Silver and Deflation

Commodities / Gold and Silver 2015 Sep 08, 2015 - 01:43 PM GMTBy: Hubert_Moolman

How does silver perform during deflation? Which is better during a deflation – silver or gold? The answers will depend on quite a few things as well as what definition of deflation one uses.

How does silver perform during deflation? Which is better during a deflation – silver or gold? The answers will depend on quite a few things as well as what definition of deflation one uses.

If you look at monetary history, then you will find that we have moved from periods where mostly real or tangible assets like gold and silver acted as monetary claims on goods and services in the economy, to today where mostly credit or debt claims (fiat currencies like the US dollar) act as monetary claims on goods and services. Therefore, we have moved from a real asset-based monetary system to a debt-based monetary system.

There can be inflation or deflation in both systems; however, they are much more limited and “natural” in a real asset- based monetary system. Moving from a real asset-based monetary system to our current debt-based monetary system has in itself been massively inflationary.

If we had to revert to the real asset-based system, by settling or liquidating debt-based monetary claims (decreased money supply), then we would have a massive deflation. In fact, that is what is happening when asset prices get overvalued, due to excessive credit, and the system seeks to find equilibrium via a contraction of economic activity.

Historically (pre 1870s) when we had a mostly asset-based monetary system, where both silver and gold were considered monetary claims; the Gold/Silver ratio traded much lower than 20. So, if we had to have deflation today, which forces us back (total system reset) to a real asset-based monetary system (primarily gold and silver), then we would likely return to a Gold/Silver ratio of about 20 or lower. In such a case, silver would obviously outperform gold, since the ratio today is in excess of 70.

Most astute gold investors know that gold performs well under a deflationary environment. Historically, gold mostly outperforms silver at the beginning of a deflationary period, while silver outperforms gold towards the end, and mostly usually (during the whole deflationary period). So, although surprising to most, silver actually performs very well during deflation.

It is important to note that every good has conditions that are unique. This is true even in the case of gold versus silver. Although, they are are so similar in nature (and trade very similar), they have different monetary histories. So, at a certain time they could trade very different, due to where they are in their own particular cycle.

The period of the Great Depression was a good example of this, since at that time silver was almost fully demonetized while gold was not. Generally, this is one reason why one would not necessarily get only falling prices in a deflation, or only rising prices during inflation.

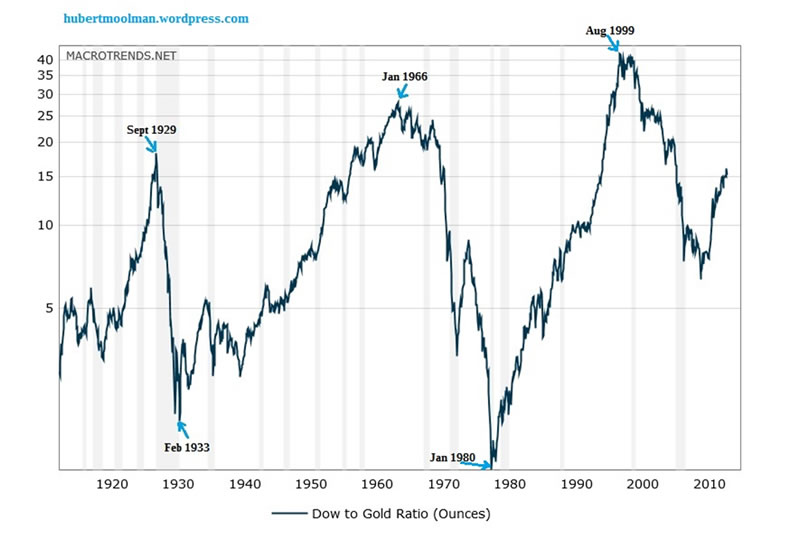

The fact that one does not necessarily get only falling prices during a deflation complicates this kind of analysis. For example, many would consider the 70s to have been a deflationary period, yet the CRB index tripled from 1970 to 1980. To simplify matters, I consider the Dow/Gold ratio chart a very good proxy for deflation or inflation. When the ratio is rising, you have inflation, and similarly, when it is falling you have deflation.

Below, is a long-term Dow/Gold ratio chart (from macrotrends.net):

September 1929 to February 1929

The period from September 1929 to February 1933 was a deflationary period. The stock market was crashing, as well as the prices of most commodities. Gold was fixed at $20; however, there was extreme pressure to increase that price. The London Fix actually rose during this time. Silver fell from 53 cents in 1929, to 28 cents in 1932. It started to rise in 1933, so that it was at 35 cents by February 1933. So, during this time gold outperformed silver.

January 1966 to Jan 1980

The stock market peaked in January 1966. The period from 1966 to January 1980 was a deflationary period, although commodity prices actually rose. The Dow did even make a higher high in 1973, but the trend was definitely down during this whole period. Although the overall trend was deflation, there were some inflationary periods in between (like from the end of 1974 to August 1976).

During this whole period, gold went from $35 to $875 (25 times), whereas silver went from $1.30 to $49 (37.7 times). This time it was silver that outperformed gold comprehensively. Unlike the Great Depression, silver actually rose during the first part (Jan 66 to May 68) of this deflation. Gold actually outperformed silver for most of this 14 year period. However, the last 12 months from Jan 1979, silver was brutal and nullified the 13 year lead gold had had.

August 1999 to Now

The period since August 1999 has been deflationary, although the Dow and most commodities have been rising for significant periods during the same time. It is interesting to note that the CRB index is currently retesting its 1999 lows (it is likely to go much lower). The Dow is following a very similar part to the 60s and 70s deflation. It has made higher highs since 1999, but will eventually end up much lower than its 1999 high, when this deflation is over. In fact, I believe that the Dow will go much lower than its 2009 low, before this deflationary period ends.

Now, one might not believe that the Dow/Gold ratio is a good proxy for deflation or inflation, but in a few years when the Dow is at extreme lows one certainly will.

From August 1999 to now, gold has actually outperformed silver (this is very similar to the 60s and 70s deflation). The Gold/Silver ratio was around 50 in August 1999, today it is around 74. This is great news for silver's performance during the rest of this deflation. Silver relative to gold is currently better value than at the beginning of this bull market. Just like in the last year of the 60s and 70s period, silver will brutally outperform gold over the remaining period of this deflation.

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2015 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.