More Stock Market Selling Ahead

Stock-Markets / Stock Markets 2015 Sep 07, 2015 - 12:51 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market?

Intermediate trend - SPX has started an intermediate correction (at least).

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

MORE SELLING AHEAD

Market Overview

Last week ended the (bear market?) rally after it had a typical 50% retracement of its initial decline. By Friday, on the bar chart, the index was trying to hold on to support created by a critical short-term trend line which had already been violated. On the P&F chart, that trend line did hold and it created a tepid bounce after being touched.

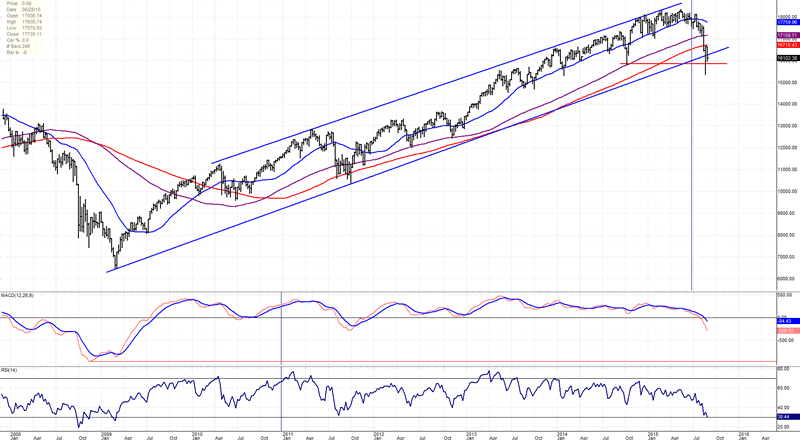

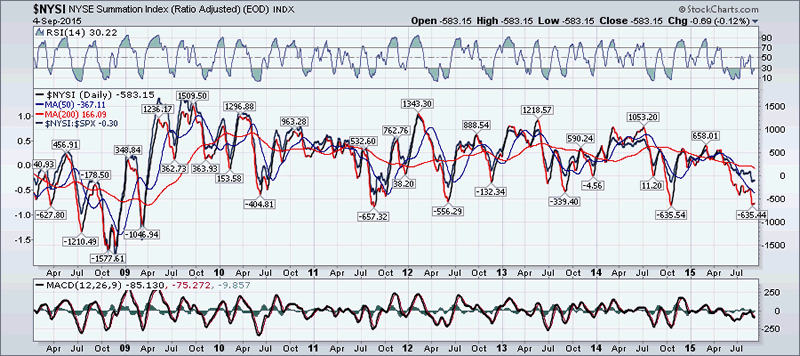

Let's look at the DJIA weekly chart (Courtesy of Quotecharts.com, as well as others below). It gives us a good argument for expressing the view that a bear market may already have started; at least, an important intermediate downtrend. The signs are obvious! We have a prolonged uptrend that ended in a large congestion pattern, followed by a sharp decline that sliced through three important MAs (30wks, 90-wks and120-wks) all at once and violated a 6-year trend line. The momentum indicators are also in a steep downtrend with no sign of deceleration or divergence. Below the chart, the McClellan Summation Index (Courtesy of StockCharts.com) had been warning since the beginning of the year that this was coming. In May, it started a downtrend well ahead of the market.

One more point! Las week, the index made a new weekly close low, which is a reason why we should be prepared for an imminent resumption of the decline. Cycles are not due to bottom until the end of the month.

Indicators Survey

Weekly indicators, including the NYSI, are shown above.

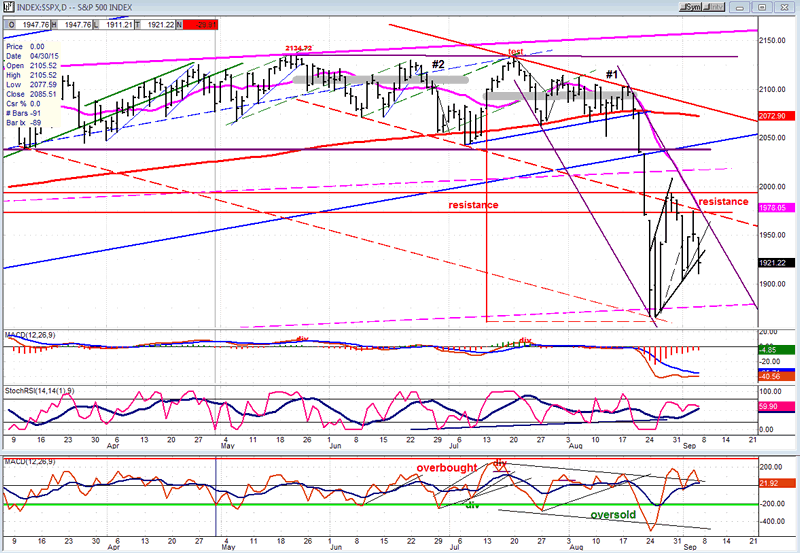

Since the initial lows, and in spite of the rally, the daily MACD has only gone sideways, remaining very negative and in a bearish configuration.

On the 1X1 P&F chart, the SPX made a distribution pattern at the 1980 level which still has some outstanding counts that are unfilled. As shown in my last newsletter, the long period of distribution above the 2040 level has the potential for significantly lower counts.

Chart Analysis

On the following chart of the Daily SPX I have drawn two trend channels. The large red one has a top trend line connecting the July and August tops, and a parallel to it traced at the March low. Its validity was confirmed by the fact that the original decline stopped right on it after filling the distribution count across the first phase, but there is no guarantee that this channel will not be expanded if prices continue to have significant drops in the future. The channel of immediate concern, however, is the steeper (purple) one. It represents the short-term trend of the index and we should not expect an attempt at reversing it until prices have broken out on the upside.

For now, we should narrow our focus even more, concentrating on the formation that has been made by the rally from the low and the price action since then. Already the first small channel within that formation had to be revised and, on Friday, the new bottom trend line was also violated with prices closing outside of it. A secondary rally occurred within that formation which again took prices to the middle dashed trend line before they were pushed back.

The entire formation is probably too large to be considered a flag in a downtrend. A viable alternative could be that it is the mid-point of a measured move, in which case, the next decline could reach as low as 1750. If only .618 of the first decline materializes, we could see 1844. In fact, the top formation across 1980 carries both potentials, even if the lower one looks a little extreme. Still, I would not be too quick a dismissing it entirely.

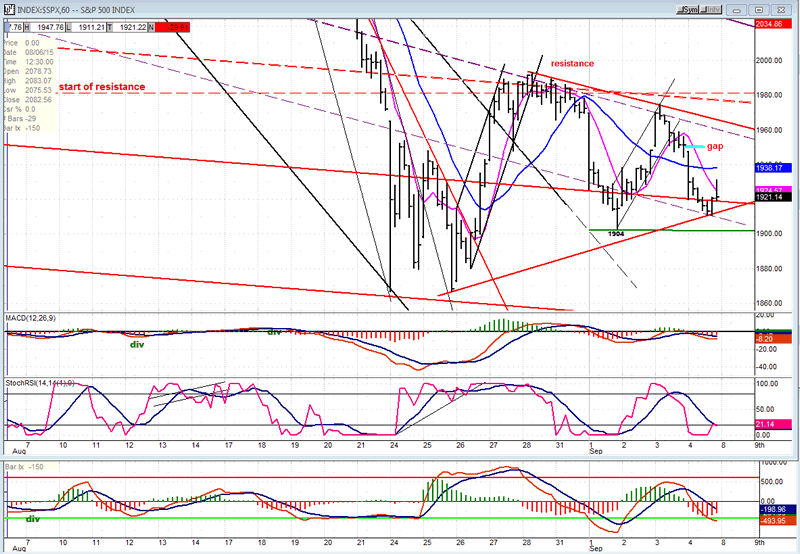

On the Hourly chart, a close-up of the consolidation looks like it may be triangle. If so, it needs another small wave to complete the pattern and, since a triangle is a continuation pattern, this would fit in with the expectation that an extension of the decline is imminent.

In fact, the indicators, as well as the deceleration showing in what appears to be the 5th wave down from the 1975 high are arguing for another small wave up. If that rally remains below the top red line, turns down sharply, and breaks below 1904, it will confirm the triangle scenario.

Carrying the analysis one step farther, since a move out of a triangle normally equals the width of the triangle, such a measurement would give us 1740, slightly beyond the "extreme" projection of 1750.

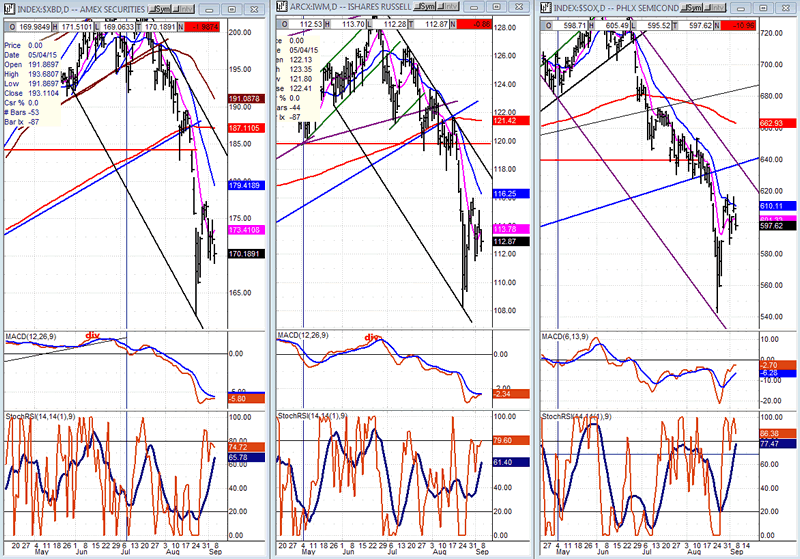

XBD -- IWM - SOX

The SOX led the decline in the market, followed by IWM and finally XBD. Now all three are in sync with it. We should keep an eye in these indices (and elsewhere) for signs that something is changing in the overall market's condition (and direction).

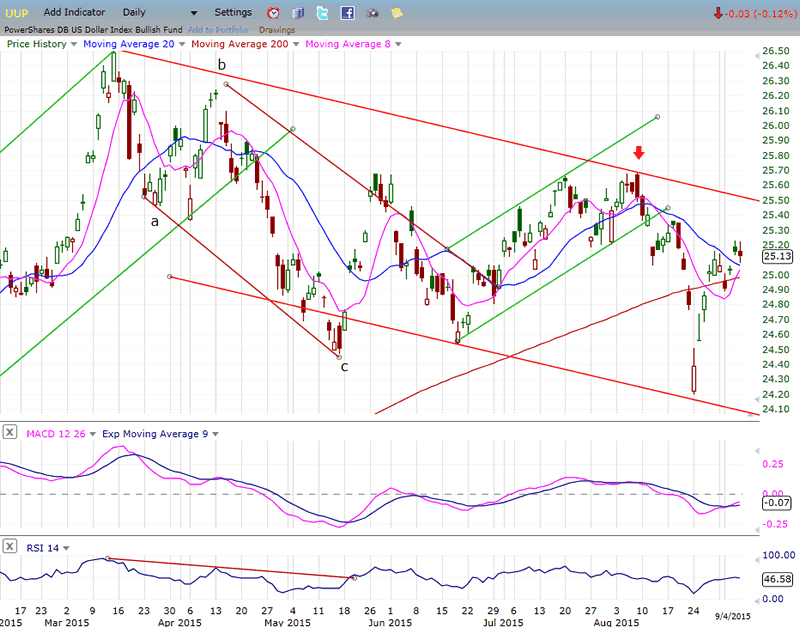

UUP (dollar ETF)

UUP has established a correction channel. Two weeks ago, it dropped sharply to the bottom trend line and had an immediate, equally sharp rebound. If it is capable of overcoming its top channel line, it should challenge its former high. We need to give it a little time to determine whether it can do it right away or if it requires additional consolidation. Since it has higher counts, the odds still favor more uptrend until its behavior warns us that it is in the process of making an important top.

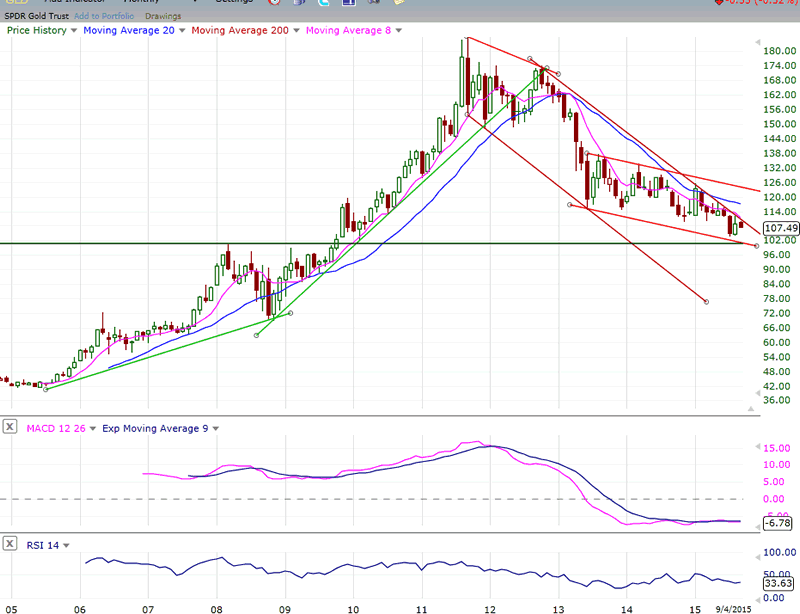

GLD (Gold trust)

GLD is at an interesting juncture. Here, I am using the monthly chart to show that its decline from 186 may be nothing more than a lengthy consolidation in a very long-term uptrend. Several factors favor that view! The retracement has reached a strong support level with a retracement of a little under .618%. Instead of continuing its sharp correction, the action has morphed into a potentially bullish long-term pattern which favors an upside break-out eventually. Cycles warn us that this reversal is very close. Best guess is early October, after it reaches its P&F target of about 100.

Furthermore, if we are starting a significant market decline, gold will, once again, most likely be sought as a safe haven.

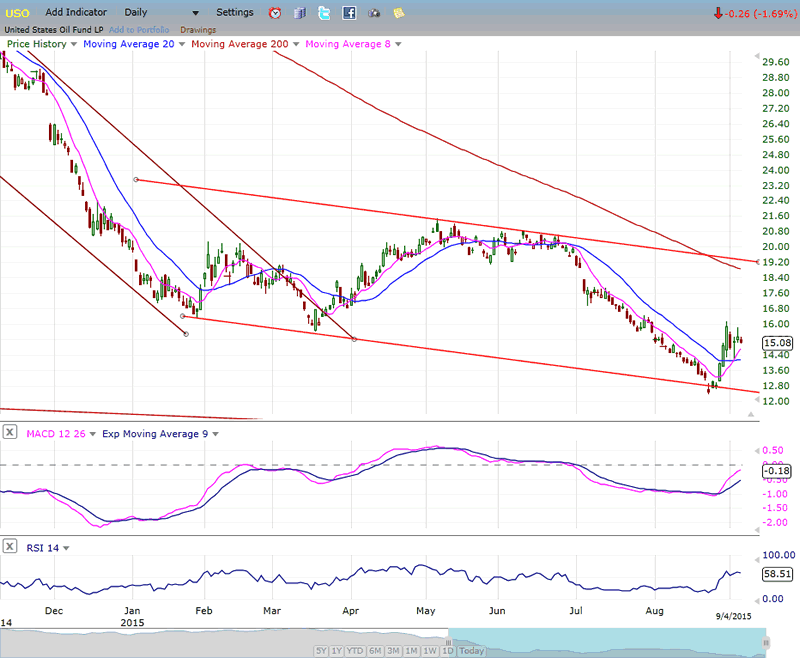

USO (US Oil Fund)

Oil has finally reached its 13 P&F target, and this prompted some buying by those who follow P&F projections. Although this has resulted in a sharp near-term rally, it remains to be seen if crude fundamentals and the future of the oil complex justify the resumption of an important uptrend.

Summary

After a long period of distribution which capped a 6-year uptrend, the stock market has entered a corrective phase which, at a minimum, should result in a significant intermediate decline. If the total amount of negative energy which has been stored during the distribution process is released, it will manifest as a lengthy downtrend and reach a price level which is unconceivable to most investors at this time.

This is not inevitable, but the potential is there and should be respected until it has been proven otherwise.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.