One of the Longest Cyclical US Stocks Bull Market May be Coming to an End

Stock-Markets / Stock Markets 2015 Aug 17, 2015 - 09:31 AM GMTBy: Jas_Jain

Sell when the market has had a long rise and is hesitating, with everybody in the frenzy of optimism. Don't be fooled by cats and dogs leaping up after the good stocks have hesitated. ~ Bernard M Baruch, one of the most successful American speculators and among the most powerful political kingmakers in American history.

Sell when the market has had a long rise and is hesitating, with everybody in the frenzy of optimism. Don't be fooled by cats and dogs leaping up after the good stocks have hesitated. ~ Bernard M Baruch, one of the most successful American speculators and among the most powerful political kingmakers in American history.

This is an update to my editorial of April 05,2015.

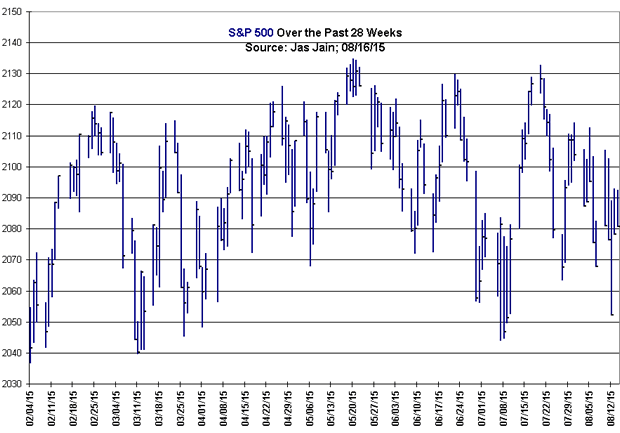

It is safe to say that the market, as represented by S&P 500, has been hesitating (see Fig. 1) and "the frenzy of optimism" seems to be receding, i.e., the best time to sell may already be in the past, but it is not too late to sell.

According to a biographer, W.L. White:

"Another Baruch practice which might be a rule is, when a market operation is finished, to liquidate completely, salt the profits down in cash and bonds ("where it wouldn't forget who owns it") and then often to take a train out of town, to "soar off like an eagle, circle high above men to look things over."

After several years of 20%+ annual rise without a serious correction, the hesitation over the past 6 months is a potential signal of a top formation to be followed by a bear market. I do agree with the bullish stock market commentators that under the current conditions we would not have a bear market unless the economy were to follow with a recession. And they imply that since no one is forecasting a recession we wouldn't have a bear market is stocks. The only problem with this logic is that there is an abysmal record of forecasting the future recessions, by economists as well as bullish stock market prognosticators, and generally the decline in the stock market is a better predictor of the coming recession. My prognosis is that a 20%+ decline in S&P 500 would be a good signal for the coming recession.

I also expect that the coming recession in the US, triggered by external events, such as China, or domestic problems, such as changes in the monetary policy, or lack there of, would be synchronous with a global recession. In that case, the bear market in stocks would be a very nasty decline, to top the declines during 2000-2003 and 2007-2009. The buy-and-hold philosophy and following of people like Warren Buffett would take a serious hit to their reputations. Most people get wiped out in the stock market only once or twice in a lifetime and the lesson is never learned. Stock market promoters are always successful in reviving general public's enthusiasm for stocks.

By Jas Jain

jas_jain@hotmail.com

The Prophet of Doom and Gloom

Copyright 2015, Jas Jain. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.