The World's Most Hated Major Currency Hits an 11-Year Low

Currencies / Canadian $ Aug 16, 2015 - 09:14 AM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: Crashing oil prices, crashing commodity prices, and a super-strong U.S. dollar – these three have been the trifecta of pain for the Canadian dollar in recent years.

Dr. Steve Sjuggerud writes: Crashing oil prices, crashing commodity prices, and a super-strong U.S. dollar – these three have been the trifecta of pain for the Canadian dollar in recent years.

All three of these together have pushed the Canadian dollar to an 11-year low.

In today's essay, I'll show you why the Canadian dollar could bottom out soon and start a solid rally...

Right now, "real money" traders have a massive bet AGAINST the Canadian dollar. We can see by looking at the Commitment of Traders (COT) report – which tracks the "real money" bets of futures traders. Today, the COT shows traders are uniformly betting against the Canadian dollar.

This is a great contrarian sign... It shows that everyone who wants to sell the Canadian dollar has already sold. There's nobody left to sell.

You see, "real money" traders have only had a significantly larger bet than today's one time in the past – in early 2007. The Canadian dollar absolutely soared right after that – from $0.85 to $1.08 in about eight months. That's a 27% move – a huge move in a currency!

Today, sentiment on the Canadian dollar is at the worst level in history (according to Jason Goepfert of SentimenTrader.com, whose data go back a few decades). That also tells me the bottom should be near...

So what's going on... and when could the rally in the Canadian dollar start?

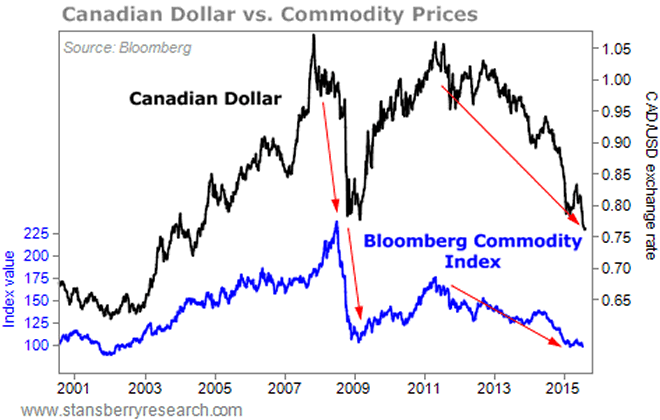

The Canadian dollar is known as a "commodity currency." Its currency tends to rise and fall with commodity prices. The problem is, everywhere you look, commodities are crashing... The Bloomberg Commodity Index, which currently tracks futures prices for 20 commodities, is down 62% since peaking in July 2008.

Take a look at the chart below. It shows the Canadian dollar versus commodity prices over the past 15 years...

You can see that the Canadian dollar crashed the last two times commodity prices peaked and began a bear market. It fell 22% from July 2008 to March 2009. And since peaking in mid-2011, the Canadian dollar is down 27%... a huge decline for any major currency.

Canada's currency can bottom out here, simply because there's nobody left to sell... However, the legitimate bottom will happen when commodity prices finally bottom.

Since commodity prices have continued lower, the Canadian dollar has continued lower. In short, we don't have an uptrend in the Canadian dollar – yet. So I'm not buying today... but the Canadian dollar will be a fantastic opportunity when commodities rebound.

The best way to take advantage of it now is to get yourself up to beautiful Vancouver – my favorite city in the world – this month. I was just there for more than a week and I can confirm that – except for real estate – prices in U.S. dollar terms were CHEAP!

So take advantage by visiting Canada while its currency is at a record low... Then buy the Canadian dollar when the uptrend finally appears...

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.