The Growth of the Asian Hedge Fund Industry, with Vietnam as a Superior Location

Companies / Hedge Funds Sep 04, 2015 - 01:17 PM GMTBy: Submissions

Dylan Waller writes: The Asian hedge fund industry, which grew by approximately 30% in 2014, is poised for substantial growth. Asian hedge funds were able to hold their ground in 2014, a year that was particularly challenging for the hedge fund industry in general. During Q2 2015, Asia Pacific based hedge funds returned 5.14%, while hedge funds in North America only returned 1.19%, and Europe based hedge funds reported a loss of 0.11%. The historical superior performance of Asia Pacific hedge funds certainly necessitates a shift of hedge funds to this region.

Dylan Waller writes: The Asian hedge fund industry, which grew by approximately 30% in 2014, is poised for substantial growth. Asian hedge funds were able to hold their ground in 2014, a year that was particularly challenging for the hedge fund industry in general. During Q2 2015, Asia Pacific based hedge funds returned 5.14%, while hedge funds in North America only returned 1.19%, and Europe based hedge funds reported a loss of 0.11%. The historical superior performance of Asia Pacific hedge funds certainly necessitates a shift of hedge funds to this region.

Necessary Growth of the Asian Hedge Fund Industry

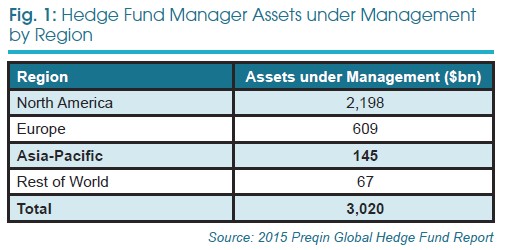

Despite their relatively superior performance, Asia Pacific based hedge funds only account for 4.8% of the industry. The historical superior performance of Asia-Pacific hedge funds, coupled with the higher economic growth in this region, will result in the continued growth of this industry, as it will be seen as a superior site for investment. In addition to its recent superior performance, the three year annualized return of Asia Pacific based hedge funds has also been the highest in the industry.

Vietnam’s Potential as a Strategic Site for the Asian Hedge Fund Industry

The soon to be initiated TPP, coupled with Vietnam’s recent removal of the foreign ownership limitation this month, are two crucial catalysts that will further contribute to the country’s economic growth, and its soon to be transition from a frontier market to an emerging market. As investment outlook in China is transitioning from bullish to bearish , with its recent currency depreciation and slowed economic growth, Vietnam stands out as a superior alternative in Asia. Vietnam has emerged as a superior location for manufacturing, as companies shift to reduce operational costs. According to a report by Standard Chartered Bank, companies can save around 19% on operating costs by shifting from China to Vietnam. Vietnam also has the relative advantage of lower corporate taxes, which should be reduced to 20% by 2016; this would result in corporate taxes being 5% lower than China.

Vietnam can also be seen as a superior site for value investing, as it has a large variety of stocks that have a single digit P/E ratio, high ROE, and high dividend yields.

- Hoa Phat Group, which has the largest market share for steel production in Vietnam, currently has a P/E ratio of 5.06. The company has consistently increased its bottom line since 2012, with a 60.9% increase in its net income during 2014.

- Petrovietnam Drilling and Well Services was able to fare well during 2009, when oil plunged to a record low, which historically confirms the company’s ability to cope amidst low oil prices. The company’s P/E is currently 5.19, and it has consistently increased its bottom line since 2010; net income only fell by 8.7% during 2009.

- Vinamilk, the most sought after company by foreign investors, currently has P/E ratio of 14.33. Foreigner investors have been willing to pay a 20% premium for this company.

Investment Implications

Investment funds in Vietnam that utilize a value based investment approach have been extremely successful, providing a stable benchmark for hedge funds that wish to enter Vietnam. Based on my observation of the industry in Vietnam, the following funds are the best pick for investors.

- The Vietnam Emerging Equity Fund is an open ended equity mutual fund launched by PXP Vietnam Asset Management. The fund currently has around 52.5% of its assets invested in companies fully held by foreign investors, which will be a substantial catalyst for the fund with the recent removal of the foreign ownership limitation. Previous performance has been substantially better than the VN index.

- Asia Frontier Capital has been extremely successful investing in Vietnam, with a strategic approach of choosing companies with low valuation and high dividend yields. The AFC Vietnam fund has returned 39.67% since its inception in December 2013.

- Investors who wish to take advantage of deeply discounted closed end funds, should consider Vietnam Holding Ltd. and VinaCapital Vietnam Opportunities Fund, which trade at a 17.33% and 18.35% discount respectively. Both funds are listed on the London Stock Exchange.

The growth of the Asian hedge fund industry is certainly befitting, and I believe that Vietnam will be a superior location for investment in the future.

About the Author

Dylan Waller is a contributor for Seeking Alpha, and an intern for the crowdsourced consultancy Wikistrat.

dylan@nomadicequity.com

© 2015 Copyright Dylan Waller - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.