Corporate Profits Have Peaked — And Will Tank Next Year

Companies / Corporate Earnings Aug 19, 2015 - 10:36 AM GMTBy: John_Rubino

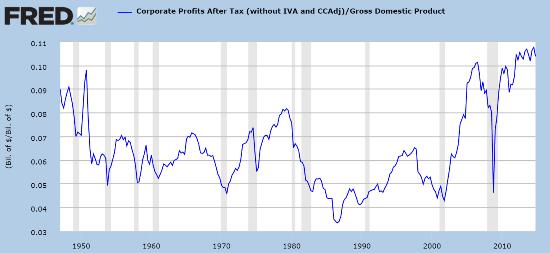

One of the reasons US stocks have had such a nice run is that public companies have been making a lot of money. The profit bounce from Great Recession lows was both big and fast, taking corporate earnings to record levels both in nominal terms and as a portion of GDP.

One of the reasons US stocks have had such a nice run is that public companies have been making a lot of money. The profit bounce from Great Recession lows was both big and fast, taking corporate earnings to record levels both in nominal terms and as a portion of GDP.

But since 2012 profits have plateaued. And now they’re about to fall off the table, as most of the reasons for the pop are reversed out. Consider:

Wages Are Finally Rising

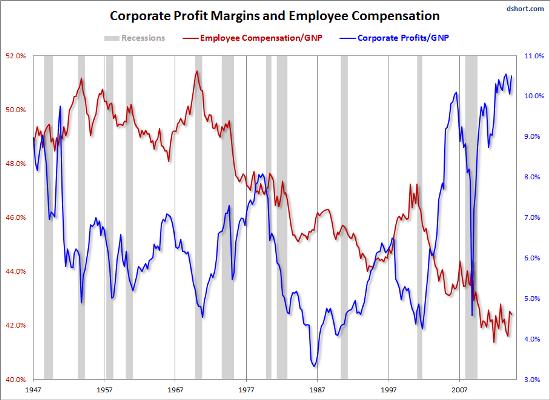

Between globalization and automation, corporations have been able to turn their remaining workers into virtual serfs. The next chart looks like a pretty good excuse for armed insurrection. At a minimum it’s a textbook definition of an unsustainable trend.

As the old saying goes, that which can’t continue won’t. Wal-Mart, that quintessential wage-squeezer, is finding out.

The Dollar Is Just Too Damn Strong

It’s up by 20% – 30% against most other currencies since 2013, raising the effective price of US exports and lowering the value of income from overseas corporate divisions (which come in the form of depreciating currencies like the euro and yen). The impact:

China Has Stopped Buying Our Stuff

China tripled its debt post-2009 and spent most of the proceeds on infrastructure like roads and airports. US corporations got a big piece of this business, either by selling raw materials and technology to Chinese builders, or doing the work themselves. Now that bubble has burst, leaving lower commodity prices and excess capacity in its wake:

Add it all up, and US corporations are looking at another year of falling revenues and much lower earnings at a time when a lot of stocks are priced for, if not perfection, at least high-single-digit growth.

And none of these headwinds are going away. US workers have just begun to redress the past decade’s injustices, and now that higher minimum wage laws have been proven to be political winners, a whole generation of would-be mayors and governors will be pushing them.

China has done exactly nothing to bring its finances back into balance so will either see a 2016 crash or bail out its banks and builders and drift into a Japanese-style lost decade. Either way, its days of sucking up all the world’s extra oil, coal and earth movers are over.

And with the rest of the world in various stages of decline, crisis or chaos while the Fed seems to sincerely want higher domestic interest rates, the dollar isn’t poised to retrace the past year’s spike. Just the opposite.

So it’s a safe bet that US corporations will, in the aggregate, be less profitable next year than this year and — to the extent that earnings dictate market cap — a lot less valuable.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.