Bye Bye Brazil Economy

Economics / Brazil Sep 04, 2015 - 05:52 PM GMTBy: John_Rubino

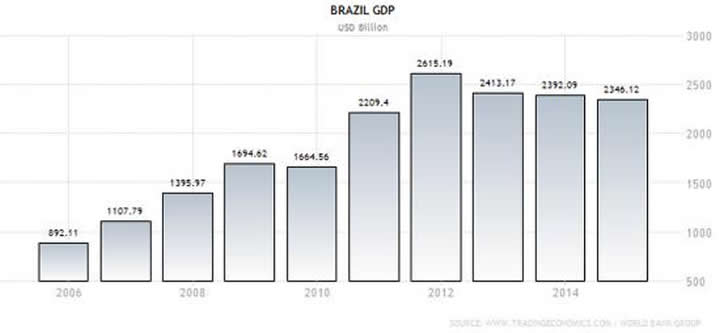

For about a decade there, Brazil was the Latin American country that got it right. Under a socialist but apparently reasonable government they kept their budgets under control, managed the population shift from farm to city, and developed some efficient export industries that brought in plenty of hard currency. The Brazilian real held its own on foreign exchange markets and inflation was, as a result, moderate.

For about a decade there, Brazil was the Latin American country that got it right. Under a socialist but apparently reasonable government they kept their budgets under control, managed the population shift from farm to city, and developed some efficient export industries that brought in plenty of hard currency. The Brazilian real held its own on foreign exchange markets and inflation was, as a result, moderate.

Then it all fell apart. The US dollar spiked, commodity prices tanked, and it was discovered that a whole range of big local players were gaming the system in various ways, sparking a corruption scandal that reaches all the way to top.

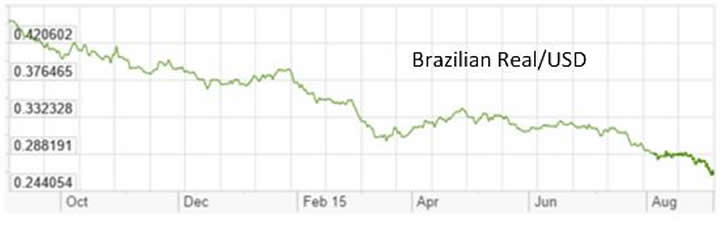

Brazil’s real is now the worst performing major currency (in a world of badly-performing major currencies), its budget deficit is 8% of GDP, the interest rate on its 10-year bonds exceeds 15%, and GDP is apparently about to fall off the table.

There are calls for the impeachment of the president and rising speculation that the finance minister, unable to get spending cuts through the legislature, is about to quit. The latter’s departure will remove the last prop from Brazil’s investment grade credit rating, making it even harder to borrow, necessitating even bigger spending cuts, and sending the country into a stereotypical LatAm death spiral. Just in time for it to host next year’s Olympics.

A big part of the problem is the decision by major Brazilian companies like oil giant Petroleo Brasileiro to fund their rapid growth by borrowing tens of billions of US dollars. When the real was rising and dollar interest rates were low, this strategy was a double winner. But when the dollar spiked in 2014 the true cost of those loans went through the roof.

In this sense Brazil is one of the high-profile casualties of the currency war. And with the US about to raise rates while most other countries lower theirs, it’s only going to get uglier. Which means (here’s why this matters beyond Brazil itself) the big US banks and other major creditors are looking at multi-billion-dollar losses in 2016. Turns out that China has been on a lending spree in Latin America, extending more than $100 billion in credit to various state-run oil and mining companies since 2005. And whenever there’s a South-of-the-Border crisis, Citigroup, Goldman and JP Morgan are in the mix, demanding a bail-out so year-end bonuses aren’t affected. The Mexican peso crisis of 1994 was, in fact, the genesis of the Greenspan put that turned the money center banks into giant hedge funds.

So Brazil will illustrate the differences between now and then — if there are any.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.