Gold and Silver Final Flush Beginning

Commodities / Gold and Silver 2015 Sep 04, 2015 - 06:00 PM GMTBy: Jordan_Roy_Byrne

While turmoil in global capital markets may ultimately benefit the precious metals sector, it certainly is not an immediate catalyst. As global markets have weakened in recent days so too have precious metals and precious metals companies. The gold miners are nearing recent lows ahead of conventional markets while the recoveries in Gold and Silver appear to be reversing. This could be the start of a final flush that marks the end of the bear market.

While turmoil in global capital markets may ultimately benefit the precious metals sector, it certainly is not an immediate catalyst. As global markets have weakened in recent days so too have precious metals and precious metals companies. The gold miners are nearing recent lows ahead of conventional markets while the recoveries in Gold and Silver appear to be reversing. This could be the start of a final flush that marks the end of the bear market.

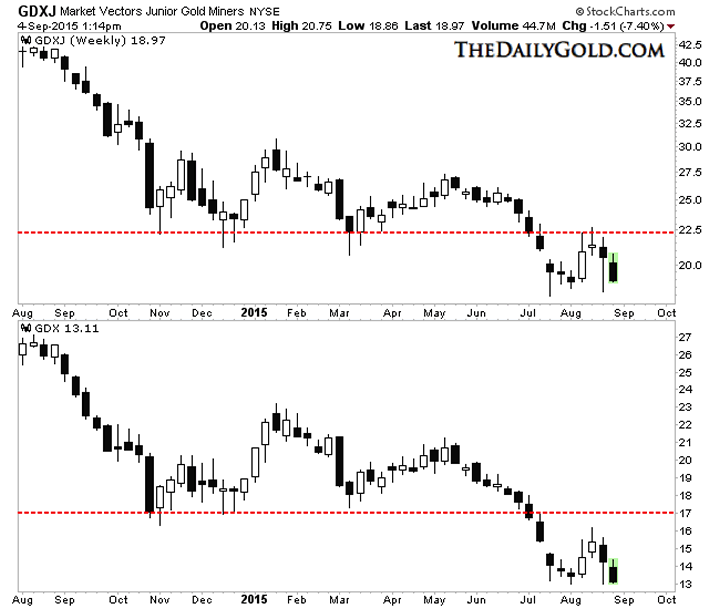

As the last week of summer (unofficially) comes to a close, the near term prognosis in the miners could not be more clear. The weekly candle chart for GDXJ and GDX is below. Both are set to close the week near or at the summer lows. Note the difference between the past few months and last winter. As the miners carved out a bottom last winter they formed strong white candles during up weeks. They held their gains and closed near the highs. That established support which held for seven months. Recent action is a strong contrast. The reversal candles in July were only mild in strength. In addition, although the miners gained in August, they failed to close near the highs of the week. That is a sign of distribution. Also, the reversal last week was temporary as miners are going to close this week near their lows. Finally, note how GDX was so weak that its rebound failed to touch $17.

The miners usually lead the metals and so their weakness could be hinting that Gold has a leg down to $1000/oz before the bear market concludes. Gold is set to close the week near $1120 after failing at $1140 on Tuesday and Wednesday. The last key weekly support for Gold is around $1080. Meanwhile, Silver may have begun a reversal today as it could close below the closes of the past three or four days. It is tough to find anything bullish for the metals, at least in the near term.

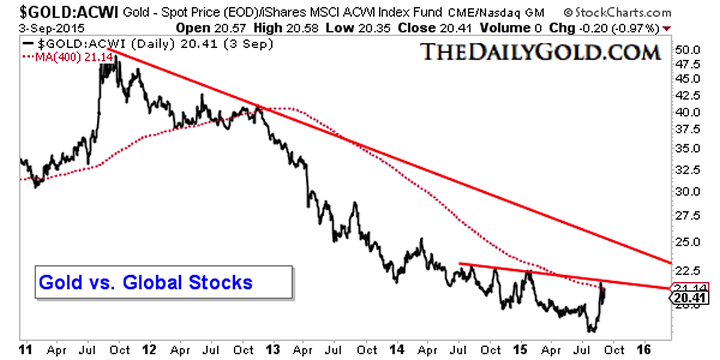

However, the one positive, as we noted last week is Gold is firming in real terms. Specifically Gold is gaining some strength against global equity markets. Gold relative to emerging markets has already broken out but next it must break the downtrend against global equities. Below we plot Gold against the all country index ETF. The ratio closed at a 6-month high a few weeks ago and is very close to retesting a confluence of resistance.

Good things are happening under the surface for Gold and the precious metals complex but that does not negate the near term downside potential. The miners are acting very poorly and appear headed to new lows. The metals are reversing their rebound and are also at risk for new lows in the days and weeks ahead. Gold traders and investors need to be careful and position their portfolios to take advantage of the coming bottom. We won’t be getting long until Gold nears $1000/oz and the junior miners become extremely oversold again.

Consider learning more about our premium service including our current favorite junior miners which we expect to outperform in the second half of 2015.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.