business surveys indicating a contraction, China's economic situation was exasperated by pegging its currency to the appreciating US dollar. After weakening the yuan by nearly 3% earlier in the year, the People's Bank of China reversed course in March to stabilize escalating capital outflows. But the rising dollar made things worse.Yesterday's yuan 1.9% devaluation and today's subsequent 1.5% decline means that 5% depreciation is inevitable. Any devaluation greater than 7%-10% would be a serious threat for global markets and China's trading partners. Let's not forget the CNY appreciated 11% after the 2008-9 crises and that it remains overvalued by most measures following the appreciating USD and deepening slowdown in the China.

A CNY decline of such magnitude could occur if China mismanages the balance between maintaining CNY competitiveness and curbing capital outflows. Another risk to such balance would be renewed Chinese data disappointments and prolonged USD appreciation. The likelihood of all this materializing is about 40%.

Yuan manipulation?

With regards to accusations against China continuing to manipulate its currency, it is a fallacy to confuse China's lack of full currency convertibility with undervaluation. This is no longer 2005 or 2006, when minimal revaluations were dwarfed by China's expansion. The currency may not fully function according to perfect market forces, but it has appreciated more than 10% against the US dollar between summer 2010 and winter 2014. During that time, China GDP slowed from 10% to 7%, exports fell from a rate of +30% to -8% and credit growth plummeted. The IMF and most economists deem the yuan to be overvalued against the US dollar.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.