The Beginning Of A New Financial / Stock Market Cycle

Stock-Markets / Stock Markets 2015 Sep 01, 2015 - 05:05 PM GMTBy: Chris_Vermeulen

Within the United States, the US Federal Government and The US Federal Reserve Bank interventions have failed. These manipulations, by the central bank, in order to maintain the current stock bubble, and the real estate bubble, are currently reflecting the acts of failed monetary and fiscal policies, as we are presently experiencing.

Within the United States, the US Federal Government and The US Federal Reserve Bank interventions have failed. These manipulations, by the central bank, in order to maintain the current stock bubble, and the real estate bubble, are currently reflecting the acts of failed monetary and fiscal policies, as we are presently experiencing.

The reality is that the US economy has already been in contraction for many years now.

The government intervention is failing in Europe, Japan, and now apparently also in China. Government interventions globally are currently becoming more vulnerable The US, Europe, Japan, and China have all been experiencing failures. We are currently witnessing the results of total failures, right under our noses. I believe, we are closer to that point of the Global Financial Meltdown than anyone else may realize. This collapse in China is a major shock, which has triggered a major market sell off within the US markets.

Over $2 trillion has been lost in the U.S. market alone within the past week of August 24th through August 28th, 2015. Globally, I estimate $5 trillion has been lost, in total, during the same time period. A domino effect has been caused by affecting economies globally rippling all simultaneously.

We are currently deal with the unspoken deflation problem. Commodities prices and oil are down sharply the past year. No major economy looks even close to true real expansion.

What is taking place right now, in the stock market, is just a precursor for what is about to happen, shortly. This is my view of foreseeing a pre-crash, and I believe that we should all be aware that this is looks to be the “real deal” and could occur take hold in more serious way before the end of October. This seems to be a bubble of historical proportion. Raising interest rates today is impossible because the market is way too fragile, at present.

We are experiencing times, as we have never before experienced in our life time. This will cause us to experience a major shift with in our culture, our civilization, our social lives and our belief systems to some extent.

The rally in gold is going to be stupendous. Gold will be the strongest currency in our future or at least for a few years as the Great Financial Reset takes place. The SDR (Special Drawing Rights) in which, I have written about in past articles, is nothing more than an index of currencies. In 2015, it will not be able to provide liquidity within the global markets, as it provided during the 2008 bear market.

The stock market has been experiencing a technical oversold rebound following its steep drop. Major damage has been done, and the stock market clearly remains BEARISH. The stock market decline was so extreme, that stocks rose as they” backed and filled” last week. When this volatility is over, the situation will become even graver, as the bear market will stay in force for many months to come.

The Fed's role, as the custodian of the world's reserve currency has ultimately failed, as it has ignored its responsibility to the World. Bond-buying has allowed the U.S. to levitate asset values, even though it has failed to stimulate the real economy.

There are currently over $500 Trillion in interest rate derivatives. THEREFORE, how can the FED ever be expected to raise interest rates in a meaningful way? I don’t believe they can! I see the FED currently working on QE 4 into Infinity!!

Legitimate buyers of US Treasury Bonds have largely vanished. There has been a huge decline in official bond holdings and purchases by our typical traditional former allies; China, Russia, Japan and the BRIC countries have actually turned into net “sellers” of US Treasuries since 2011. This created what could have been a huge financial disaster for the Federal Reserve, to whom they were selling large amounts of US Government securities, in order, to absorb the excesses in the market place.

They continued to expand their largest and most secretive Ponzi scheme, in history, to include Belgium, Luxembourg, Ireland, The Cayman Islands, and Switzerland. The US Fed is using currency swap arrangements to secretly serve as a backstop liquidity facility, with the above mentioned countries. QE is being exported through a secretive global integration process by using several front offices, which are under their control. It involves permanent reciprocal currency arrangements, whereby these foreign central banks have been given large lines of credit, by the US Federal Reserve Bank, in order that they can purchase US Treasuries. The manipulation of the central banks of Belgium, Luxembourg, Ireland, The Cayman Islands, and Switzerland have been used to keep these purchases off of the balance sheet of the US Federal Reserve Bank. These manipulations have been a new proxy entity that have been designed, solely for this purpose. This undisclosed “systemic risk” is being spread to secondary nations, without the benefit of knowledge to the general investing public, throughout the Financial World. This will come to be known, as what I believe to be, the Greatest Fraud perpetrated on the American public taxpayers. It will be the systemic failure that will totally bring down our current existing global financial system.

Central banks around the world have entered into a multitude of bilateral currency swap agreements with one another since the financial crisis of 2007. These agreements allow a central bank in one country to exchange currency, its domestic currency, for a certain amount of foreign currency. The recipient central bank can then lend this foreign currency on to its domestic banks, on its own terms and at its own risk. Swaps involving the U.S. Federal Reserve were the most important of all the cross-border policy responses to the crisis, helping to alleviate potentially devastating dollar funding problems among non-U.S. banks.

The swaps have been used by central banks to obtain foreign currency to boost reserves and to lend on to domestic banks and corporations. These swap agreements are designed to protect both central banks involved due to fluctuations in currency values. There is risk that a central bank will refuse or be unable to honor the terms of the agreement. Currency swaps is a meaningful sign of trust between governments.

QE is not a stimulus, but rather a death sentence of the US Dollar. This will bring about the return to the "GOLD TRADING STANDARD". With my Predictive Trend System Analytics, I shall immediately inform you as to when the bottoms of Gold and Silver have been CONFIRMED, at which time, you will be able to start purchasing these two precious metals, at historically low prices.

Quantitative Easing was implemented when the US Federal Government and the US Federal Reserve stepped in and manipulated monetary policies, in order for them to levitate asset values. This was to artificially increase asset prices and enhance the wealth effect. They were trying to postpone the inevitable crash that we are currently witnessing.

There has not been any economic growth since 2007. This perpetrated fraud will bring down the whole western financial system, and ensure its future devastating collapse. I currently envision the Petro- Gold and the new “Scheiss Dollar” to become a new vision.

Thus, the Global Currency Reset; the new "Scheiss Dollar" will be launched.

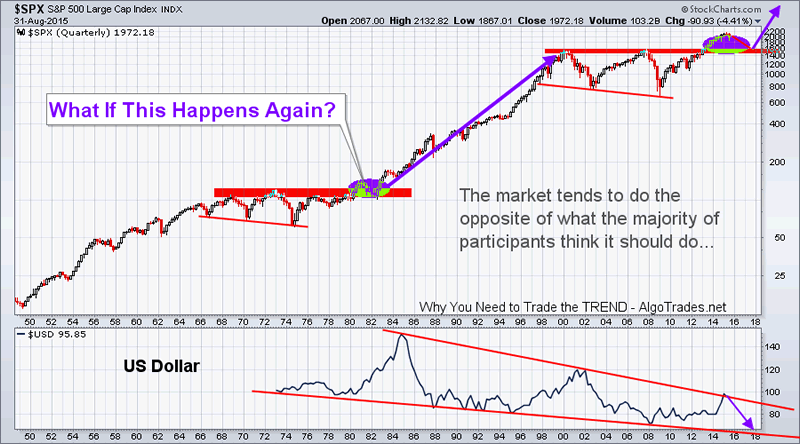

S&P 500 Monthly Chart – 7 Year Cycle

The SP500 index (US Stock Market) has now officially exited its up trend. It can be argued that the stock market is either in a stage 3 topping phase or a stage 4 decline. Either way, it’s not good for buy and hold investors.

The major trend line on the chart below has been broken in a big way. The AlgoTrades INNER-Market Analysis tell us to be sitting pretty in cash, or short the market so you can profit from falling prices over the next 6- 18 months.

I do fear a global economic collapse is possible which I talk about in our ETF Trading Newsletter – TheGoldAndOilGuy. In August we started investing in funds that will rise as the stock market falls in value. If you need help with this be sure to check out that newsletter.

S&P 500 Quarterly Chart – BIGGER PICTURE

This chart I feel provides a great perspective on the overall market trend and price patterns. This is the 70 year historical chart. I hope something like this unfolds. Fingers crossed to a nominal 12 month correction/bear market. This will build a new base for the next super cycle.

US Dollar has now reached the upper resistance trend line... we could see weakness in the dollar going forward... Keep in mind this is a quarterly chart, lower prices may still be a few months away.

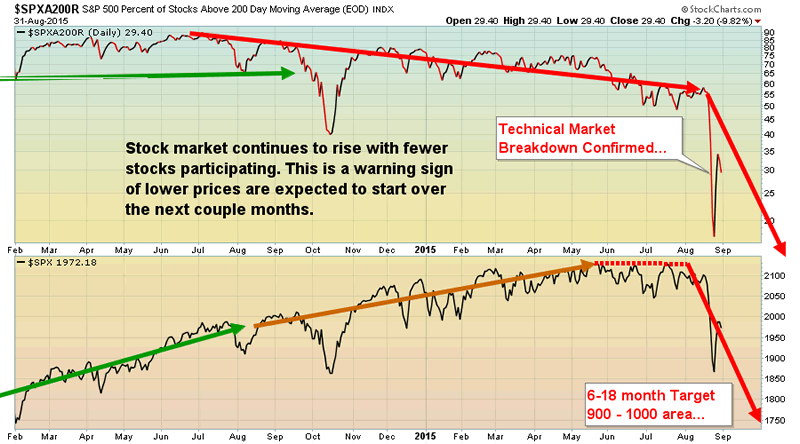

Stock Market Rises with Fewer Stocks – RED FLAG

Since mid 2014 the US stock market has become move volatile. Fewer stocks participating in the markets move up. This can be seen by comparing the percent of stocks trading above their 200 day moving average and the S&P 500 index.

Last issue I stated “Once the stock market comes to a complete stall it will drop violently.”

What we saw from August 20 – 24th was the break of the bulls back… The market always has a way to keep average investors bullish and left holding the bag of overprices stocks when the music stops. The market could very well rally here and test recent highs or possibly make a new high to be sure investors remain bullish to buy into the next wave of distribution selling.

INNER-Investor Monthly Conclusion:

The months of July and August were incredible months for our automated trading systems as you can see from our recent results. The frustrating part is that it takes some time for us to move and integrate this improved system into the platform to trade everyone’s account. Our trading system has done incredibly well during on the toughest market conditions we have experienced in years, users of our system did not have these trades executed in their accounts as that starts/started on September 1st 2015. It is tough watching all this money being made day after day and the trades are not executed in our users accounts, but the good news is that our systems are live and trades will be executed in users accounts now!

The stock market typically falls 3-7 times faster than it rises, which means we can make more money, and make it faster during a falling market then we can make from a rising market. Now that the trend has turned down we should be off to the races with outsized trading gains once again.

The simple solution to profit from this market is to become a user of ourAutomated Trading System so these trades are executed for you, allowing you to enjoy the finer things in life like spending time with family, friends or your own business.

Get My ETF Swing Trades, and ETF Investment Positions Today: www.TheGoldAndOilGuy.com – SPECIAL OFFER

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.